- United States

- /

- Healthcare Services

- /

- NasdaqGS:NRC

Many Would Be Envious Of National Research's (NASDAQ:NRC) Excellent Returns On Capital

There are a few key trends to look for if we want to identify the next multi-bagger. In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. That's why when we briefly looked at National Research's (NASDAQ:NRC) ROCE trend, we were very happy with what we saw.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on National Research is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.42 = US$42m ÷ (US$134m - US$34m) (Based on the trailing twelve months to June 2023).

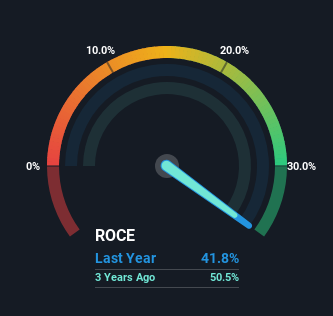

Thus, National Research has an ROCE of 42%. That's a fantastic return and not only that, it outpaces the average of 9.7% earned by companies in a similar industry.

View our latest analysis for National Research

Historical performance is a great place to start when researching a stock so above you can see the gauge for National Research's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of National Research, check out these free graphs here.

So How Is National Research's ROCE Trending?

It's hard not to be impressed by National Research's returns on capital. The company has consistently earned 42% for the last five years, and the capital employed within the business has risen 43% in that time. With returns that high, it's great that the business can continually reinvest its money at such appealing rates of return. You'll see this when looking at well operated businesses or favorable business models.

The Bottom Line On National Research's ROCE

In summary, we're delighted to see that National Research has been compounding returns by reinvesting at consistently high rates of return, as these are common traits of a multi-bagger. And given the stock has only risen 28% over the last five years, we'd suspect the market is beginning to recognize these trends. So because of the trends we're seeing, we'd recommend looking further into this stock to see if it has the makings of a multi-bagger.

On the other side of ROCE, we have to consider valuation. That's why we have a FREE intrinsic value estimation on our platform that is definitely worth checking out.

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if National Research might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:NRC

National Research

Provides analytics and insights that facilitate measurement and improvement of the patient and employee experience.

Slight risk second-rate dividend payer.

Market Insights

Community Narratives