- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Abbott Laboratories (NYSE:ABT) Partners With Tandem To Develop Dual Sensor Diabetes Solutions

Reviewed by Simply Wall St

Tandem Diabetes Care, Inc. recently announced a significant collaboration with Abbott Laboratories (NYSE:ABT) to integrate Abbott's upcoming dual glucose-ketone sensor with Tandem’s insulin delivery systems. This and other collaborations, such as the agreement with Sequel Med Tech, align with Abbott's strategic focus on enhancing diabetes care. Abbott's shares rose 3% over the last quarter, aligning closely with broader market trends, which advanced 13% over the past year. The company's robust product approvals and partnerships, alongside positive market sentiment, likely reinforced investor confidence in Abbott’s growth trajectory amid generally favorable market conditions.

You should learn about the 1 possible red flag we've spotted with Abbott Laboratories.

Find companies with promising cash flow potential yet trading below their fair value.

The recent collaboration between Tandem Diabetes Care, Inc. and Abbott Laboratories to integrate Abbott's dual glucose-ketone sensor has the potential to enhance Abbott's market positioning in diabetes care. This partnership, along with other strategic agreements, could support revenue growth in Abbott’s Diabetes Care segment, though challenges such as tariffs and VBP program impacts in China remain. Abbott's five-year total return, including share price and dividends, stands at 63.31%, showcasing strong longer-term performance, despite some earnings forecast pressure.

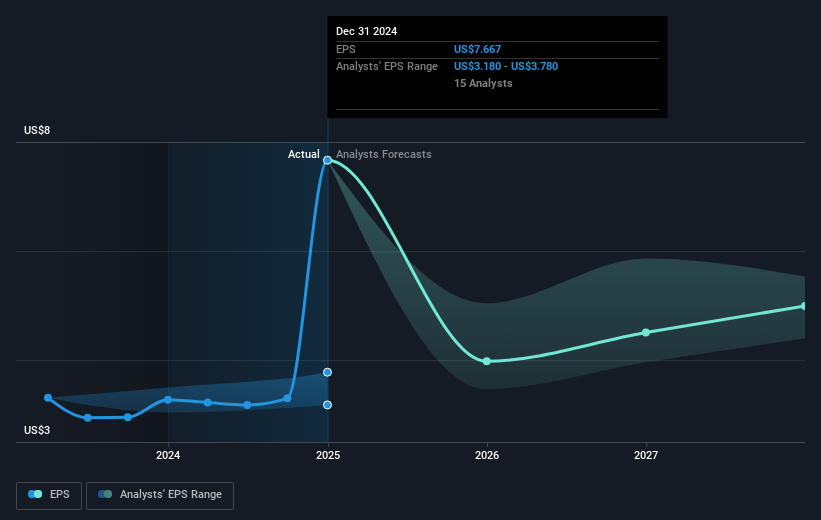

In the past year, Abbott's shares have risen above the US Medical Equipment industry, which saw a return of 8.2%. This outperformance over a shorter time horizon indicates that investor confidence remains buoyant. However, the expectation of declining earnings over the next three years, with a 10.1% decrease per year, highlights forecast challenges. This contrasts with a forecasted revenue growth of 6.9% annually, which is slower than the broader US market growth rate of 8.6% per year. The current share price of US$133.06 reflects a modest 5.2% discount to the consensus analyst price target of US$140.41, suggesting a perception of fair valuation compared to expected earnings growth and projected revenue increases.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives