- United States

- /

- Medical Equipment

- /

- NYSE:AVNS

Avanos Medical (AVNS): Extended Losses Undercut Turnaround Hopes Despite Discounted Valuation

Reviewed by Simply Wall St

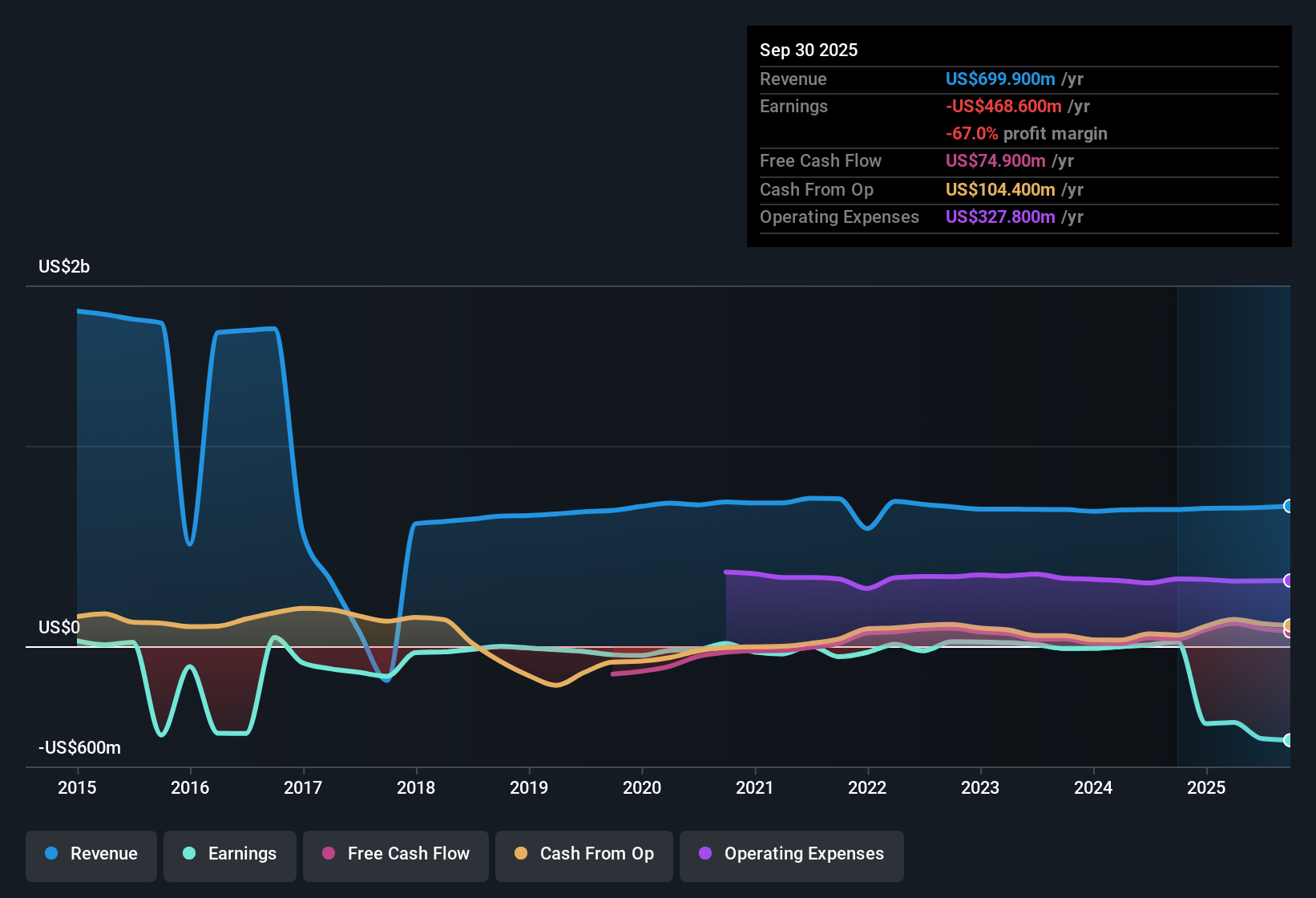

Avanos Medical (AVNS) remains unprofitable, with losses widening at an average rate of 74.4% per year over the past five years. Improving profit growth has proven elusive and the company’s net profit margin shows no sign of a turnaround. Despite these challenges, investors may still see a potential value play as persistent profitability headwinds are set against a discounted valuation and a share price of $10.66, which is notably below the estimated fair value of $45.32.

See our full analysis for Avanos Medical.The next section assesses how these headline numbers measure up against the major narratives shaping sentiment around Avanos Medical, highlighting both points of alignment and areas of divergence.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profitability Remains Under Pressure

- Net profit margin has shown no signs of improvement, confirming that Avanos Medical remains in a loss-making position with no acceleration in profit growth, as supported by an average annual loss increase of 74.4% over the past five years.

- Ongoing loss trends point to persistent execution hurdles. This stands in contrast to the idea that consistent operational improvement will drive a turnaround.

- Analysts monitoring sector peers highlight that operational discipline elsewhere has created investor optimism, but Avanos’s continually negative margins underline a key challenge.

- This sustained lack of margin recovery means any near-term sentiment shift will likely depend on clear evidence of a reversal in these loss dynamics.

Revenue and Earnings Growth Not Expected Near-Term

- The company faces a major risk: neither revenue nor earnings are expected to show meaningful growth, with historical losses persisting and a lack of high-quality past earnings as specifically highlighted in the EDGAR summary.

- Critics highlight that sustained losses and failure to demonstrate earnings acceleration reinforce cautious outlooks.

- The absence of improved top-line or bottom-line growth erodes the case for a near-term fundamental re-rating.

- Ongoing struggles with profit generation suggest that management has not yet unlocked drivers that would inspire renewed investor confidence.

Valuation Gap Versus Peers Remains Wide

- Avanos Medical’s Price-to-Sales Ratio sits at 0.7x, materially below the peer group average of 1.2x and the U.S. Medical Equipment industry average of 2.9x. The share price of $10.66 also trades at a sharp discount to the DCF fair value of $45.32.

- What is surprising is that this large valuation gap could attract bargain-seeking investors even as operational concerns persist.

- The discounted valuation alone heavily supports arguments for recovery potential, especially if operational execution begins to improve in future periods.

- However, until profit and revenue trends shift, the low valuation underscores investor skepticism rather than market confidence in an imminent turnaround.

- To see how the story could evolve once operational results change, some investors dig into detailed narratives for Avanos Medical and track how opinion shifts over time. 📊 Read the full Avanos Medical Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Avanos Medical's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Avanos Medical continues to struggle with persistent losses, stagnant revenue, and no clear improvement in profitability or earnings momentum.

If you want to focus on companies showing steady revenue and profit expansion instead, use our stable growth stocks screener (2074 results) to discover businesses delivering consistent results through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AVNS

Avanos Medical

A medical technology company, provides medical device solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives