- United States

- /

- Medical Equipment

- /

- NasdaqGM:STAA

Getting In Cheap On STAAR Surgical Company (NASDAQ:STAA) Might Be Difficult

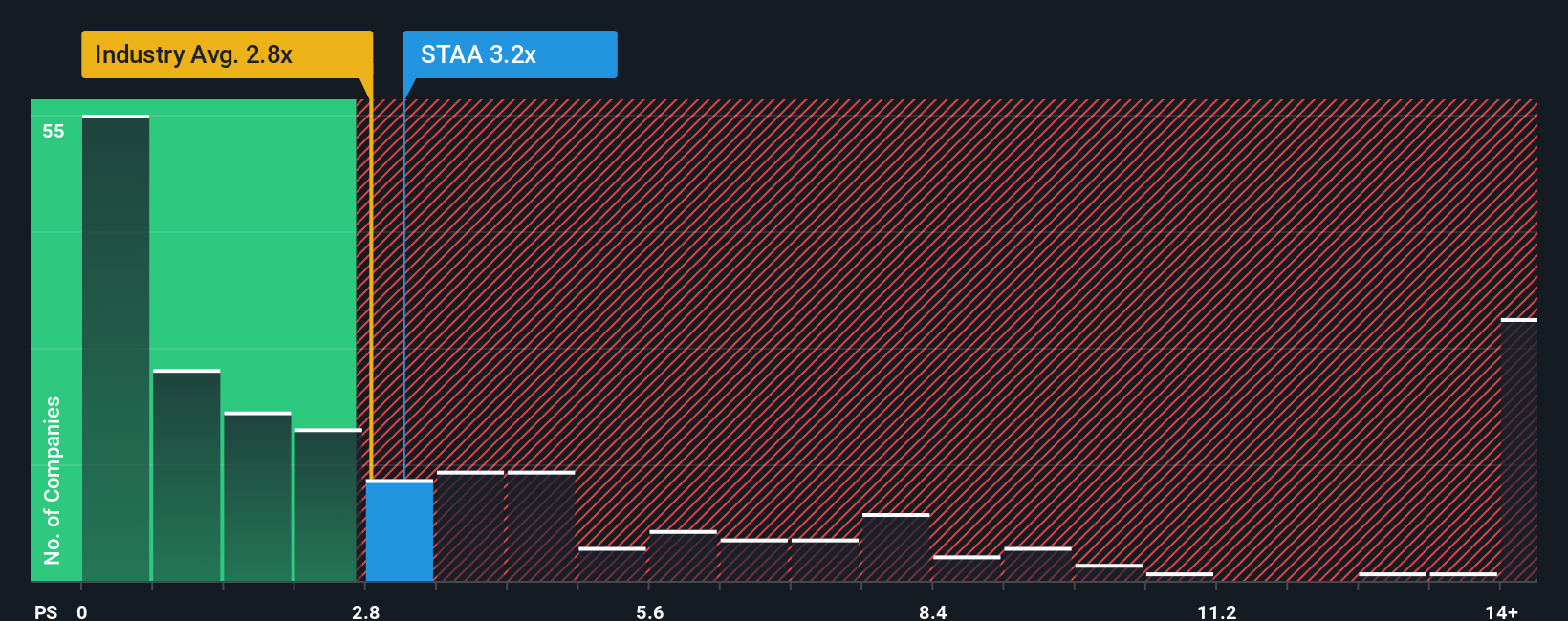

There wouldn't be many who think STAAR Surgical Company's (NASDAQ:STAA) price-to-sales (or "P/S") ratio of 3.2x is worth a mention when the median P/S for the Medical Equipment industry in the United States is similar at about 2.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for STAAR Surgical

How Has STAAR Surgical Performed Recently?

STAAR Surgical could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on STAAR Surgical will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For STAAR Surgical?

There's an inherent assumption that a company should be matching the industry for P/S ratios like STAAR Surgical's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. Regardless, revenue has managed to lift by a handy 15% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 8.5% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 9.9% per annum, which is not materially different.

With this information, we can see why STAAR Surgical is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What We Can Learn From STAAR Surgical's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at STAAR Surgical's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for STAAR Surgical with six simple checks on some of these key factors.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:STAA

STAAR Surgical

Designs, develops, manufactures, and sells implantable lenses for the eye and accessory delivery systems to deliver the lenses into the eye.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives