- United States

- /

- Healthcare Services

- /

- NasdaqGS:OMDA

Omada Health (OMDA): Is the Stock Overvalued After Recent Volatility?

Reviewed by Simply Wall St

Omada Health (OMDA) has been the subject of some investor attention lately. It is worth taking a closer look at how the company's stock has performed in the past month and what might be driving sentiment.

See our latest analysis for Omada Health.

Omada Health’s share price return has been volatile lately, dropping 17.3% over the last week alone and down 15.3% for the month, even as it remains up for the past quarter. Momentum appears to have faded in the short term, hinting at shifting investor sentiment after a period of earlier gains.

If you’re interested in how innovation is shaping healthcare investments, consider discovering fresh opportunities with our healthcare stocks screener. See the full list for free.

With shares now trading at a significant discount to analyst price targets, investors may be wondering whether the recent pullback leaves Omada Health undervalued, or if the current price already reflects future growth prospects.

Price-to-Sales of 5x: Is it justified?

Compared to similar healthcare stocks, Omada Health trades at a price-to-sales ratio of 5x, which is notably above both the industry average and peer group. At last close, the share price of $20.31 appears expensive on this metric and raises questions about whether the premium is warranted.

The price-to-sales ratio measures how much investors are paying for each dollar of a company's sales. In the healthcare sector, this multiple is often used for companies that do not yet report profits because it provides a snapshot of market expectations relative to top-line results.

For Omada Health, a high price-to-sales suggests investors anticipate strong future growth or strategic advantages that justify paying more for its current revenue base. However, given the company's unprofitability and a price-to-sales ratio of 5x versus an industry average of just 1.2x, the market is assigning a premium well above what is typical in its sector. Compared to its direct peers, Omada Health's valuation appears elevated and could be at risk of correction if growth expectations do not materialize.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 5x (OVERVALUED)

However, with slowing momentum and a relatively high valuation, any missed growth targets or sector headwinds could trigger further downside for Omada Health’s shares.

Find out about the key risks to this Omada Health narrative.

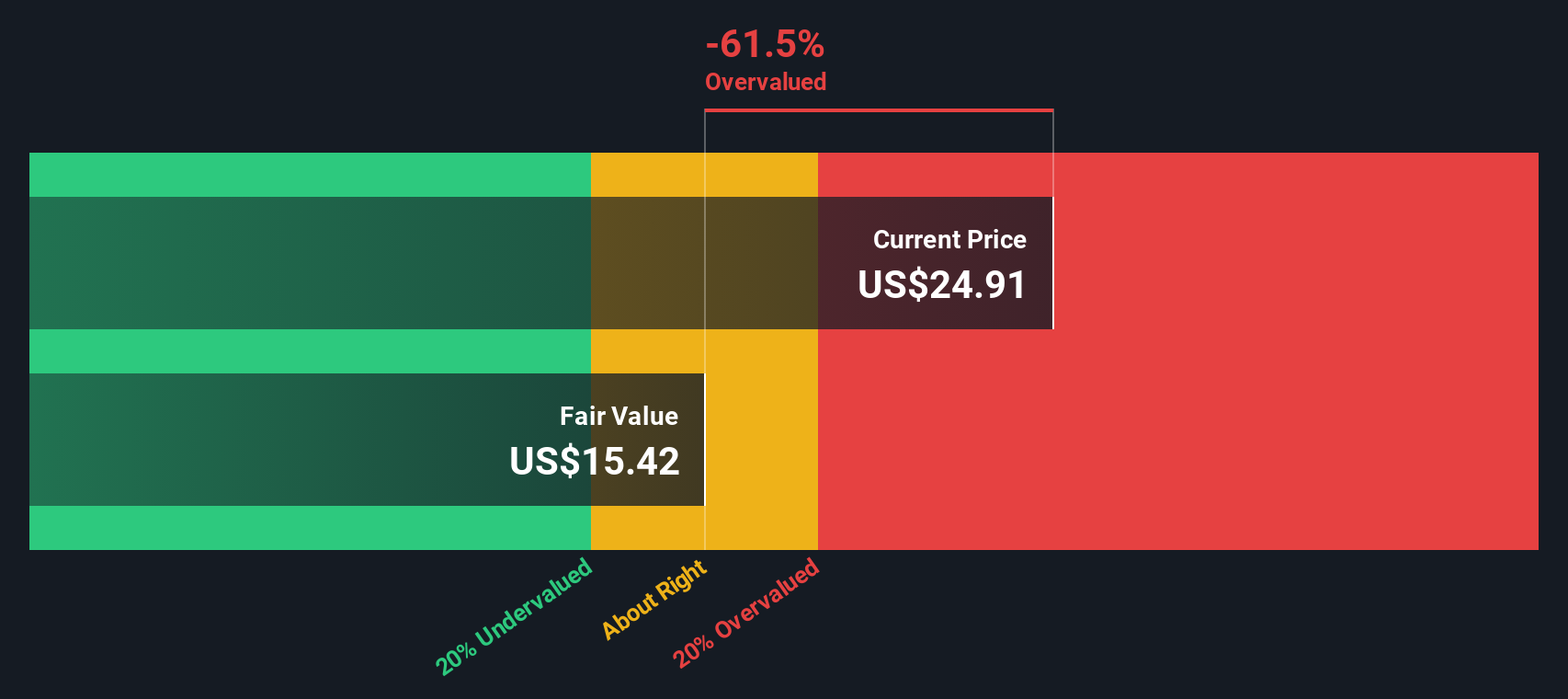

Another View: Our DCF Model Says Shares Are Overvalued

While Omada Health's price-to-sales ratio points to a high relative valuation, the SWS DCF model gives an even starker verdict. Our DCF estimate of fair value is $13.95, which is well below the current share price. This approach suggests the shares could still be overvalued. Which method will prove more accurate in the months ahead?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Omada Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Omada Health Narrative

You can always dive into the numbers and craft your own view of Omada Health. Building a unique perspective takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Omada Health.

Looking for more investment ideas?

Why stop with just one opportunity? The smartest investors always keep their options open, and Simply Wall Street’s tools can help you uncover the next big winner before everyone else does. Check out these game-changing avenues today:

- Unlock long-term income potential by reviewing these 16 dividend stocks with yields > 3% with yields above 3% and robust fundamentals.

- Tap into the explosive growth of AI innovation with these 24 AI penny stocks that are reshaping industries across the globe.

- Find tomorrow’s undervalued gems by scanning these 870 undervalued stocks based on cash flows chosen for strong cash flow prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMDA

Omada Health

Provides a range of virtual care programs in the United States.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives