- United States

- /

- Medical Equipment

- /

- NasdaqGS:XRAY

Is DENTSPLY SIRONA a Bargain After Leadership Changes and a 32% Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering whether DENTSPLY SIRONA is a deal, a risk, or something in between? Let's break down what really matters when sizing up its value.

- Despite a slight dip of 1.9% over the past week, the stock has moved just 0.8% in the last month and remains down a significant 32.7% year-to-date. This hints at investors juggling uncertainty and opportunity.

- Recent headlines have focused on ongoing leadership changes and the company's renewed commitment to cost-cutting strategies. Notably, DENTSPLY SIRONA's push to streamline operations is grabbing attention, causing some market movement as investors digest the long-term implications.

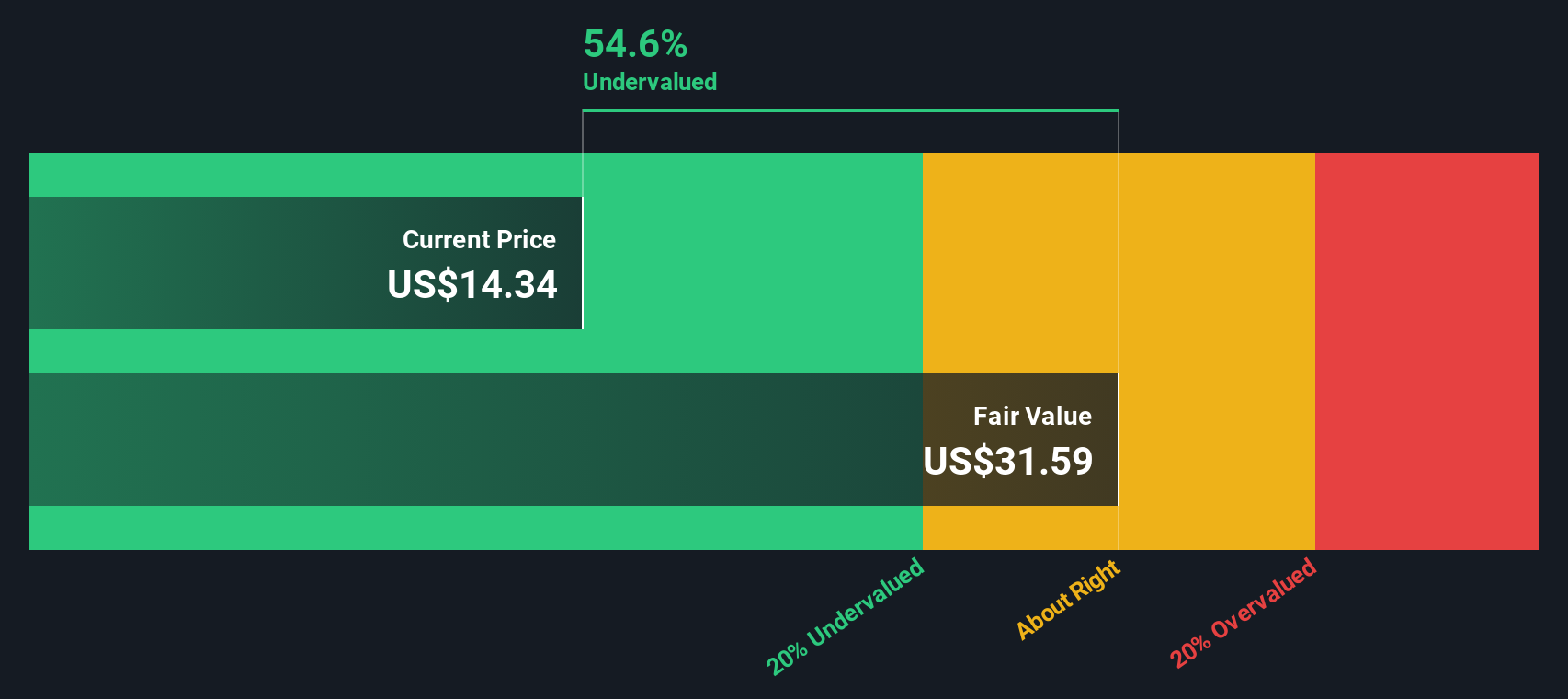

- All this leads us to DENTSPLY SIRONA's current valuation score of 5 out of 6, suggesting there are several signs of undervaluation. We will compare the different ways to assess that score in a moment, but stay tuned for a deeper perspective on what really drives value. Sometimes the best insights come last.

Find out why DENTSPLY SIRONA's -45.1% return over the last year is lagging behind its peers.

Approach 1: DENTSPLY SIRONA Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and then discounting them back to today's value. This process helps investors understand what the business is worth based on its ability to generate cash over time, rather than simply looking at earnings or dividends.

DENTSPLY SIRONA currently generates an annual Free Cash Flow of $141.3 million. Analyst projections anticipate this figure to grow substantially, reaching $407 million by the end of 2029. While analysts supply estimates for the next five years, projections beyond that are extrapolated to capture expected future performance as fully as possible.

Applying the 2 Stage Free Cash Flow to Equity DCF model, the estimated intrinsic value per share comes out to $29.77. This represents a 57.6% discount compared to the company's recent trading price, implying that the stock is significantly undervalued based on these cash flow projections.

The takeaway is clear: if these growth expectations are even close to being met, DENTSPLY SIRONA's shares look attractively priced.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests DENTSPLY SIRONA is undervalued by 57.6%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: DENTSPLY SIRONA Price vs Sales

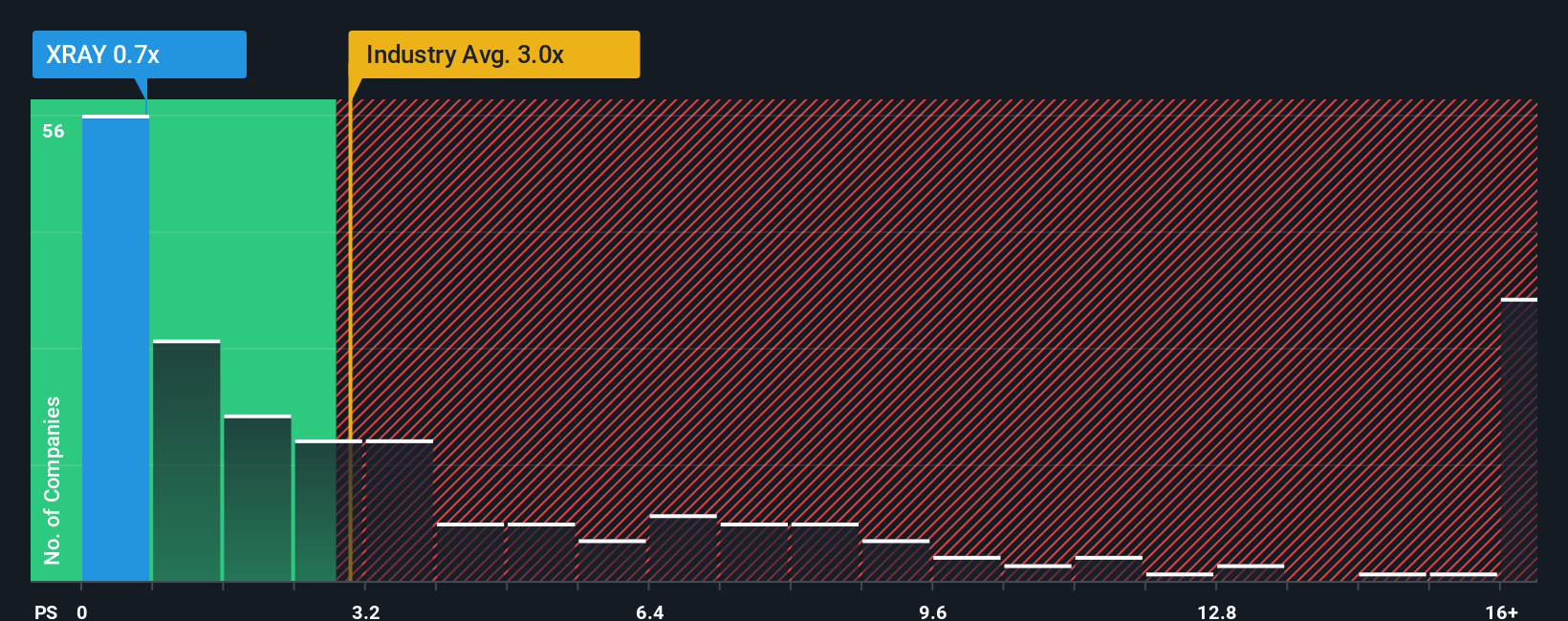

For companies like DENTSPLY SIRONA, which are working to return to stronger profitability, the Price-to-Sales (P/S) ratio is often preferred as a valuation metric. Unlike price-to-earnings (P/E), which can be distorted by temporary losses, the P/S ratio offers a clear sense of how much investors are paying for each dollar of the company’s sales. This makes it useful when earnings are negative or volatile.

Typically, faster growth and lower risk warrant a higher P/S ratio because investors are willing to pay more for each dollar of revenue. Conversely, slow growth or higher risk point to a lower "fair" P/S multiple. DENTSPLY SIRONA is currently trading at a P/S ratio of 0.69x, well below both the Medical Equipment industry average at 3.02x and the peer average at 4.64x. This indicates the market is discounting its sales relative to similar companies.

To put this in context, Simply Wall St calculates a "Fair Ratio" for the stock: 1.43x. This proprietary metric gives a more tailored benchmark, as it factors in DENTSPLY SIRONA’s earnings outlook, profit margins, industry, market capitalization, and risks. By going beyond simple peer or industry multiples, the Fair Ratio offers a more realistic gauge of true value.

Given the Fair Ratio of 1.43x and the company’s current P/S of 0.69x, DENTSPLY SIRONA appears notably undervalued by this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your DENTSPLY SIRONA Narrative

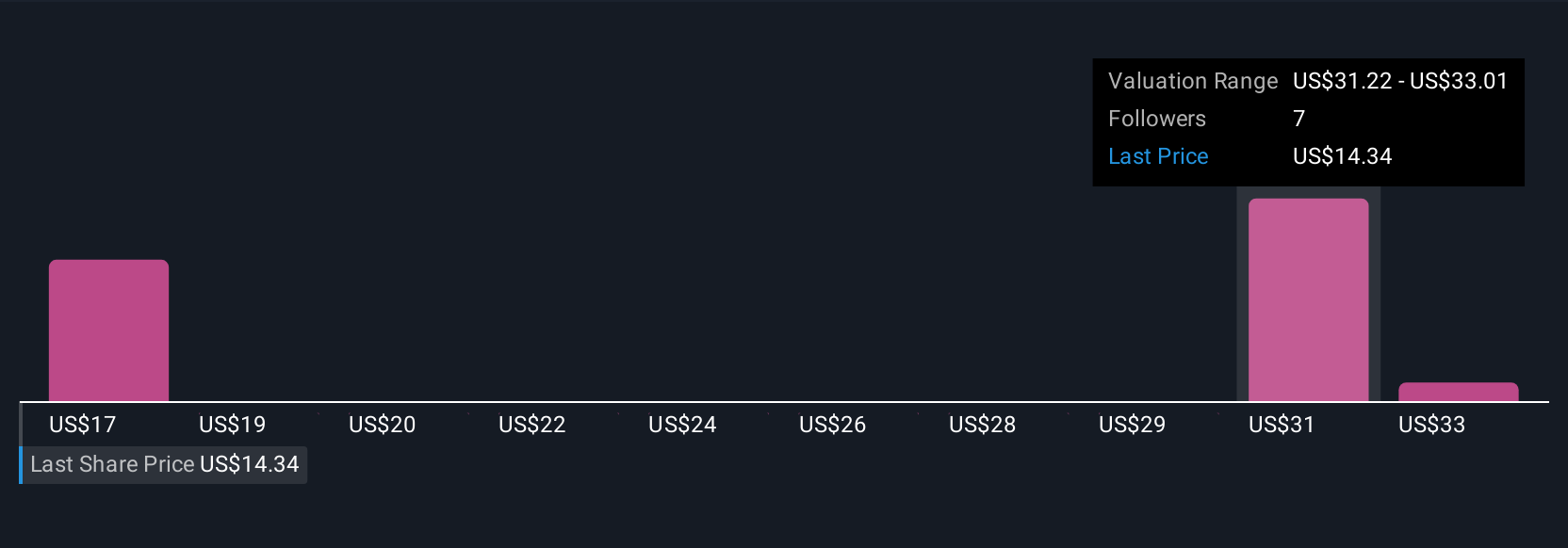

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story, reflecting how you see a company's future and connecting your personal expectations about DENTSPLY SIRONA's future sales, earnings, and margins to a financial forecast and an estimated fair value. Narratives show you the link between the real-world business story and the numbers behind a share price, making it easy for anyone, from novice to pro, to track their investing thesis.

On Simply Wall St’s Community page, millions of investors share and update Narratives. This tool helps you compare your own fair value to the market price, so you can see whether your view suggests a buy or sell. Narratives update automatically as news, earnings, or company events unfold.

For instance, a bullish Narrative on DENTSPLY SIRONA might use optimistic revenue recovery and margin expansion estimates to justify a price target near $24, while a cautious Narrative might highlight continued sales pressure and margin risk, aligning with the lowest price target of $14. Whatever your perspective, Narratives empower you to invest based on your own informed story, not just the latest headline or market mood.

Do you think there's more to the story for DENTSPLY SIRONA? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:XRAY

DENTSPLY SIRONA

Develops, manufactures, and markets dental equipment supported by cloud-enabled solutions, dental products, and healthcare consumable products in urology and enterology worldwide.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives