- United States

- /

- Medical Equipment

- /

- NasdaqGM:STIM

A Piece Of The Puzzle Missing From Neuronetics, Inc.'s (NASDAQ:STIM) 28% Share Price Climb

Those holding Neuronetics, Inc. (NASDAQ:STIM) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 16% over that time.

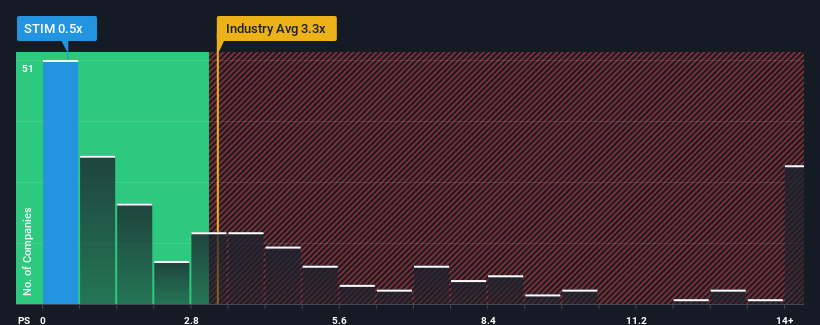

Even after such a large jump in price, Neuronetics' price-to-sales (or "P/S") ratio of 0.5x might still make it look like a strong buy right now compared to the wider Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.3x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Neuronetics

How Has Neuronetics Performed Recently?

Recent times haven't been great for Neuronetics as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Neuronetics.Is There Any Revenue Growth Forecasted For Neuronetics?

The only time you'd be truly comfortable seeing a P/S as depressed as Neuronetics' is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company managed to grow revenues by a handy 6.2% last year. The latest three year period has also seen an excellent 32% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 15% per year as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 9.3% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Neuronetics' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Neuronetics' recent share price jump still sees fails to bring its P/S alongside the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

To us, it seems Neuronetics currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Neuronetics you should be aware of, and 1 of them shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Neuronetics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:STIM

Neuronetics

Engages in providing in office treatments for patients with neurohealth disorders in the United States and internationally.

Moderate risk and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success