- United States

- /

- Medical Equipment

- /

- NYSE:BDX

A Look at Becton Dickinson’s Valuation Following New Product Launches and Strong Preliminary Revenue Results

Reviewed by Simply Wall St

Becton Dickinson (BDX) unveiled a pair of new healthcare technologies, including a self-collection HPV test and a digital connected care platform. The company also posted upbeat preliminary revenue for the latest fiscal quarter and year.

See our latest analysis for Becton Dickinson.

Becton Dickinson’s recent product launches and upbeat revenue guidance have put a spotlight back on its innovation-led growth strategy, even as broader concerns weigh on the sector. Despite the positive headlines, the stock’s share price return is down 17.4% year-to-date and total shareholder return has slipped 20.1% over the past 12 months, signaling that investor sentiment remains cautious for now. Still, with fresh technologies rolling out alongside a solid revenue trajectory, momentum may be starting to shift for the longer term.

If these new healthcare advances have you curious about what other companies are moving the needle, now’s a great time to explore See the full list for free.

With the latest launches and revenue beat, is Becton Dickinson trading at a discount that overlooks its future growth? Or has the market already built these advances into its valuation, leaving little room for upside?

Most Popular Narrative: 10.1% Undervalued

With the narrative assigning a fair value of $208 for Becton Dickinson versus a last close price of $187.04, the gap between market expectations and growth assumptions is significant. This suggests forward-looking optimism compared to where the stock currently trades. Read on for a direct excerpt capturing a major driver behind this estimate.

Strong new product launches in diagnostics, advanced tissue regeneration, and connected care, including the BD COR HPV platform and at-home collection kits, are set to capture growing demand driven by increasing chronic disease burden and the global shift toward decentralized and home-based care. This is expected to support future revenue growth acceleration.

Becton Dickinson’s consensus fair value is driven by more than just product launches. Under the surface, the most popular narrative relies on aggressive margin expansion, sharper earnings growth, and shrinking share count. Want to know which blockbuster assumptions make the difference? The real numbers behind the hype are one click away.

Result: Fair Value of $208 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global trade headwinds and execution risks from business separation could easily disrupt BD's margin improvement and long-term growth momentum.

Find out about the key risks to this Becton Dickinson narrative.

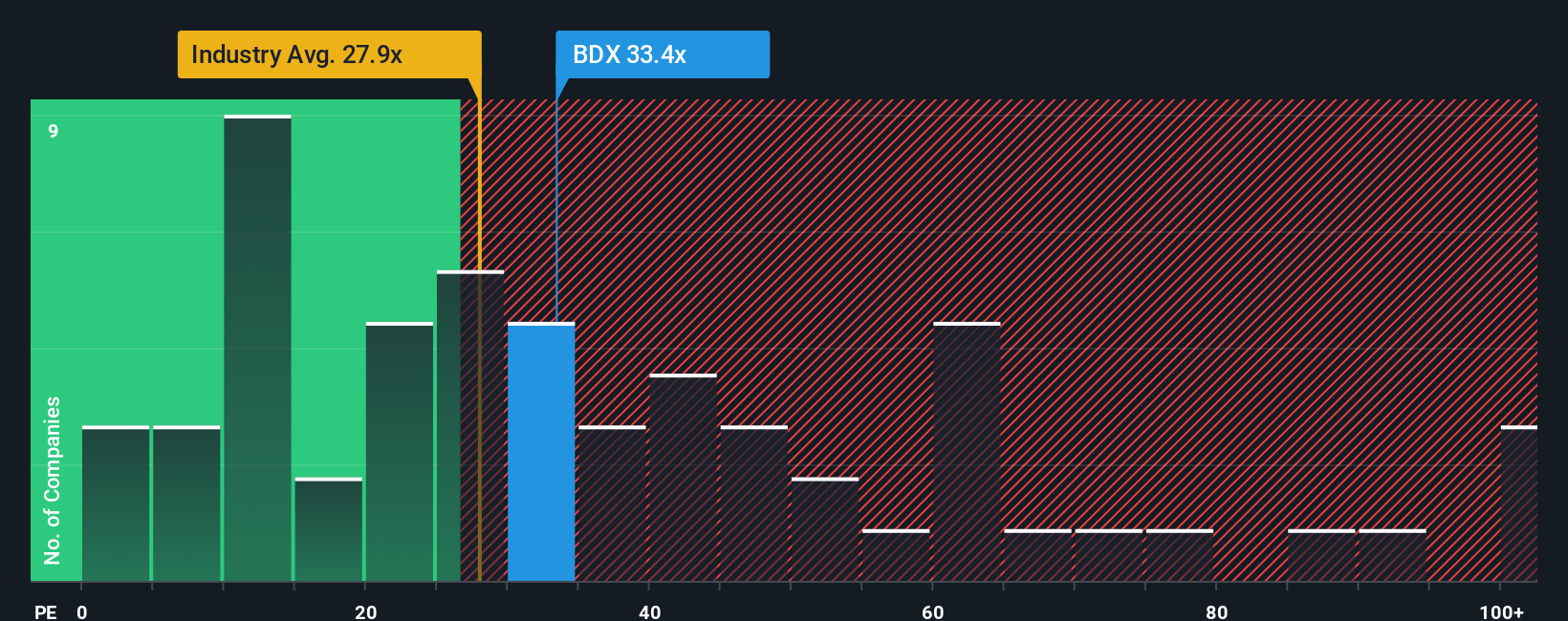

Another View: Market Ratios Tell a Different Story

Comparing Becton Dickinson’s valuation against peers, its price-to-earnings ratio stands at 33.8 times, which is more expensive than both the industry average of 29.7 and its closest rivals. The fair ratio points even lower, at just 31.4. Is the market pricing in more optimism than fundamentals support?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Becton Dickinson Narrative

If you see things differently or want to dig into the details yourself, you can piece together your own narrative in just minutes. Do it your way

A great starting point for your Becton Dickinson research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t let unique investment prospects pass you by while others act. Filter top stocks by strategy, catalyst, or sector, all in one place with Simply Wall Street.

- Boost your income potential by targeting stable companies offering impressive returns through these 19 dividend stocks with yields > 3%.

- Catch the wave of the artificial intelligence boom by zeroing in on promising opportunities with these 27 AI penny stocks.

- Seize hidden gems trading below fair value and unlock fresh upside using these 874 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Becton Dickinson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BDX

Becton Dickinson

Develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives