- United States

- /

- Medical Equipment

- /

- NasdaqGM:TNDM

Is Integration With FreeStyle Libre 3 Plus CGM Changing the Investment Case for Tandem Diabetes Care (TNDM)?

Reviewed by Sasha Jovanovic

- In October 2025, Tandem Diabetes Care announced that its t:slim X2 insulin pump with Control-IQ+ technology is now integrated with Abbott's FreeStyle Libre 3 Plus CGM sensor for U.S. users, marking the start of a global rollout.

- This integration introduces expanded device compatibility and allows both new and eligible current users to access the updated system via a remote software update at no additional cost.

- Next, we'll examine how this expanded CGM compatibility could reinforce Tandem Diabetes Care’s market positioning and future growth narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Tandem Diabetes Care Investment Narrative Recap

At its core, the Tandem Diabetes Care investment thesis centers on the company’s ability to maintain innovation, grow its user base, and translate advanced technology into recurring high-margin supply revenue in a highly competitive market. The recent integration of the t:slim X2 pump with Abbott’s FreeStyle Libre 3 Plus sensor could support short-term adoption and ecosystem lock-in, but does not immediately address the biggest near-term risk: pressure from new and existing competitors slowing pump starts or eroding market share.

Among recent developments, the FDA clearance and scheduled rollout of the SteadiSet extended wear infusion set stands out. This aligns with the push for new automated and user-friendly pump solutions highlighted as growth drivers, but the effectiveness of these product launches in accelerating new patient growth remains crucial alongside expanded device compatibility.

However, in contrast to these innovations, investors should be aware that heavy reliance on renewals, especially as renewal growth is projected to flatten in 2026, means that even expanded compatibility can only offset...

Read the full narrative on Tandem Diabetes Care (it's free!)

Tandem Diabetes Care's outlook anticipates $1.2 billion in revenue and $14.4 million in earnings by 2028. This is based on a 7.5% annual revenue growth rate and a $219.9 million improvement in earnings from the current level of -$205.5 million.

Uncover how Tandem Diabetes Care's forecasts yield a $20.64 fair value, a 41% upside to its current price.

Exploring Other Perspectives

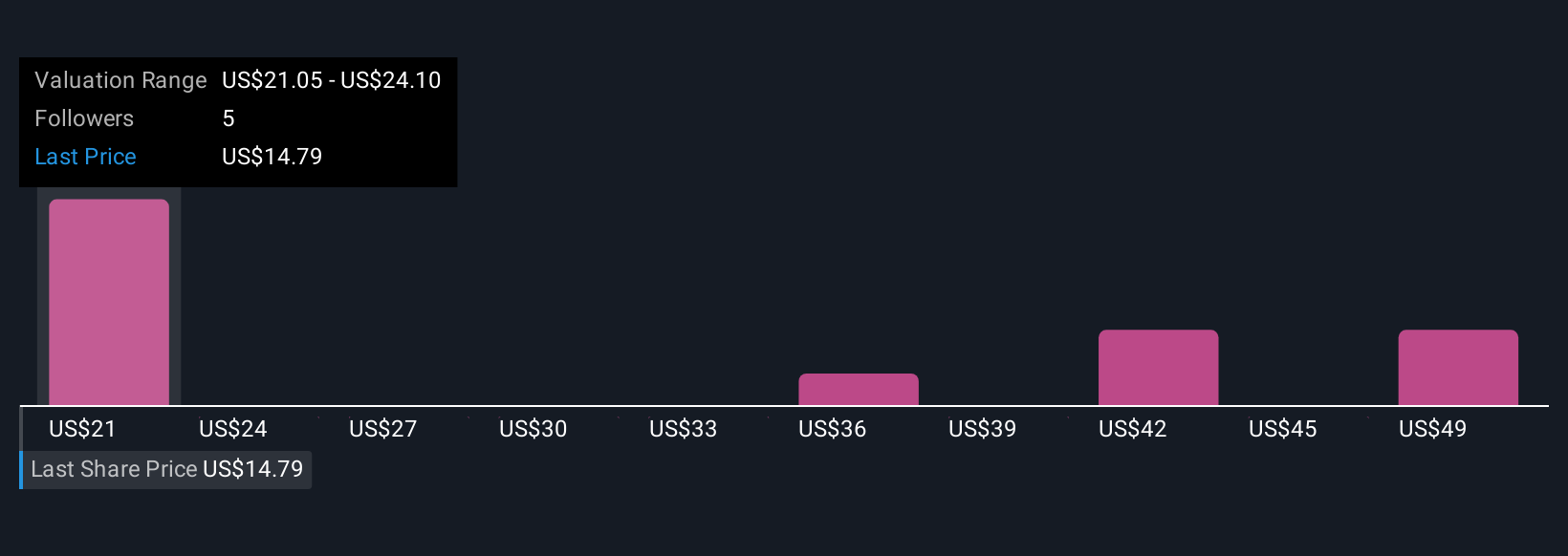

Private investors in the Simply Wall St Community put fair value for Tandem Diabetes Care stock between US$20.64 and US$51.58, across five separate estimates. This diversity of views highlights how broader interoperability and innovation potential influence expectations, yet growing competition remains a central challenge for sustaining returns.

Explore 5 other fair value estimates on Tandem Diabetes Care - why the stock might be worth over 3x more than the current price!

Build Your Own Tandem Diabetes Care Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tandem Diabetes Care research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Tandem Diabetes Care research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tandem Diabetes Care's overall financial health at a glance.

No Opportunity In Tandem Diabetes Care?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tandem Diabetes Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TNDM

Tandem Diabetes Care

Designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives