- United States

- /

- Healthcare Services

- /

- NasdaqGS:OPK

OPKO Health (OPK): Evaluating Valuation After Oncology Business Sale and Updated Earnings Guidance

Reviewed by Simply Wall St

OPKO Health (OPK) is in the spotlight after updating its earnings guidance for the fourth quarter, taking into account the recent sale of its oncology business. Revenue expectations and profit shares are being recalibrated as a result.

See our latest analysis for OPKO Health.

The latest earnings guidance update comes after OPKO Health's recently reported quarterly results, which showed both revenue and net income sliding year-over-year. Investors have clearly taken note: the share price is currently $1.33, with a 1-month return of -11.92% and a steep 1-year total shareholder return of -17.39%. Momentum has faded over both the short and long term as the market weighs the implications of the oncology business sale and ongoing profitability challenges.

If you’re watching for opportunity in the healthcare space amid shifting earnings, now is a great time to compare companies using our curated list See the full list for free.

The question for investors now is whether OPKO Health’s struggles have left its shares undervalued, or if the market has already accounted for the company’s future growth and ongoing restructuring. Could there be a buying opportunity here?

Most Popular Narrative: 63.3% Undervalued

The crowd’s consensus suggests OPKO Health’s fair value sits far above its current $1.33 share price. This opens the door to a potential re-rating. With so much upside implied, the catalysts and assumptions driving this estimate deserve a closer look.

The sale of BioReference's oncology and related clinical testing assets to Labcorp is expected to sharpen OPKO Health's focus on its core testing business, drive significant cost savings, and support the Diagnostics segment's transition to cash flow positive and profitability in 2025. This is anticipated to provide margin expansion and stabilize earnings.

Curious how a company with persistent losses could warrant such a high price target? The narrative hinges on a handful of bold financial leaps, future margin expansion, and top-line growth projections. Wondering how analysts expect OPKO to defy its recent history? Discover the pivotal assumptions and strategic bets shaping this fair value now.

Result: Fair Value of $3.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent unprofitability and ongoing share dilution could quickly erase potential upside if OPKO fails to deliver expected revenue and margin improvements.

Find out about the key risks to this OPKO Health narrative.

Another View: Market Multiples Perspective

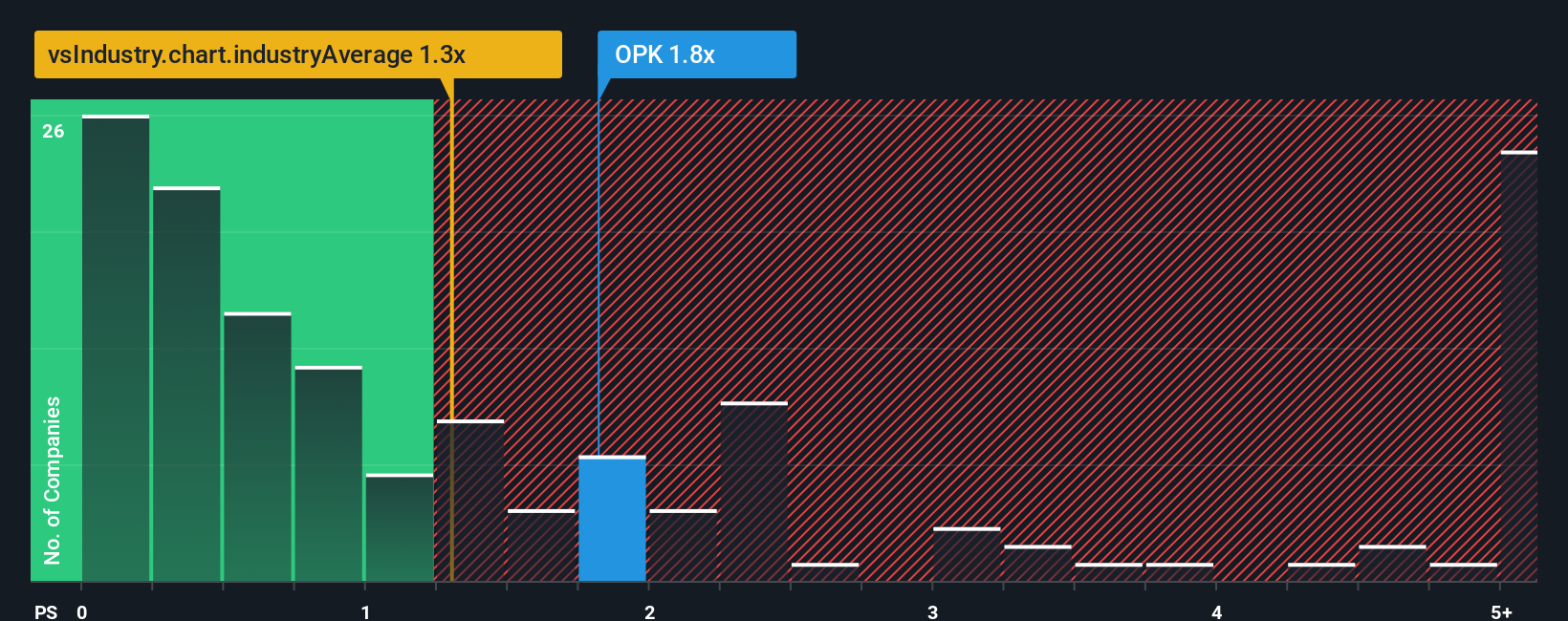

Taking a different approach, market multiples tell a more cautious story. OPKO Health trades at a sales ratio of 1.6x, which is higher than both the US Healthcare industry average (1.3x) and the fair ratio suggested by regression analysis (0.4x). This elevated multiple means investors are paying a premium compared to peers and what the market has historically considered fair. This signals greater valuation risk if expectations do not pan out. Could this premium hold up as the company works to turn losses around?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own OPKO Health Narrative

If this view doesn’t match your outlook, or you want to dig deeper, you can review the numbers and build a personal thesis in just a few minutes. Do it your way

A great starting point for your OPKO Health research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready to Find Your Next Big Opportunity?

Don’t let a crowded market hold you back from spotting your next winner. Simply Wall Street’s powerful tools can help you zero in on standout investments tailored to your style.

- Boost your income potential by targeting companies with generous yields through these 16 dividend stocks with yields > 3% delivering over 3%.

- Capitalize on the artificial intelligence surge by accessing these 24 AI penny stocks setting new standards across industries.

- Uncover undervalued gems that may be flying under the radar by reviewing these 866 undervalued stocks based on cash flows primed for future growth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPK

OPKO Health

A healthcare company, engages in the diagnostics and pharmaceuticals businesses in the United States, Ireland, Chile, Spain, Israel, Mexico, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives