- United States

- /

- Medical Equipment

- /

- NasdaqGM:STAA

STAAR Surgical (STAA): Assessing Valuation Following Recent Earnings Growth and Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for STAAR Surgical.

STAAR Surgical’s share price has pulled back 4.7% over the past month after a strong 39.9% gain in the past 90 days, reflecting a recent improvement in investor sentiment following better results. However, the 1-year total shareholder return remains negative, showing momentum is still in recovery mode despite the latest uptick.

With market sentiment shifting, now could be a smart time to uncover other healthcare stocks that are adapting to change. See the full list for free with See the full list for free.

With recent financial gains and a notable pullback in the share price, the key question now is whether STAAR Surgical is trading at a bargain, or if the market has already factored in the company's future prospects.

Most Popular Narrative: Fairly Valued

The widely followed market narrative places STAAR Surgical’s fair value at $25.88, almost matching its last close price of $25.87. This close alignment suggests market consensus sees the current price as a fair reflection of the company’s future prospects.

STAAR Surgical has significant cash reserves and no debt, providing a strong financial base to navigate the current challenges, reduce production outputs temporarily, and invest selectively in growth initiatives, potentially stabilizing earnings and providing upside if conditions improve.

Curious what’s driving this balanced valuation? The narrative hinges on an ambitious transformation: future profit and revenue growth are expected, along with a pivotal shift in how STAAR Surgical is valued. Want to understand the bold forecasts putting this fair value within reach? Unlock the full story and the numbers behind these projections.

Result: Fair Value of $25.88 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty remains as weaker consumer demand in China, along with the ongoing reliance on a single distributor, could challenge growth expectations and earnings visibility.

Find out about the key risks to this STAAR Surgical narrative.

Another View: A Closer Look at Valuation Ratios

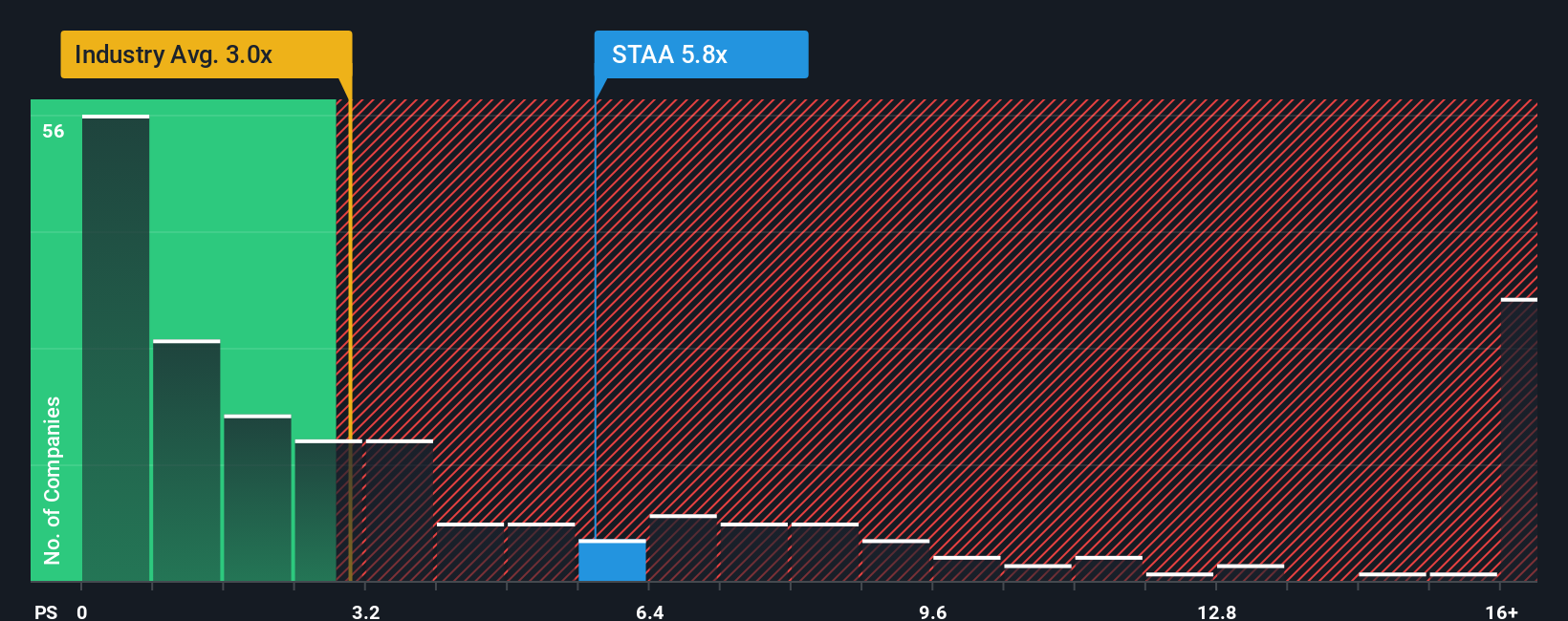

When analyzing STAAR Surgical from a price-to-sales perspective, the picture looks less appealing. Its ratio stands at 5.7x, significantly higher than both the industry average of 2.9x and the peer average of 3.1x. The fair ratio, based on market trends, is estimated at 3.6x. This sizable gap hints at a potential valuation risk if the market decides to re-rate the stock. Could future results justify this premium, or is the current price out of step with reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own STAAR Surgical Narrative

If you see things differently or want to dig deeper, you can analyze the numbers and build your own narrative in just a few minutes. Do it your way

A great starting point for your STAAR Surgical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don't let the best opportunities slip through your fingers. The markets are always moving, and smart investors act before the crowd catches on.

- Spot high-potential bargains by checking out these 840 undervalued stocks based on cash flows, which offer standout value based on solid cash flow fundamentals.

- Tap into future-defining innovation and see which companies are at the forefront of artificial intelligence breakthroughs through these 27 AI penny stocks.

- Secure steady income with ease by reviewing these 22 dividend stocks with yields > 3%, featuring shares with strong yields above 3% and resilient business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:STAA

STAAR Surgical

Designs, develops, manufactures, and sells implantable lenses for the eye and accessory delivery systems to deliver the lenses into the eye.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives