- United States

- /

- Medical Equipment

- /

- NasdaqGM:STIM

Neuronetics, Inc.'s (NASDAQ:STIM) Shares Leap 69% Yet They're Still Not Telling The Full Story

Despite an already strong run, Neuronetics, Inc. (NASDAQ:STIM) shares have been powering on, with a gain of 69% in the last thirty days. The last 30 days bring the annual gain to a very sharp 35%.

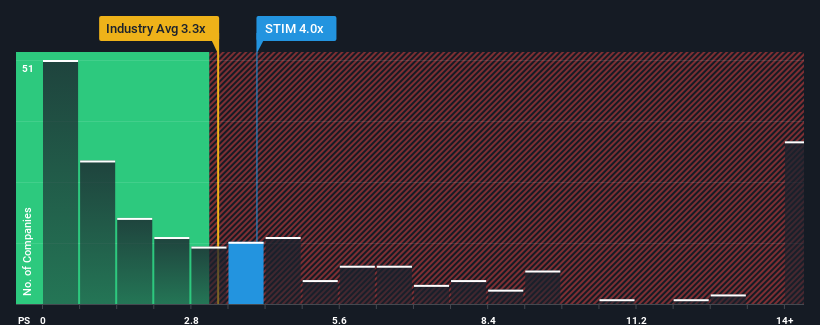

Even after such a large jump in price, it's still not a stretch to say that Neuronetics' price-to-sales (or "P/S") ratio of 4x right now seems quite "middle-of-the-road" compared to the Medical Equipment industry in the United States, where the median P/S ratio is around 3.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Neuronetics

How Neuronetics Has Been Performing

With revenue growth that's inferior to most other companies of late, Neuronetics has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Neuronetics will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Neuronetics' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 5.0%. This was backed up an excellent period prior to see revenue up by 35% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 35% each year during the coming three years according to the four analysts following the company. That's shaping up to be materially higher than the 9.4% each year growth forecast for the broader industry.

In light of this, it's curious that Neuronetics' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Neuronetics' P/S?

Neuronetics appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Neuronetics' P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Neuronetics (2 shouldn't be ignored) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Neuronetics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:STIM

Neuronetics

Engages in providing in office treatments for patients with neurohealth disorders in the United States and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives