- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Omnicell (OMCL) Is Up 6.5% After Raising Full-Year Guidance and Completing Share Buyback

Reviewed by Sasha Jovanovic

- Omnicell, Inc. recently reported third quarter 2025 earnings, highlighting a year-over-year revenue increase to US$310.63 million, a decrease in quarterly net income, and improved profitability over the nine-month period; additionally, the company raised full-year revenue guidance and completed a significant share repurchase program.

- Omnicell's updated guidance and buyback activity underscore management's ongoing confidence in operational improvements and future business prospects in the healthcare automation sector.

- We’ll examine how Omnicell’s raised full-year revenue outlook influences its investment narrative and the outlook for recurring revenue growth.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Omnicell Investment Narrative Recap

To be a shareholder in Omnicell, you need to believe that the company’s transition toward higher-margin, recurring SaaS-based revenues, driven by increased adoption of cloud-native automation solutions, will outweigh current risks like margin compression from tariffs and macro headwinds affecting hospital spending. The recent earnings update shows robust top-line growth and higher full-year guidance, which offers support for this catalyst; however, the impact on the biggest short-term risk, profit volatility due to tariffs, remains largely unchanged.

Among recent announcements, Omnicell’s completion of a substantial share repurchase stands out as particularly relevant. While significant buybacks can signal management confidence, their real benefit to investors will depend on the company’s ability to sustain profitability and mitigate ongoing tariff and supply chain cost pressures, both of which remain important near-term variables.

But even with a raised revenue outlook, investors should be alert to the persistent margin pressure risk from tariff costs and shifting hospital budgets, especially if...

Read the full narrative on Omnicell (it's free!)

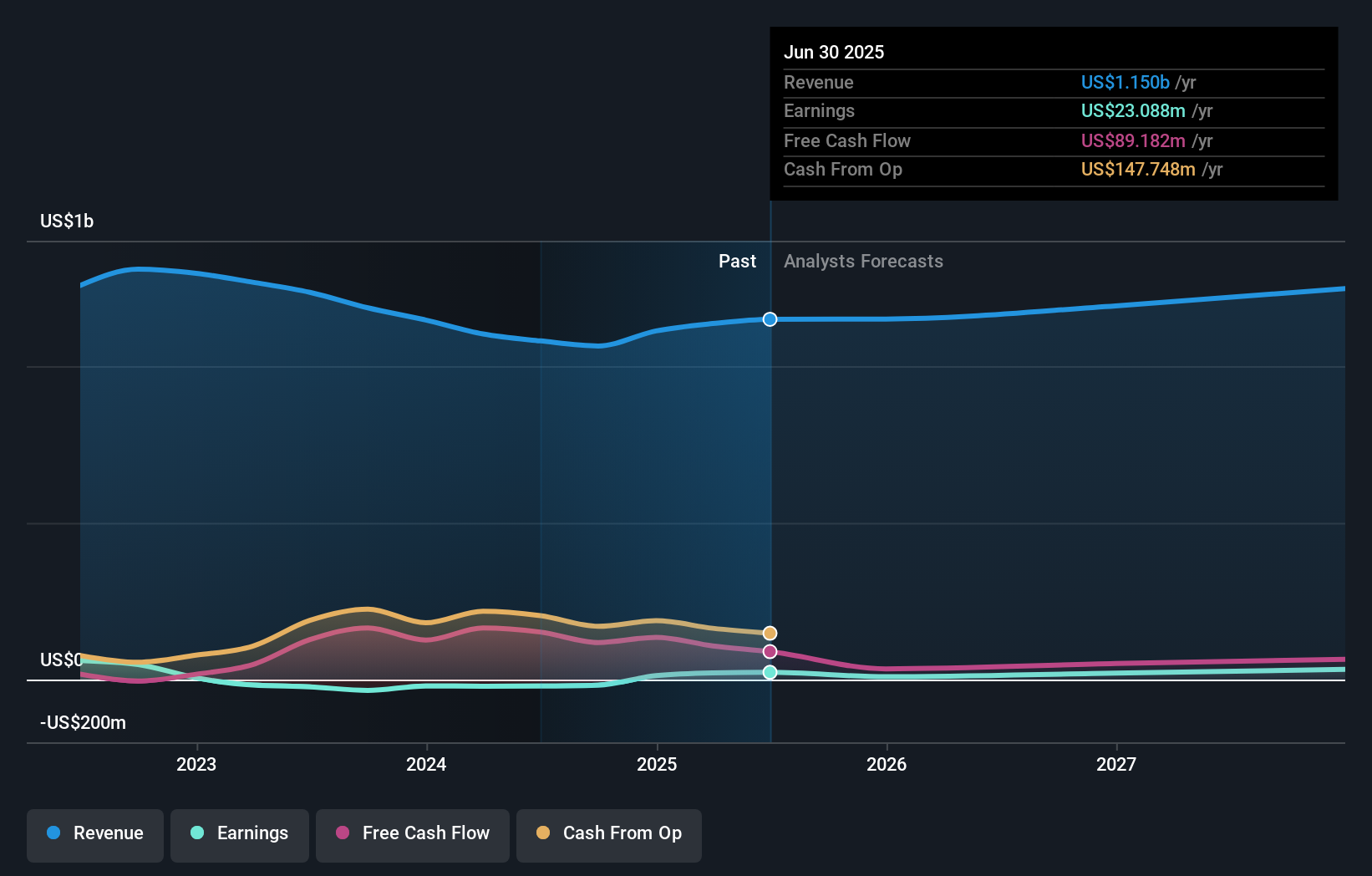

Omnicell's outlook anticipates $1.3 billion in revenue and $30.4 million in earnings by 2028. This scenario requires 3.0% annual revenue growth and a $7.3 million increase in earnings from the current $23.1 million.

Uncover how Omnicell's forecasts yield a $47.33 fair value, a 32% upside to its current price.

Exploring Other Perspectives

All ten Community fair value estimates for Omnicell sit at US$47.33, revealing no spread in private investor opinion. Recurring revenue growth remains a key focus as broader market participants weigh Omnicell’s future predictability and margin resilience.

Explore another fair value estimate on Omnicell - why the stock might be worth just $47.33!

Build Your Own Omnicell Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Omnicell research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Omnicell research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Omnicell's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives