- United States

- /

- Medical Equipment

- /

- OTCPK:SIEN.Q

Fewer Investors Than Expected Jumping On Sientra, Inc. (NASDAQ:SIEN)

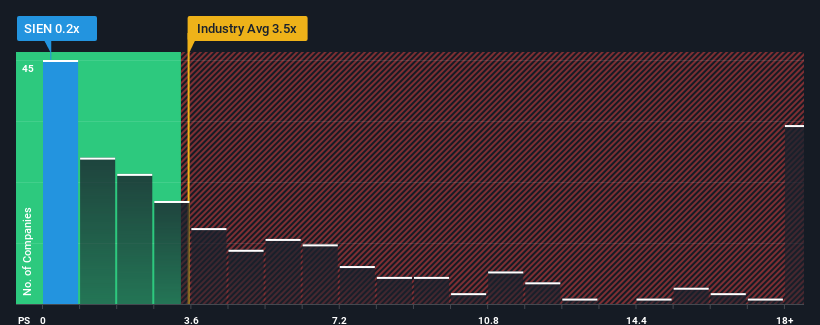

Sientra, Inc.'s (NASDAQ:SIEN) price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.5x and even P/S above 8x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for Sientra

How Has Sientra Performed Recently?

Recent times have been advantageous for Sientra as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sientra.Is There Any Revenue Growth Forecasted For Sientra?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Sientra's to be considered reasonable.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. Pleasingly, revenue has also lifted 95% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 13% each year over the next three years. With the industry only predicted to deliver 8.9% per year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Sientra's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Sientra currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Plus, you should also learn about these 6 warning signs we've spotted with Sientra (including 3 which are potentially serious).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:SIEN.Q

Project Sage Oldco

Sientra, Inc., a medical aesthetics company, develops and sells medical aesthetics products in the United States and internationally.

Slightly overvalued with weak fundamentals.

Similar Companies

Market Insights

Community Narratives