- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Omnicell (OMCL): Evaluating Valuation After Q3 Earnings Beat, Raised Guidance, and Buyback Progress

Reviewed by Simply Wall St

Omnicell (OMCL) just delivered its third quarter earnings, raised its full-year revenue guidance, and announced further progress on its share buyback program. These moves offer clear and material signals for investors considering the stock.

See our latest analysis for Omnicell.

After a challenging start to the year, Omnicell’s 1-month share price return of 20% shows clear momentum following the earnings beat, higher revenue guidance, and progress on its buyback. Still, the 1-year total shareholder return is down nearly 29%, reminding investors that while recent sentiment is recovering, the longer-term picture remains mixed.

If buyback programs and revenue upgrades catch your eye, it might be the right moment to broaden your radar and discover See the full list for free.

With shares still trading at a discount to analyst targets, the question now is whether Omnicell remains undervalued after its recent rally or if the market has already priced in the company’s next phase of growth.

Most Popular Narrative: 24.6% Undervalued

Omnicell's narrative puts its fair value at $47.33 per share, well above the last close of $35.68. This sets up a debate about whether this rally has further to run or will lose steam as assumptions meet reality.

The continued rollout and adoption of the cloud-native OmniSphere platform across Omnicell's customer base will simplify enterprise-wide medication management, make adding new features and integrating advanced analytics much easier, and accelerate the company's transition to higher-margin, recurring SaaS-based revenues, supporting improved revenue predictability and net margins.

Want to see the playbook fueling this price target? The narrative pivots on game-changing growth assumptions and bold profit margin bets. Hungry for the specifics behind this compelling valuation? Dive into the full breakdown to see the details of these projections.

Result: Fair Value of $47.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff-related costs and a slower shift to recurring revenues could still affect Omnicell’s margins and threaten future earnings growth.

Find out about the key risks to this Omnicell narrative.

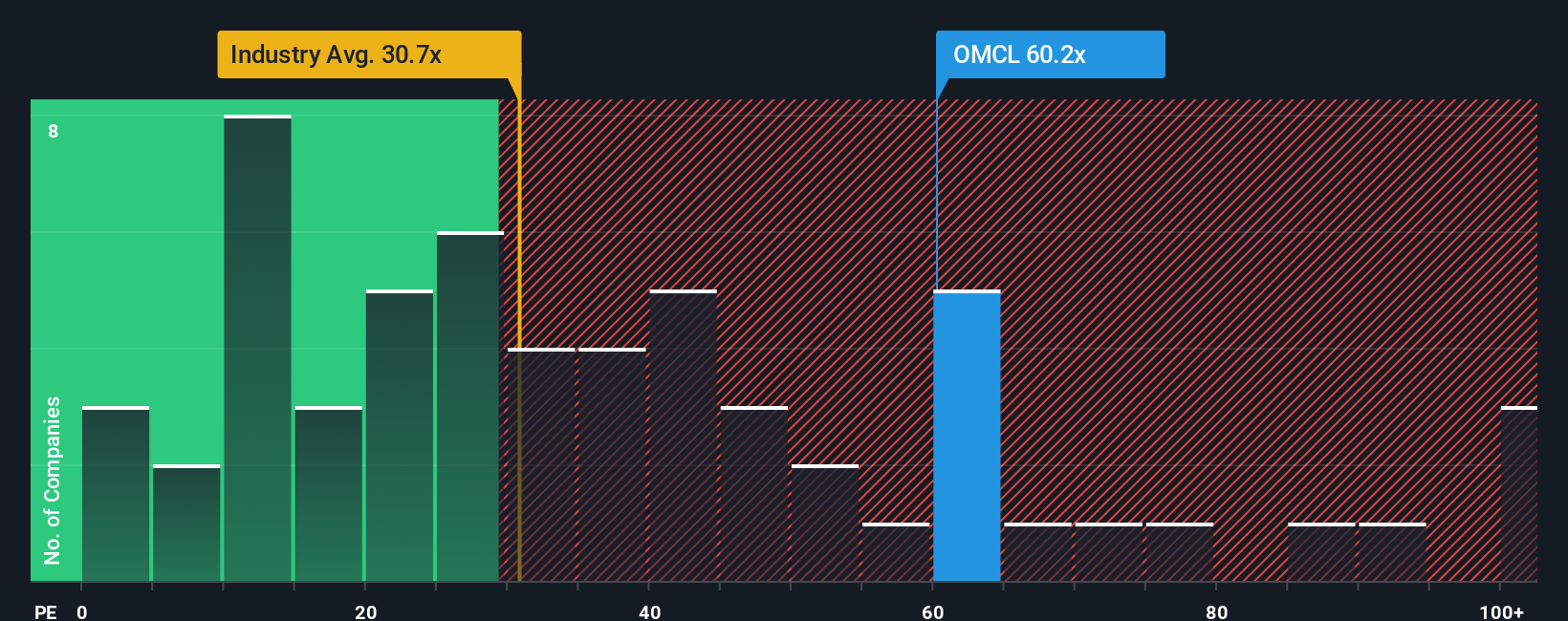

Another View: Multiples Paint a Cautious Picture

While some see Omnicell as undervalued based on future cash flows, a look at its price-to-earnings ratio tells a less optimistic story. At 80.4x, the company trades well above both the industry average of 28.3x and its own fair ratio of 32.3x. This premium could signal investors are already betting heavily on Omnicell’s turnaround, but it also raises the risk that recent optimism is overextended. Is this outlook justified, or could expectations outpace reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Omnicell Narrative

If you believe there’s another angle or want to dig into the numbers yourself, you can shape your own Omnicell outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Omnicell.

Looking for more investment ideas?

If you want to get ahead of the curve, check out new ways to grow your wealth and truly supercharge your portfolio with specialized stock picks.

- Tap into opportunities for income and stability by evaluating these 16 dividend stocks with yields > 3% which offers attractive yields and a strong track record of regular payouts.

- Unlock the potential of cutting-edge health technology by targeting these 32 healthcare AI stocks that drives breakthroughs in medical innovation and artificial intelligence.

- Ride the next wave in financial technology and future-proof your investments by assessing these 82 cryptocurrency and blockchain stocks positioned at the forefront of digital transformation and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives