- United States

- /

- Medical Equipment

- /

- NYSE:BDX

Did New Leadership and Device Launch Just Shift Becton Dickinson’s (BDX) Healthcare Innovation Trajectory?

Reviewed by Sasha Jovanovic

- BD (Becton, Dickinson and Company) recently appointed Robert Huffines and Jacqueline Wright to its board and unveiled the PureWick™ Portable Collection System, while also announcing that Duncan Regional Hospital is the first in the US to implement BD Alaris™ EMR Interoperability with MEDITECH.

- These developments highlight BD's ongoing commitment to executive leadership, healthcare technology integration, and innovative medical device expansion across both hospital and home care settings.

- We'll explore how the addition of board members with technology and healthcare expertise could influence BD's growth strategy and investment outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Becton Dickinson Investment Narrative Recap

To be a BD shareholder, you need to believe in the company’s ability to execute on innovation, operational efficiency, and the transition toward more predictable, consumables-driven revenues, despite tariff pressures and potential challenges in global markets. The recent addition of high-profile board members with healthcare and technology expertise enhances BD's leadership bench but does not materially alter the near-term catalyst, which remains the successful separation of the Biosciences and Diagnostics business. However, the biggest risk continues to be the execution and cost management of this separation, which could impact future earnings if not handled efficiently. Of BD’s latest announcements, the implementation of BD Alaris™ EMR Interoperability at Duncan Regional Hospital is particularly relevant, demonstrating tangible progress in digital health integration, a key capability given the focus on connected care and operating margin expansion. The ability to enhance patient safety and workflow with this technology underlines one of BD's core growth drivers, even as investors keep a close eye on margin pressures and cost containment as the business evolves. Yet investors should make sure they are not overlooking the potential risks associated with separating a major business segment...

Read the full narrative on Becton Dickinson (it's free!)

Becton Dickinson's narrative projects $24.7 billion in revenue and $2.8 billion in earnings by 2028. This requires 4.9% yearly revenue growth and a $1.2 billion earnings increase from $1.6 billion currently.

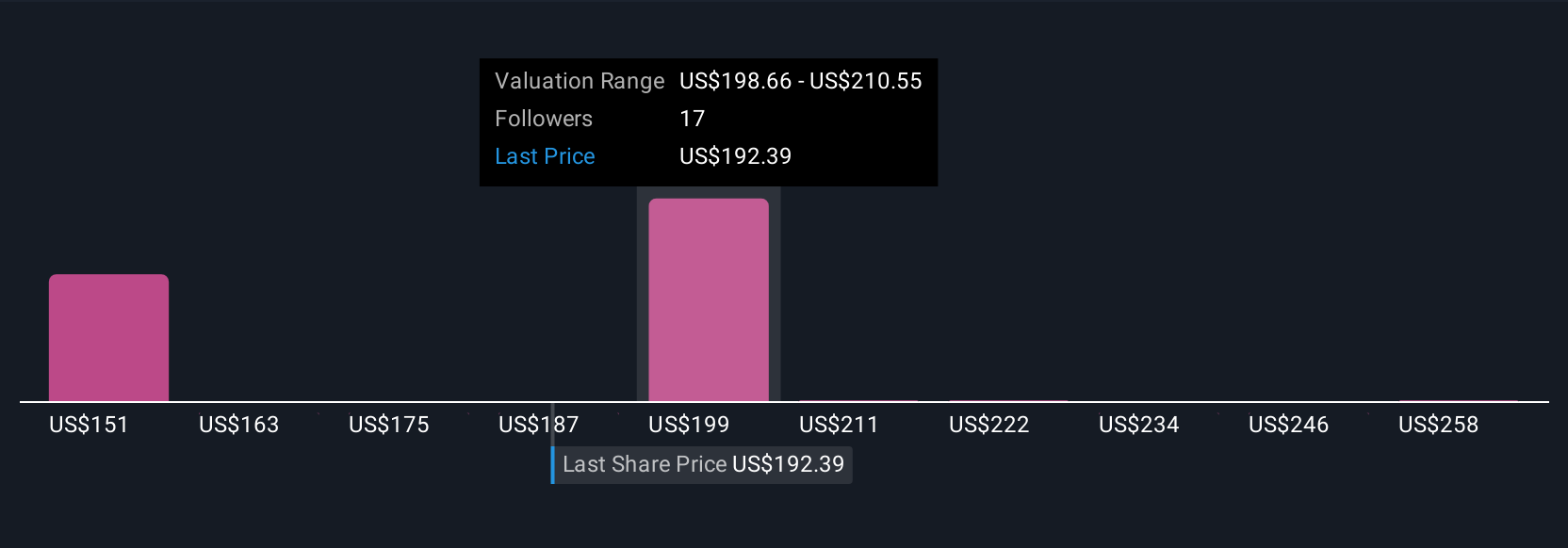

Uncover how Becton Dickinson's forecasts yield a $206.58 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided five fair value estimates for BD, spanning US$206.58 to US$323.36 per share. With execution risk tied to the planned business separation still present, perspectives on future performance can differ significantly.

Explore 5 other fair value estimates on Becton Dickinson - why the stock might be worth just $206.58!

Build Your Own Becton Dickinson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Becton Dickinson research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Becton Dickinson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Becton Dickinson's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives