- United States

- /

- Healthcare Services

- /

- NasdaqGS:PNTG

Pennant Group (PNTG): Earnings, Revenue Forecasts Outpace Market as Margins Remain Stable

Reviewed by Simply Wall St

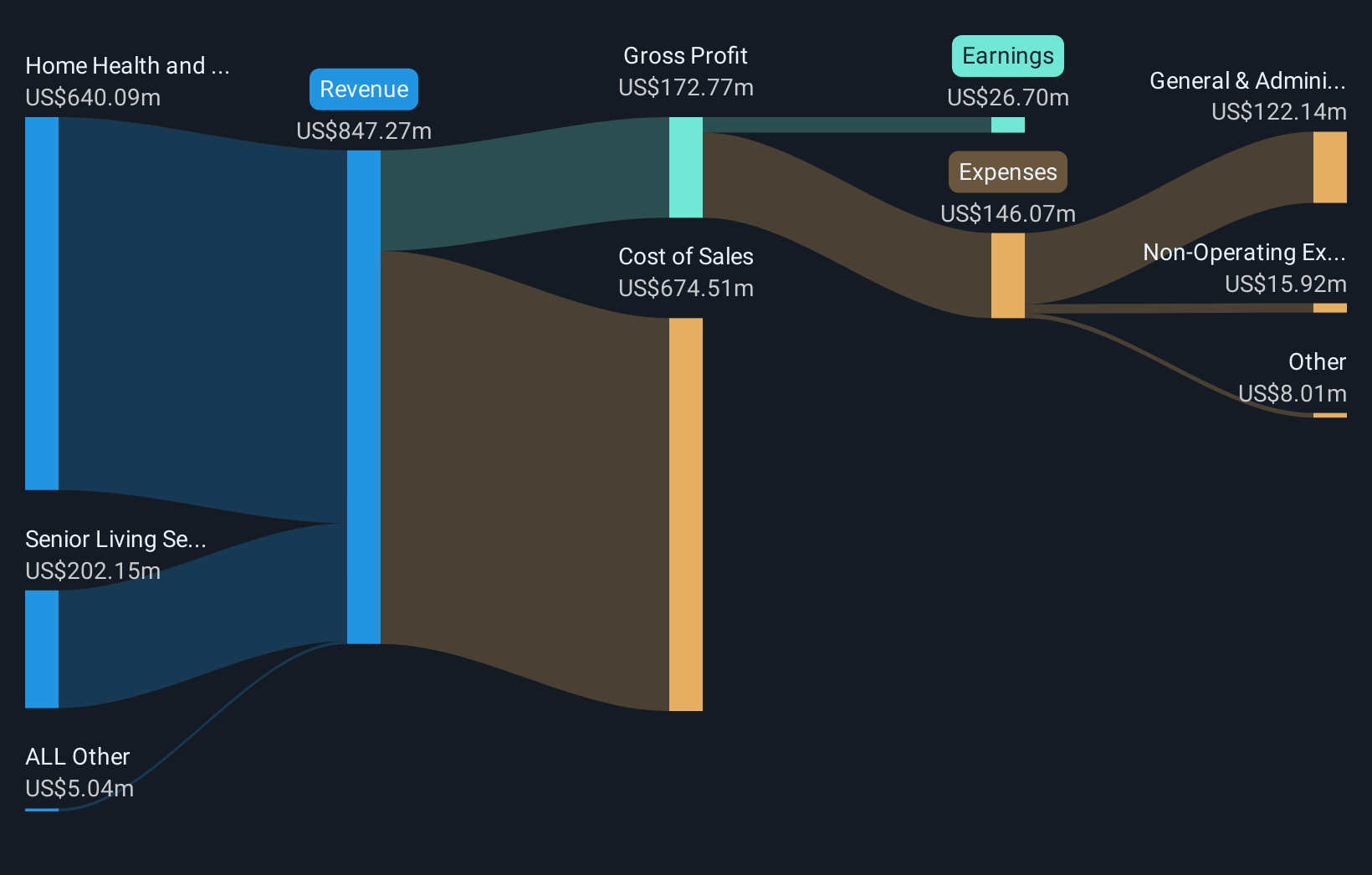

Pennant Group (PNTG) has continued its strong track record, with earnings forecast to grow by 30.38% per year and revenue expected to rise 16.6% annually, both comfortably ahead of US market averages. Over the past five years, the company delivered annual earnings growth of 29.1%, while profit margins held steady at 3.2%. Investors will note the stock trades at a 30.8x Price-To-Earnings ratio, which is higher than most healthcare peers but below the average of its direct competitors. The business is considered to be trading below fair value and shows no current risk factors, alongside several compelling reward indicators.

See our full analysis for Pennant Group.Next, we’ll see how Pennant Group’s numbers align with the prevailing market narratives and what that means for the story going forward.

See what the community is saying about Pennant Group

Margin Path Points to 5.1% by 2028

- Analysts forecast profit margins rising from 3.4% today to 5.1% within three years, marking a notable step up in profitability as Pennant’s operations scale and efficiencies improve.

- According to analysts' consensus view, expanding strategic market clusters and improved operational efficiencies are expected to play the biggest role in supporting higher margins.

- Operational efficiencies, such as integration of new acquisitions and investments in technology, are seen as primary contributors.

- Demographic tailwinds are fueling organic growth and increased utilization in senior care segments. These segments are less capital-intensive and help protect overall margins.

- Profit margin expansion ties directly to Pennant's ability to drive earnings. This remains a focal point for analysts evaluating the bull case.

- Consensus narrative hooks: See how rising margins drive Pennant’s balanced outlook. 📊 Read the full Pennant Group Consensus Narrative.

PE Ratio Compression and Valuation Signal

- Pennant’s forward PE ratio is projected to move from 32.0x today to 24.1x by 2028. The price remains below its DCF fair value of $60.73, while the current share price is $23.75.

- Analysts' consensus view notes that despite Pennant trading well below its $60.73 DCF fair value, or 62% less than intrinsic value, analysts’ price target of $32.20 reflects modest multiple compression.

- There is shared skepticism among analysts about whether Pennant can sustain premium multiples as projected growth normalizes.

- The current price-to-earnings ratio, though higher than the industry average, is considerably below direct peer averages. This indicates some margin of safety based on price and growth profile.

Regulatory Risk: Watch CMS Policy Moves

- Pennant faces the possibility of a net 6.4% payment reduction from the proposed 2026 CMS home health rule. This could directly pressure both revenue and margin, especially for contracts indexed to Medicare rates.

- Analysts' consensus view flags regulatory and reimbursement risk as a critical wildcard for Pennant’s future.

- Pennant’s recent entry into new states increases exposure to regional payer volatility. Local policy swings could amplify downside risk to earnings.

- Heavy reliance on government payers (Medicare and Medicaid) makes the business particularly sensitive to policy shifts. Both top-line and bottom-line performance could be affected if reimbursement growth slows or declines.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Pennant Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own angle on Pennant’s outlook? Shape your personal narrative in just a few minutes and put your unique insights to work. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Pennant Group.

See What Else Is Out There

While Pennant Group shows revenue growth and margin potential, concerns remain about regulatory risk, pressure on reimbursement rates, and the ability to maintain premium multiples.

If you want to reduce exposure to valuation risk and find a better margin of safety, filter for promising opportunities with these 854 undervalued stocks based on cash flows that trade well below their intrinsic value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PNTG

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives