- United States

- /

- Healthtech

- /

- NasdaqGS:SOPH

SOPHiA GENETICS (SOPH): Revenue Growth Forecast at 17.91% Sets High Bar Before Earnings

Reviewed by Simply Wall St

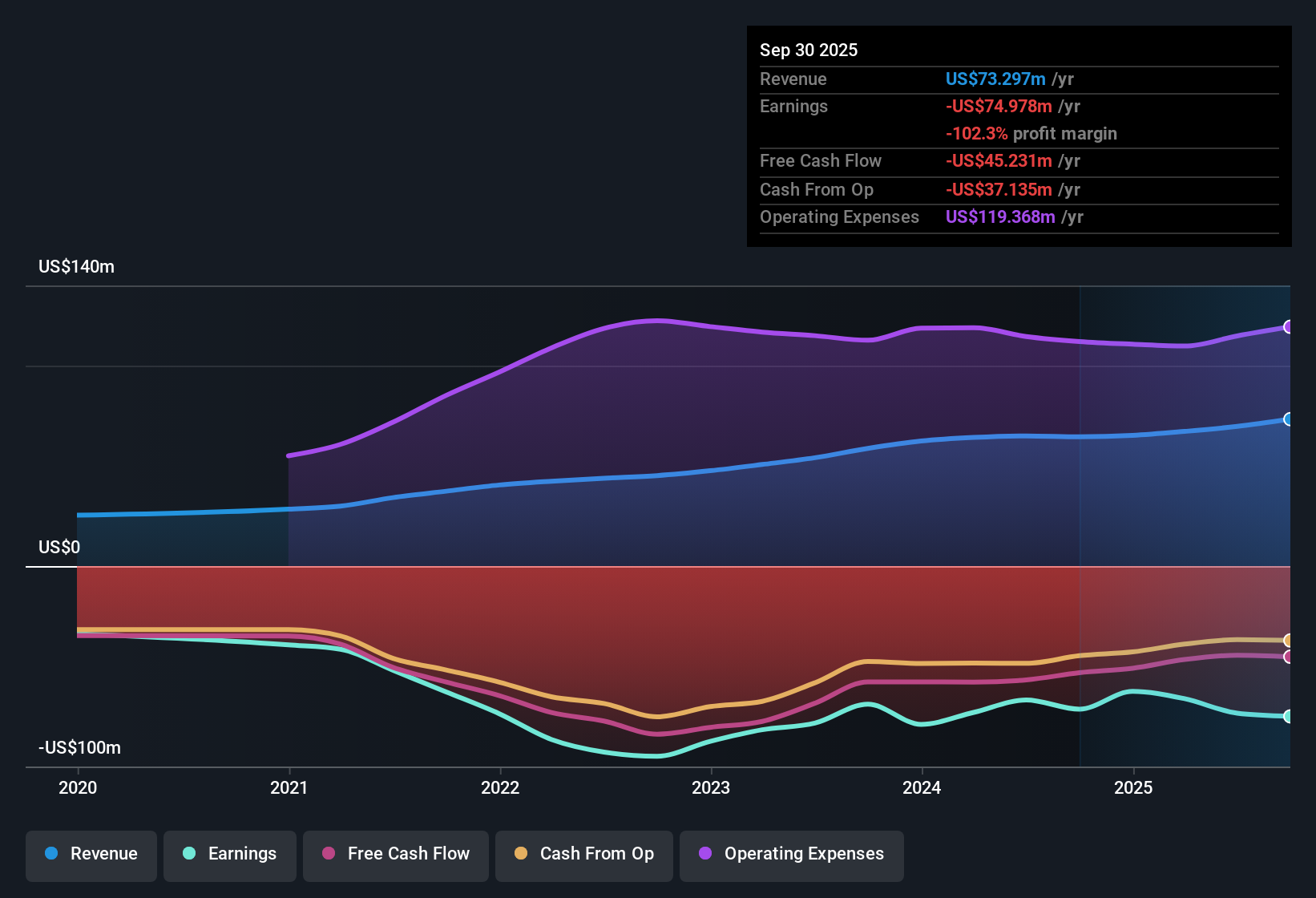

SOPHiA GENETICS (NasdaqGS:SOPH) is forecast to post annual revenue growth of 17.91%, surpassing the broader US market's expected 10.5% rate. The company has not yet achieved profitability and losses have actually grown at 4% per year for the past five years, with its net profit margin still in negative territory. For investors, the critical narrative is clear: the top-line growth potential stands out, but persistent losses and questions around the path to profitability remain a defining concern this earnings season.

See our full analysis for SOPHiA GENETICS.Next, we will examine how these headline results hold up when compared against the most widely discussed narratives in the market and on Simply Wall St, and where the numbers may start to challenge the story.

See what the community is saying about SOPHiA GENETICS

Margin Progress Without Profit

- SOPHiA GENETICS' net profit margin remains negative, and the company is not forecast to reach profitability within the next three years, even as gross margin (adjusted) improves to 74.4% thanks to process efficiencies and automation.

- According to the analysts' consensus view, ongoing investments in automation and cost discipline are improving gross margins and potentially reducing the rate of cash burn. However, persistent adjusted EBITDA losses highlight the uphill journey toward profitability.

- Bulls highlight that efficiencies are positioning the company for long-term operating leverage, but consensus notes that profitability is still years away because forecasted losses are expected to continue over the mid term.

- This dynamic creates near-term pressure but leaves meaningful upside if management can accelerate the shift from top-line growth to net earnings.

- To see if margin gains can turn the tide, see what the market’s consensus is on the full narrative.📊 Read the full SOPHiA GENETICS Consensus Narrative.

Premium Valuation Amid Losses

- The company trades at 4.3x Price-To-Sales, a notable premium to both peers (2.4x) and the US Healthcare Services industry average (3.2x), despite sustained unprofitability and a current share price of $4.68.

- Analysts' consensus view calls attention to this tension, noting that while rapid revenue growth is an attractive feature, the premium valuation demands investor confidence in SOPHiA GENETICS' ability to convert growth into meaningful earnings.

- Consensus acknowledges that failure to realize improved net margins or positive earnings over the next few years would challenge the rationale for paying above-industry multiples.

- Analysts suggest that, to justify the current price and analyst target of $7.00, the company needs to transition from fast growth toward sustainable profitability.

Revenue Growth Outpaces Market, But Risks Loom

- SOPHiA GENETICS is forecast to grow revenue by 17.91% annually, well above the US market’s projected 10.5% rate. However, the company’s growth is heavily reliant on ramping adoption of its platforms and large new partnerships, introducing customer concentration risk.

- Analysts' consensus narrative highlights that the accelerating adoption of personalized medicine and a significant new partnership with AstraZeneca could drive future recurring revenues, but warns that revenue growth is vulnerable if major customers slow implementation or partnerships do not deliver as planned.

- Increased exposure to foreign exchange swings and intensifying competition in genomics are also flagged as key risks to the growth story.

- This means future top-line outperformance is far from assured unless SOPHiA GENETICS maintains both innovation and execution at scale.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for SOPHiA GENETICS on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to interpret these figures your own way? It takes just minutes to build your personal narrative and put your investment view into context. Do it your way

A great starting point for your SOPHiA GENETICS research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

SOPHiA GENETICS faces premium valuation, ongoing net losses, and uncertainty over when its rapid revenue growth will translate into sustainable profits.

If you want to discover companies where current prices better reflect future earnings potential, check out these 844 undervalued stocks based on cash flows and target investments that offer stronger value for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SOPH

SOPHiA GENETICS

Operates as a cloud-native software technology company in the healthcare space.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives