- United States

- /

- Medical Equipment

- /

- NasdaqGS:QDEL

Lacklustre Performance Is Driving QuidelOrtho Corporation's (NASDAQ:QDEL) 28% Price Drop

QuidelOrtho Corporation (NASDAQ:QDEL) shareholders won't be pleased to see that the share price has had a very rough month, dropping 28% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 44% in that time.

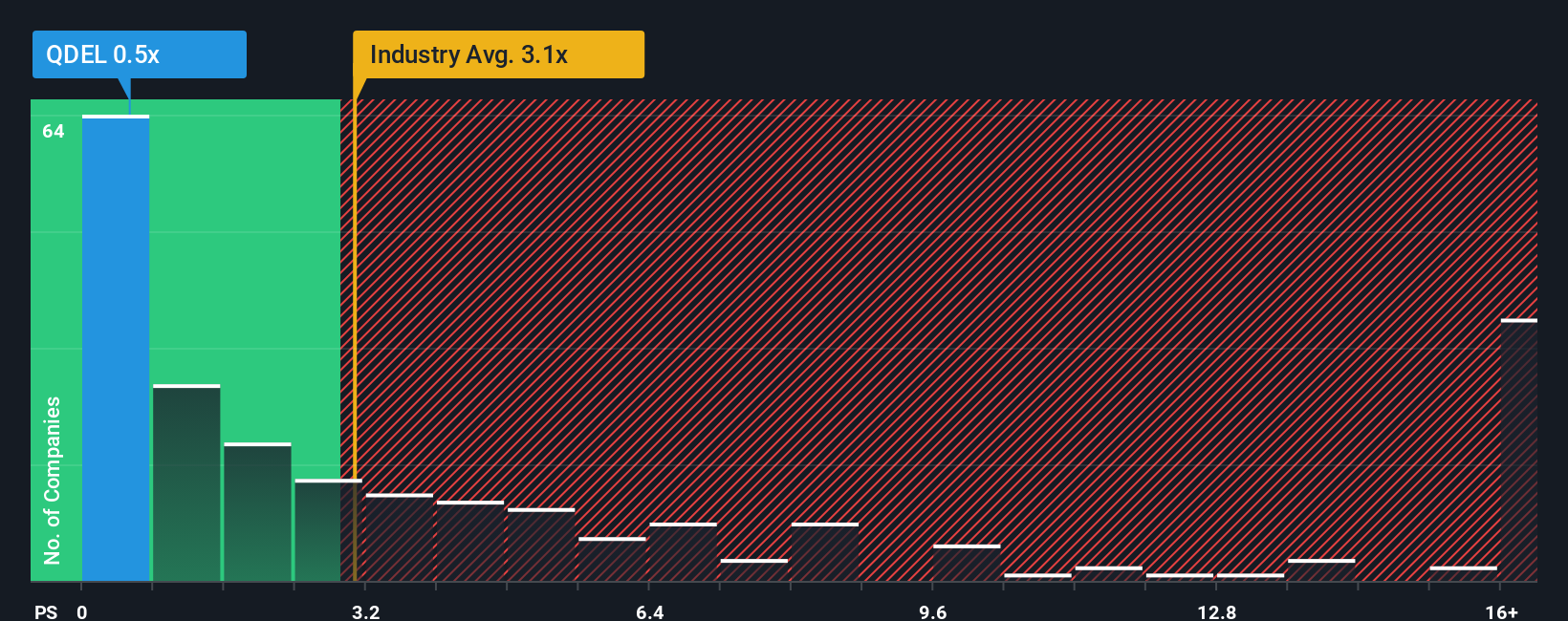

After such a large drop in price, QuidelOrtho's price-to-sales (or "P/S") ratio of 0.5x might make it look like a strong buy right now compared to the wider Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 3.1x and even P/S above 8x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for QuidelOrtho

What Does QuidelOrtho's P/S Mean For Shareholders?

QuidelOrtho could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on QuidelOrtho will help you uncover what's on the horizon.How Is QuidelOrtho's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like QuidelOrtho's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 3.7% decrease to the company's top line. As a result, revenue from three years ago have also fallen 11% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 3.0% per annum as estimated by the seven analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 9.3% per year, which is noticeably more attractive.

With this in consideration, its clear as to why QuidelOrtho's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Having almost fallen off a cliff, QuidelOrtho's share price has pulled its P/S way down as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of QuidelOrtho's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 2 warning signs for QuidelOrtho you should be aware of.

If you're unsure about the strength of QuidelOrtho's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if QuidelOrtho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:QDEL

Undervalued with very low risk.

Similar Companies

Market Insights

Community Narratives