- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

Positive WRAPSODY CIE Data and Delayed Medicare Decision Could Be a Game Changer for Merit Medical (MMSI)

Reviewed by Sasha Jovanovic

- Merit Medical Systems recently announced positive long-term clinical results for its WRAPSODY Cell-Impermeable Endoprosthesis (CIE) presented at the VIVA conference, while also disclosing that the Centers for Medicare & Medicaid Services has deferred its decision on a key reimbursement application until at least January 2027.

- This combination of promising clinical trial outcomes and a significant regulatory delay may affect expectations surrounding future adoption and commercial growth for WRAPSODY CIE in the U.S. outpatient and ASC settings.

- We'll explore how the deferred Medicare reimbursement decision, alongside encouraging new clinical data, could shape Merit Medical's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Merit Medical Systems Investment Narrative Recap

To be a Merit Medical shareholder today, you must believe that robust clinical innovation, like WRAPSODY CIE’s strong study results, can eventually translate into commercial success despite regulatory headwinds. The recent CMS reimbursement deferral is a clear reminder that while positive trial data fuels long-term optimism, timely U.S. outpatient adoption and associated revenue streams remain tied to regulatory outcomes; this risk now overshadows most short-term catalysts for the company.

Among recent announcements, the late-breaking WAVE trial data showcasing improved long-term patency for WRAPSODY CIE stands out. Although the device’s clinical profile appears compelling, commercial momentum is now likely to depend more on regulatory clarity than additional trial successes.

However, with the reimbursement timeline pushed out, investors should be aware that even the most promising clinical milestones may not quickly offset the risk that...

Read the full narrative on Merit Medical Systems (it's free!)

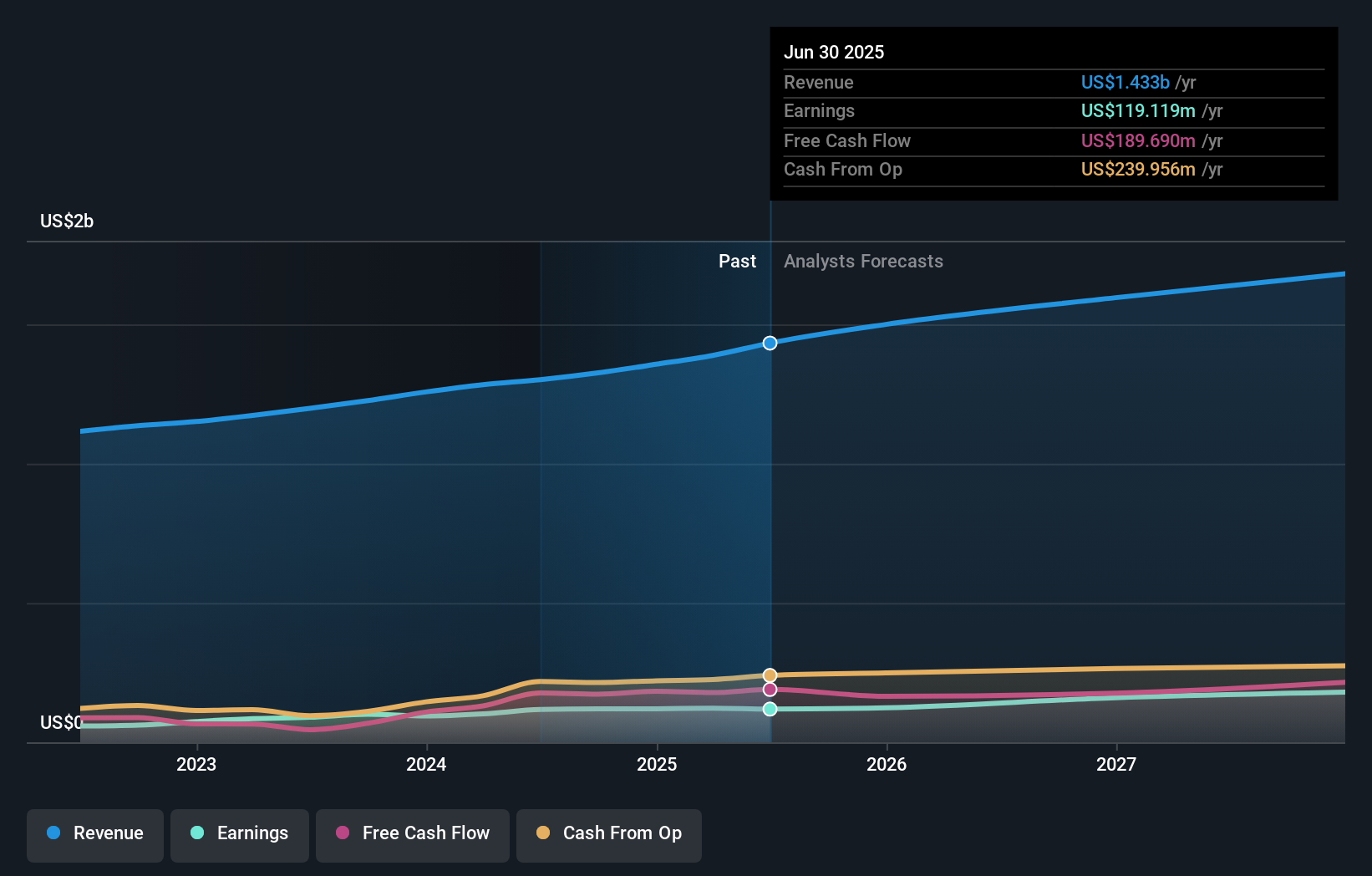

Merit Medical Systems is projected to reach $1.8 billion in revenue and $197.2 million in earnings by 2028. This outlook assumes annual revenue growth of 7.0% and reflects a $78.1 million increase in earnings from the current $119.1 million.

Uncover how Merit Medical Systems' forecasts yield a $103.55 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from US$77.93 to US$103.55, drawing on two distinct perspectives. With reimbursement delays now the most relevant risk, you can see how opinions about Merit Medical’s future path differ, explore these alternative viewpoints to better inform your own outlook.

Explore 2 other fair value estimates on Merit Medical Systems - why the stock might be worth 7% less than the current price!

Build Your Own Merit Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Merit Medical Systems research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Merit Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Merit Medical Systems' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives