- United States

- /

- Healthcare Services

- /

- NasdaqGS:PGNY

A Fresh Look at Progyny (PGNY) Valuation After Strong Q3 Results and Major Buyback Announcement

Reviewed by Simply Wall St

Progyny (PGNY) saw its stock jump after the company reported third quarter results that outpaced expectations, raised its full-year revenue guidance, and announced a $200 million share buyback program in addition to a CEO share purchase.

See our latest analysis for Progyny.

Progyny’s momentum has been building throughout the year, spurred by a string of upbeat earnings, raised revenue guidance, and insider buying. After lagging in past years, the stock has delivered a standout total shareholder return of nearly 82% over the past twelve months, sharply outperforming its longer-term trajectory and highlighting a shift in market optimism.

If Progyny’s rebound has caught your attention, you can discover other healthcare stocks showing strong growth and innovation with our curated list here: See the full list for free.

With shares rallying on strong results and insider buying, investors may wonder if Progyny’s recent momentum signals an undervalued opportunity or if the market has already priced in the company’s future growth story.

Most Popular Narrative: 10.1% Undervalued

The latest widely followed narrative values Progyny at $28.25 per share, about 10% above its last close at $25.40. This suggests the market may still be catching up to strong business drivers. Here is a look behind the headline valuation argument.

Investment in an integrated women's health platform (including new services such as pelvic floor therapy, leave navigation, and enhanced digital engagement) positions Progyny to cross-sell adjacent products. This can result in a higher share of wallet with current clients and additional revenue streams, supporting both topline and margin expansion.

What is driving this premium? The most bullish assumptions focus on the future, such as higher margins, rising recurring revenue, and bold profit growth targets. Curious which forecasts are crucial to believing in that price? Take a closer look to see what the narrative really expects from Progyny’s next chapter.

Result: Fair Value of $28.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, broad cost containment by employers or heightened competition from both startups and major insurers could temper Progyny's expected growth if adoption slows.

Find out about the key risks to this Progyny narrative.

Another View: Is the Market Overlooking Risks?

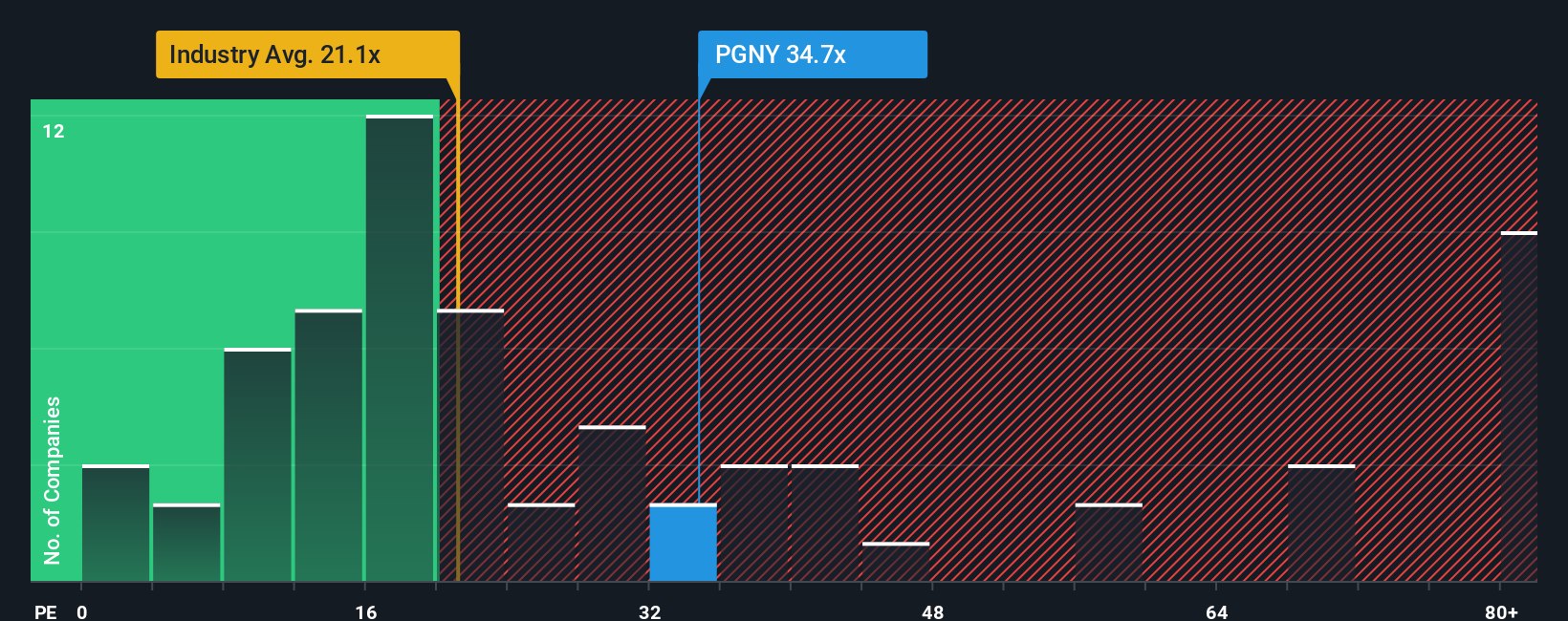

While analyst forecasts see Progyny as undervalued, a closer look at its price-to-earnings ratio tells a different story. Shares trade at 38.7 times earnings, well above both the peer average (25.8x) and the industry (21.9x), and notably higher than a fair ratio of 25.2x. That is a significant premium, which could leave little margin for error if expectations fall short. Could this lofty multiple signal that investors are paying up for growth, or does it introduce new risks for those jumping in now?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Progyny Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own narrative about Progyny in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Progyny.

Looking for More Investment Opportunities?

Unlock your next great idea with the Simply Wall Street Screener. Don’t let fresh market moves pass you by; level up your investing game now.

- Capture potential outperformance by targeting these 898 undervalued stocks based on cash flows, which are trading below their intrinsic value. This can position you ahead of the broader market.

- Boost your portfolio’s income stream and stability when you check out these 15 dividend stocks with yields > 3%, offering reliable yields and strong fundamentals.

- Tap into game-changing innovation by reviewing these 27 AI penny stocks, powering the next era in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGNY

Progyny

A benefits management company, provides fertility, family building, and women’s health benefits solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives