- United States

- /

- Medical Equipment

- /

- NYSE:ABT

Abbott Laboratories (NYSE:ABT) Gains FDA Nod For Tendyne Mitral Valve System

Reviewed by Simply Wall St

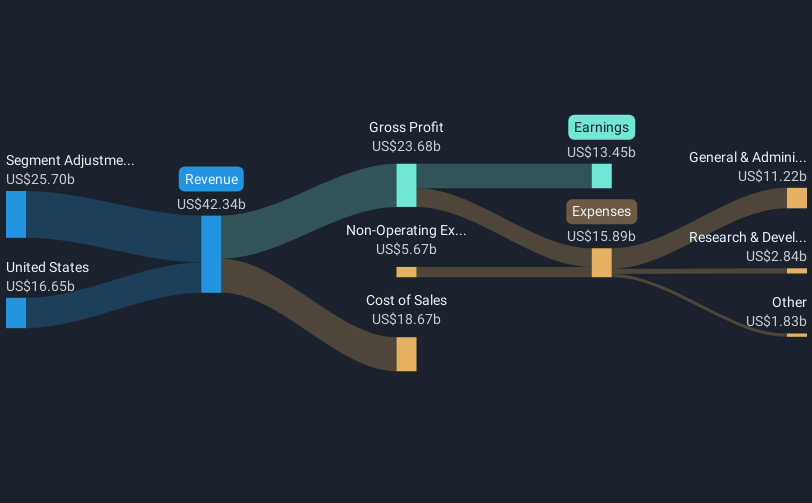

Abbott Laboratories (NYSE:ABT) recently received FDA approval for its Tendyne™ TMVR system, a significant milestone enhancing its cardiovascular product portfolio. Over the past month, Abbott's stock price moved up by about 3%, which aligns with broader market trends, suggesting that its advancements may have supported this momentum. Alongside this, updates on partnerships and product innovations, such as integrating glucose monitoring data with Epic's health records and collaborating with MotoAmerica for brain injury assessments, likely added positive sentiment towards the company's robust and diversified healthcare offerings amidst a relatively flat market.

We've spotted 1 warning sign for Abbott Laboratories you should be aware of.

Abbott Laboratories' recent FDA approval for the Tendyne™ TMVR system could support its cardiovascular offerings and potentially bolster the company's financial outlook amid challenges like tariffs in 2025 and VBP programs in China. The share price's 3% rise over the past month, although modest, juxtaposed with prolonged financial pressures could signal mixed market sentiments. This aligns closely with the analyst price target of $140.41 in light of the current share price of US$133.06, highlighting cautious investor outlook amidst macroeconomic uncertainties.

Over a five-year period ending May 2025, Abbott's total shareholder return, including dividends, hit 56.83%, marking a substantial increase. This contrasts with a return of 11.3% exceeding the US market in the past year alone. Within the US Medical Equipment industry, Abbott also performed better, surpassing the industry's 9.7% return over the same year span. However, earnings forecasts reflect challenges, with projections indicating a 10.1% annual decline over the next three years, raising questions about sustaining the past momentum.

The recent developments involving FDA product approvals and partnerships with Epic and MotoAmerica may prompt revised revenue and earnings forecasts. These innovations could act as catalysts for future growth, yet significant investments required might compress margins short-term. As the projected returns align closely with current market valuations, investors may anticipate marginal increases as indicated by the consensus price target. As Abbott continues its diversification and global expansion efforts, understanding its financial dynamics becomes crucial for evaluating future potential returns.

Evaluate Abbott Laboratories' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABT

Abbott Laboratories

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives