- United States

- /

- Healthcare Services

- /

- NYSE:AMN

AMN Healthcare Services' (NYSE:AMN one-year decrease in earnings delivers investors with a 52% loss

Even the best stock pickers will make plenty of bad investments. Anyone who held AMN Healthcare Services, Inc. (NYSE:AMN) over the last year knows what a loser feels like. To wit the share price is down 52% in that time. We note that it has not been easy for shareholders over three years, either; the share price is down 47% in that time. The falls have accelerated recently, with the share price down 12% in the last three months.

If the past week is anything to go by, investor sentiment for AMN Healthcare Services isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for AMN Healthcare Services

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

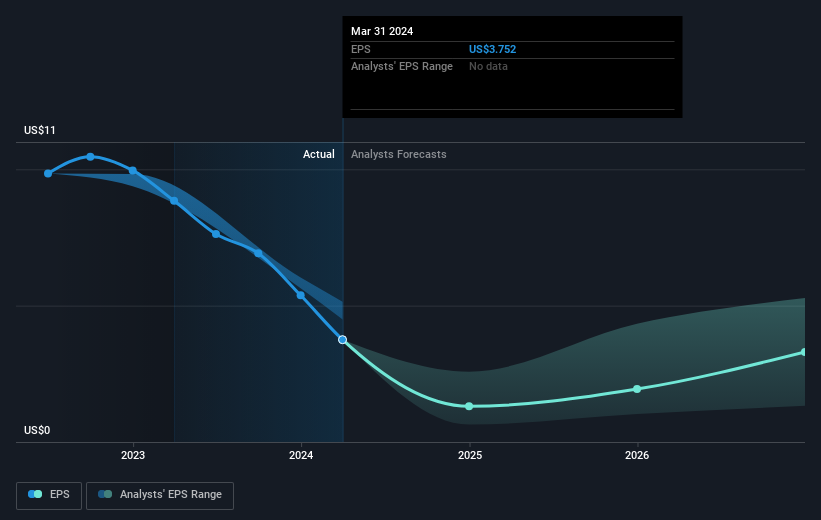

Unhappily, AMN Healthcare Services had to report a 58% decline in EPS over the last year. We note that the 52% share price drop is very close to the EPS drop. So it seems that the market sentiment has not changed much, despite the weak results. Instead, the change in the share price seems to reduction in earnings per share, alone.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of AMN Healthcare Services' earnings, revenue and cash flow.

A Different Perspective

AMN Healthcare Services shareholders are down 52% for the year, but the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for AMN Healthcare Services that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: most of them are flying under the radar).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMN

AMN Healthcare Services

Provides healthcare workforce solutions and staffing services to healthcare facilities in the United States.

Undervalued with mediocre balance sheet.