Stock Analysis

- United States

- /

- Healthcare Services

- /

- NasdaqGS:MODV

Earnings Miss: ModivCare Inc. Missed EPS By 52% And Analysts Are Revising Their Forecasts

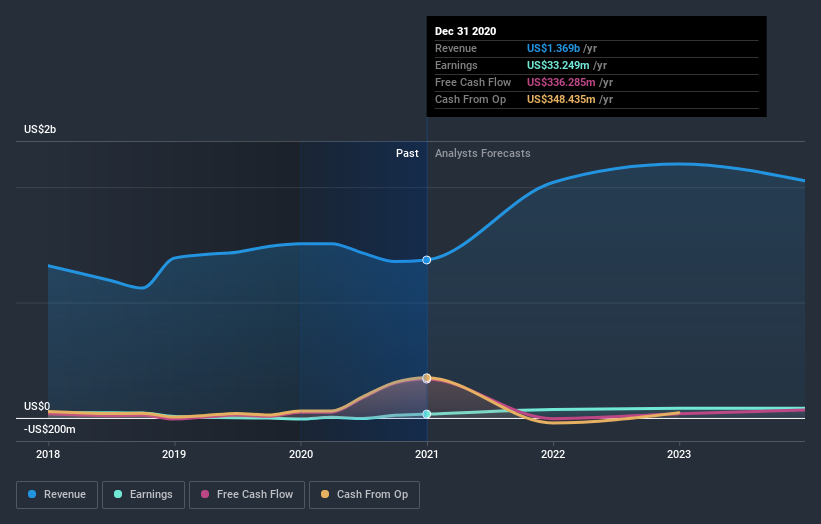

ModivCare Inc. (NASDAQ:MODV) shareholders are probably feeling a little disappointed, since its shares fell 8.5% to US$134 in the week after its latest full-year results. Statutory earnings per share fell badly short of expectations, coming in at US$2.37, some 52% below analyst forecasts, although revenues were okay, approximately in line with analyst estimates at US$1.4b. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for ModivCare

Taking into account the latest results, the most recent consensus for ModivCare from four analysts is for revenues of US$2.04b in 2021 which, if met, would be a huge 49% increase on its sales over the past 12 months. Per-share earnings are expected to leap 110% to US$5.14. Before this earnings report, the analysts had been forecasting revenues of US$2.05b and earnings per share (EPS) of US$5.17 in 2021. The consensus analysts don't seem to have seen anything in these results that would have changed their view on the business, given there's been no major change to their estimates.

It will come as no surprise then, to learn that the consensus price target is largely unchanged at US$183. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values ModivCare at US$205 per share, while the most bearish prices it at US$162. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing stands out from these estimates, which is that ModivCare is forecast to grow faster in the future than it has in the past, with revenues expected to display 49% annualised growth until the end of 2021. If achieved, this would be a much better result than the 1.2% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 7.1% annually. So it looks like ModivCare is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with the analysts reconfirming that the business is performing in line with their previous earnings per share estimates. Happily, there were no major changes to revenue forecasts, with the business still expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple ModivCare analysts - going out to 2023, and you can see them free on our platform here.

However, before you get too enthused, we've discovered 2 warning signs for ModivCare that you should be aware of.

If you decide to trade ModivCare, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether ModivCare is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:MODV

ModivCare

A technology-enabled healthcare services company, provides a suite of integrated supportive care solutions for public and private payors and their members.

Undervalued with reasonable growth potential.