- United States

- /

- Healthcare Services

- /

- NasdaqGS:SGRY

Surgery Partners (NASDAQ:SGRY) delivers shareholders enviable 32% CAGR over 5 years, surging 5.8% in the last week alone

For many, the main point of investing in the stock market is to achieve spectacular returns. And highest quality companies can see their share prices grow by huge amounts. For example, the Surgery Partners, Inc. (NASDAQ:SGRY) share price is up a whopping 307% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. It's also good to see the share price up 27% over the last quarter.

Since the stock has added US$220m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Surgery Partners

Surgery Partners wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Surgery Partners saw its revenue grow at 11% per year. That's a pretty good long term growth rate. However, the share price gain of 32% during the period is considerably stronger. It might not be cheap but a (long-term) growth stock like this is usually well worth taking a closer look at.

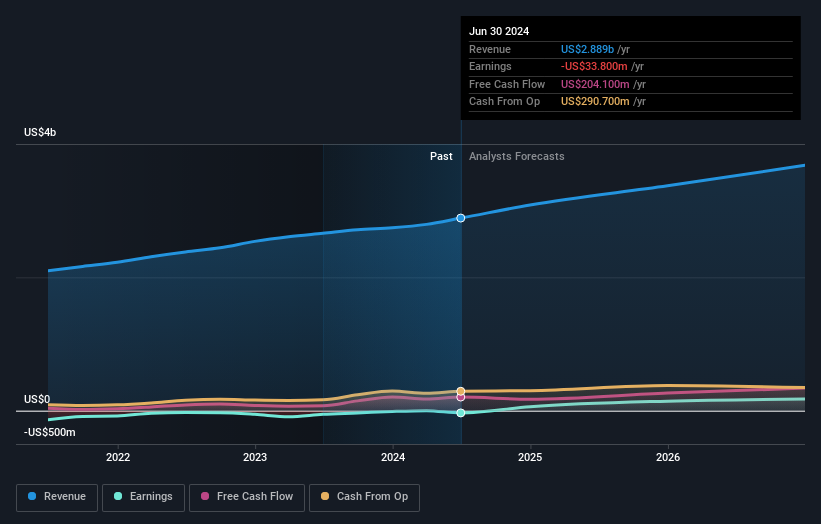

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Surgery Partners is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Surgery Partners shareholders are up 1.6% for the year. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 32% a year, over half a decade) look better. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. If you would like to research Surgery Partners in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Surgery Partners better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SGRY

Surgery Partners

Owns and operates a network of surgical facilities and ancillary services in the United States.

Good value with reasonable growth potential.