- United States

- /

- Medical Equipment

- /

- NasdaqGM:PRCT

PROCEPT BioRobotics (PRCT): Valuation Insights Following Strong Sales Growth and Upbeat 2026 Outlook

Reviewed by Simply Wall St

PROCEPT BioRobotics reported strong year-over-year sales growth for the third quarter and the first nine months of 2025. The company also reaffirmed its revenue targets and provided upbeat projections for the coming year, fueling fresh investor attention.

See our latest analysis for PROCEPT BioRobotics.

Even with the company's robust sales growth and upbeat revenue targets, momentum has not yet translated into the stock’s performance. PROCEPT BioRobotics’ recent 1-day share price return was up 1.5%, but the 90-day share price return is still down over 23%, and the total shareholder return over the past year sits at a steep -63.3%. This mix of strong business progress and sustained share price pressure hints that investors are remaining cautious for now, possibly weighing longer-term growth potential against ongoing losses.

If you’re watching for healthcare stocks showing resilience and innovation, discover new ideas in our curated list: See the full list for free.

With the stock trading well below analyst price targets despite rapid revenue growth and optimistic forecasts, investors face a crucial question: is PROCEPT BioRobotics a discounted growth story or is the market already pricing in its potential?

Most Popular Narrative: 42.5% Undervalued

PROCEPT BioRobotics has a popular narrative fair value of $60.90, which is significantly higher than the recent close of $35.02. This sets the stage for bullish expectations, especially given ongoing business expansion and sector momentum.

Robust procedure growth is underpinned by increasing surgeon adoption and a meaningful shift toward minimally invasive therapies. This aligns with broader healthcare trends and supports durable net revenue and margin expansion as clinical outcomes continue to validate Aquablation as standard of care.

Want to know the hidden numbers driving this big valuation gap? The real surprise could be found in ambitious projections such as surging sales, rising margins, and a future profit trajectory rarely seen in medical devices. What bold underlying assumptions give analysts such confidence? Dive deeper to uncover the growth leaps that justify this sharp price target.

Result: Fair Value of $60.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant operating losses and reliance on a single core product remain potential stumbling blocks. These factors could quickly reverse optimism around rapid revenue growth.

Find out about the key risks to this PROCEPT BioRobotics narrative.

Another View: Looking at Price Ratios

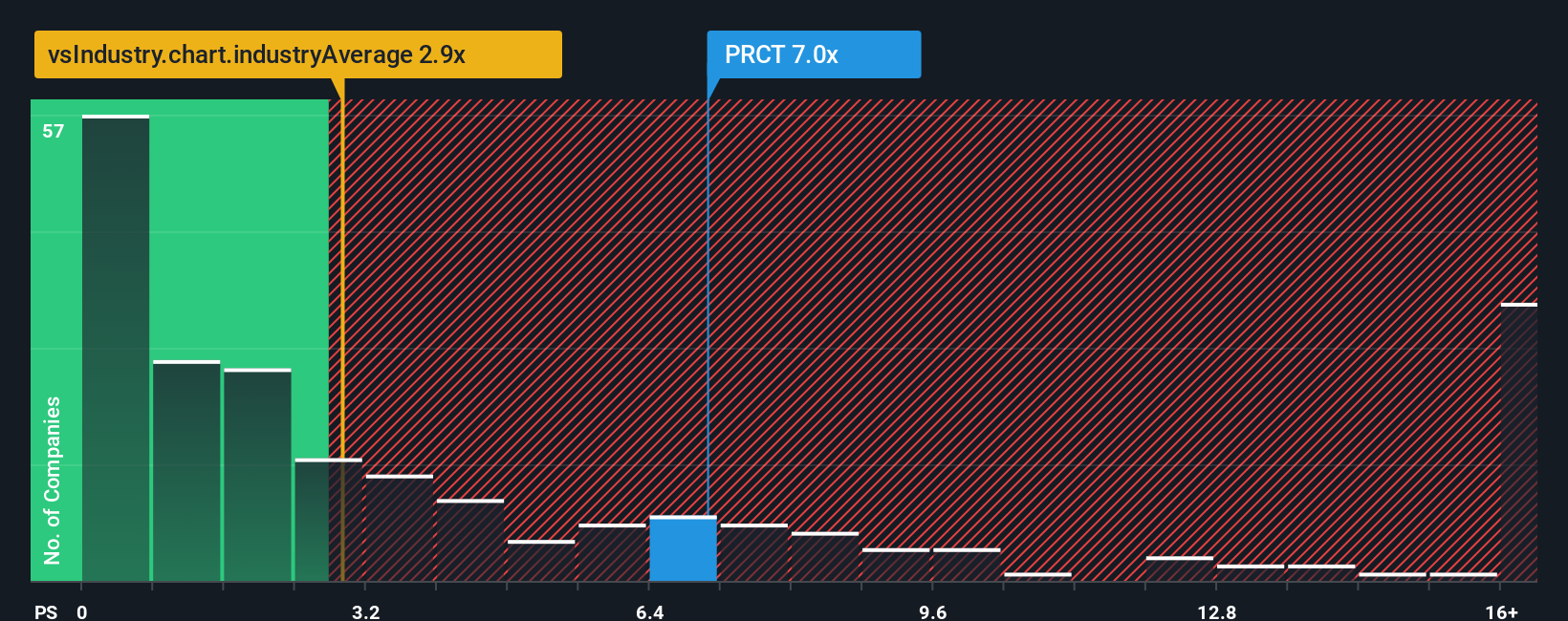

While the fair value narrative paints PROCEPT BioRobotics as significantly undervalued, a closer look at its price-to-sales ratio tells a different story. The company trades at 7.1 times sales, which is more expensive than both the US Medical Equipment industry average of 2.8x and its peers at 7x. It is also above the estimated fair ratio of 4x. This substantial gap suggests that, despite growth, the market may already be pricing in much of the future upside and there could be higher risk if results do not meet expectations. Is the stock’s premium justified, or is optimism running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PROCEPT BioRobotics Narrative

If you have a different perspective or want to draw your own conclusions from the numbers, you can craft your own narrative in just a few minutes: Do it your way

A great starting point for your PROCEPT BioRobotics research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Winning Ideas?

Smart investors never settle for one opportunity when there are promising trends all around. Use these powerful shortcuts to uncover tomorrow’s leaders and strengthen your portfolio today:

- Catch early movers and seize the potential with these 3605 penny stocks with strong financials that boast strong financials and big upside stories.

- Access steady income streams by targeting these 20 dividend stocks with yields > 3% offering yields over 3 percent for more reliable returns.

- Ride the next digital wave and position yourself at the forefront of innovation by tapping into these 82 cryptocurrency and blockchain stocks shaping the new financial landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PRCT

PROCEPT BioRobotics

A surgical robotics company, focuses on developing transformative solutions in urology in the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives