- United States

- /

- Healthcare Services

- /

- NasdaqCM:TALK

Talkspace (TALK) One-Off $1.2M Loss Challenges Bullish Profitability Narrative Despite Strong Growth

Reviewed by Simply Wall St

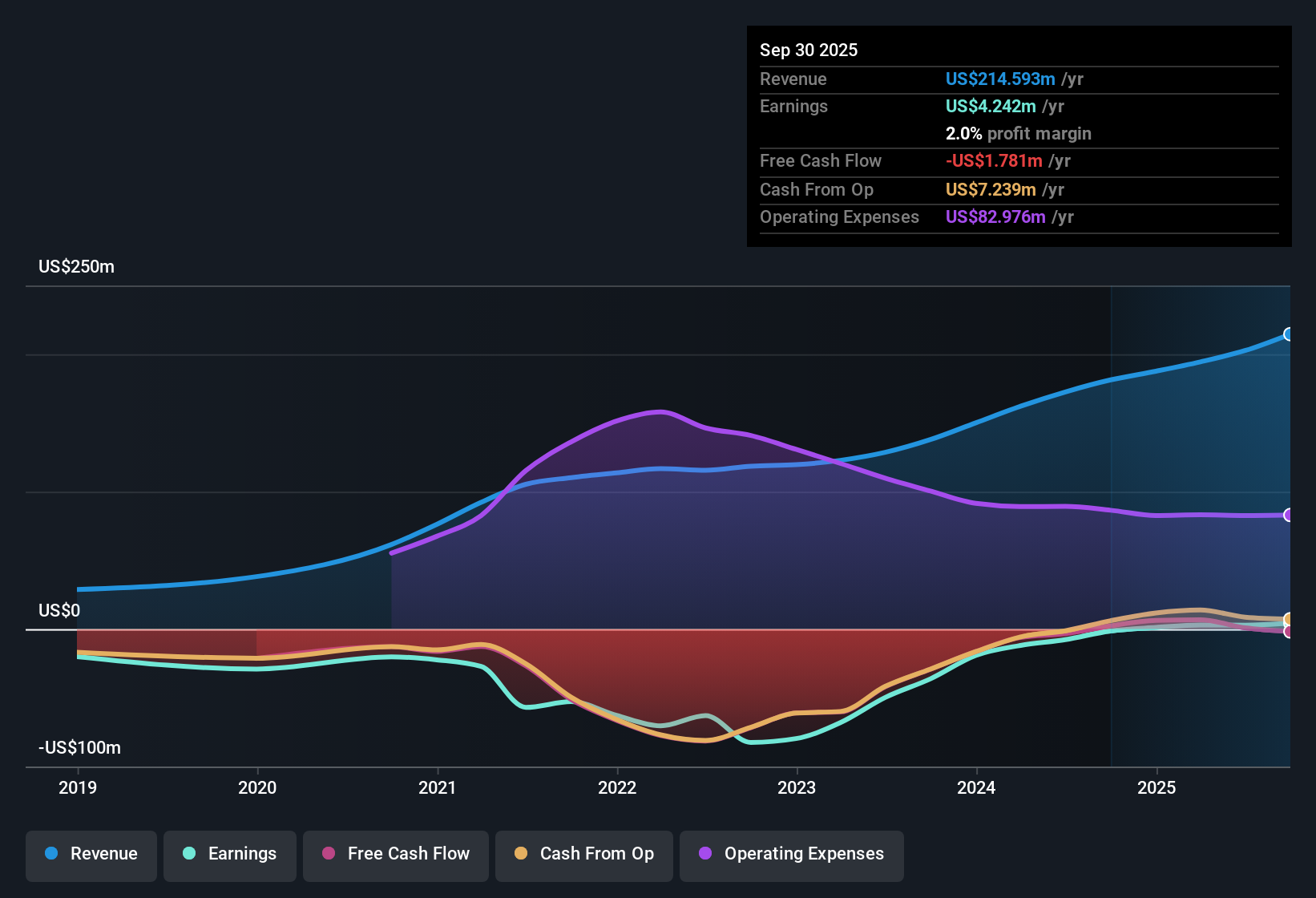

Talkspace (TALK) has turned profitable, with earnings climbing at an annual rate of 29.1% over the last five years. Forecasts point to a 41.2% earnings growth each year ahead. Revenue is expected to rise 16.9% per year, outpacing the broader US market’s 10.3% growth. However, a one-off loss of $1.2 million weighed on the most recent results through September 30, 2025. Trading at $2.9, shares sit below an estimated fair value of $15.82. This has set the stage for ongoing debate about growth and valuation as TALK navigates its first stretch of sustained profitability.

See our full analysis for Talkspace.Next, we’ll see how these numbers compare to the widely discussed narratives in the market, highlighting where the earnings story supports or challenges investor expectations.

See what the community is saying about Talkspace

Gross Margin Set for Major Upswing

- Profit margins are expected to climb from 1.4% today to 12.7% over the next three years, according to analyst forecasts.

- Analysts' consensus view links margin expansion closely to two factors:

- Broader insurance coverage and robust employer demand are projected to boost recurring revenue, which supports these rising profit levels.

- AI-driven improvements in operational efficiency are already driving higher retention and scalability. If demand trends continue, this could make margin expansion more durable.

- The consensus narrative notes that investments in proprietary AI tools and streamlined marketing lowered operating costs in 2025. This sets the stage for operating leverage and improved EBITDA in the coming quarters.

- With much of this year's tech and marketing spend already incurred, incremental growth is expected to translate more directly into earnings going forward.

- Long-term viability relies on these operational efficiencies continuing to outpace rising competition and regulatory costs.

See how analysts view these profit margin forecasts and why they matter most for long-term investors. 📊 Read the full Talkspace Consensus Narrative.

Industry Premium Tied to High Growth Expectations

- Talkspace trades at a Price-to-Sales ratio of 2.4x, a premium to both the US healthcare industry average of 1.3x and peer average of 0.4x.

- The consensus narrative frames this premium as a bet on future growth:

- Forecast revenue growth of 16.9% annually is well above the US market average of 10.3%, helping justify a higher valuation multiple for now.

- However, to keep this premium pricing, bulls will need to see those projected profit margins actually materialize, since a one-off $1.2 million loss still affects perceptions of earnings quality.

DCF Fair Value Implies Deep Discount

- At the current share price of $2.90, the stock sits far below its DCF fair value estimate of $15.82, creating a significant valuation gap for investors monitoring discounted cash flows.

- The consensus narrative highlights tension in price targets and market views:

- The analyst consensus price target of $4.80 is 44.8% above the current price, suggesting Wall Street sees upside even if targets fall well short of DCF-based fair value calculations.

- For this potential upside to be realized, the path to $45 million in earnings and margin expansion to 12.7% must stay on track, while managing risks like payer concentration and regulatory shifts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Talkspace on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on the data? Share your perspective and shape the story in just a few minutes. Do it your way

A great starting point for your Talkspace research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Talkspace posts strong growth projections, its premium valuation and recent one-off loss show profits are still vulnerable if margins do not expand as hoped.

If you want steadier performers with consistent returns, search for companies delivering reliable results through cycles by starting with stable growth stocks screener (2093 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talkspace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TALK

Talkspace

Operates as a virtual behavioral healthcare company that connects patients with licensed mental health providers in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives