- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

Merit Medical Systems (MMSI): Profit Margins Decline Challenges Bullish Growth Narratives

Reviewed by Simply Wall St

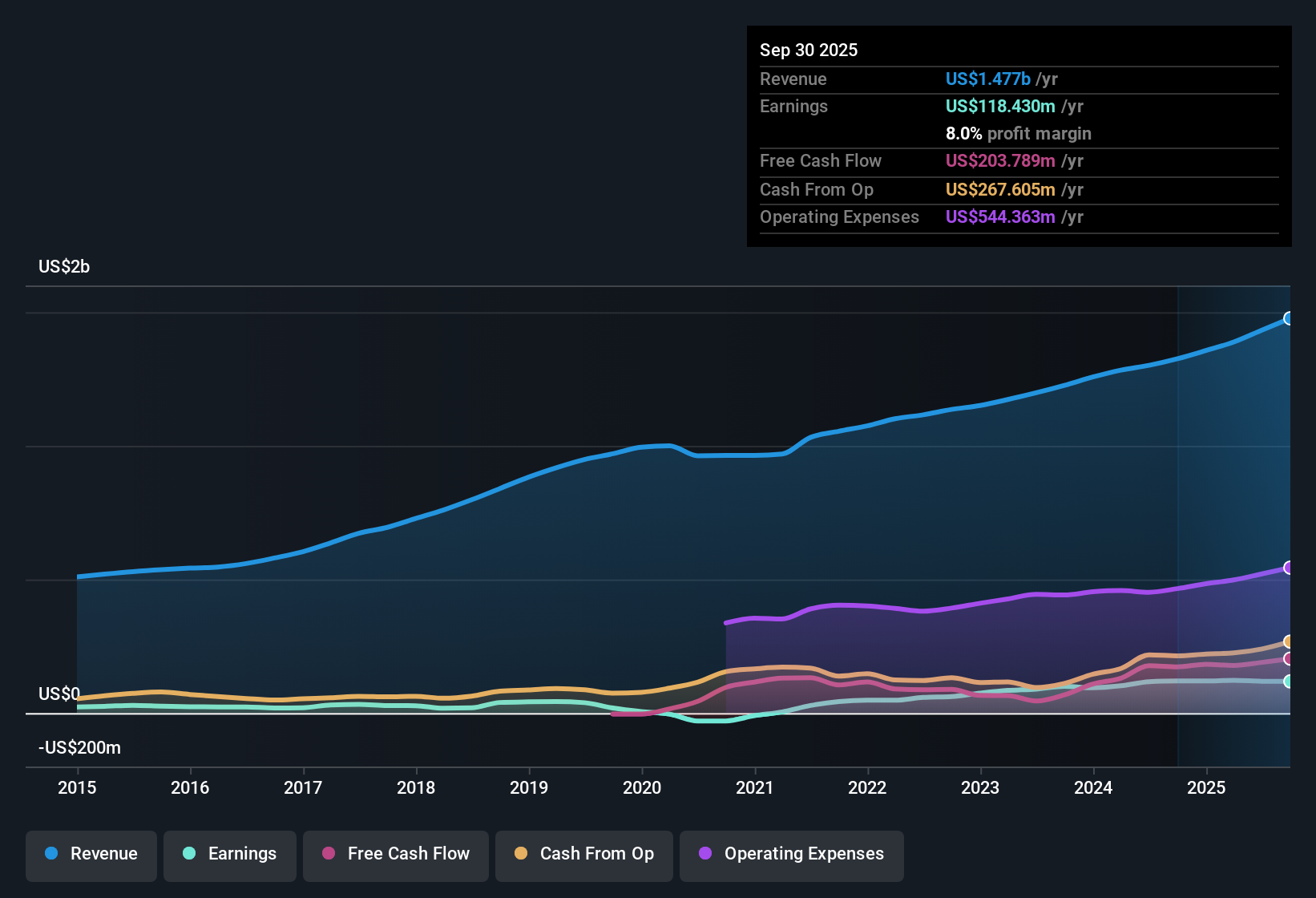

Merit Medical Systems (MMSI) posted net profit margins of 8.3%, down from 9% last year, while earnings advanced just 1.4%, well below its five-year average of 40.5% annual growth. With the company’s Price-to-Earnings Ratio sitting at 43.5x, a premium over both peer and industry averages, and the stock trading slightly above the estimated fair value of $85.48 per share, investors may be weighing whether current lofty valuations can be sustained. Forecasts indicate earnings growth could accelerate to 16.25% each year going forward, although revenue growth projections of 6.1% still lag the wider US market.

See our full analysis for Merit Medical Systems.Next, we'll set these headline numbers against the most widely followed narratives about Merit Medical Systems to uncover which views find support in the data and which could be up for debate.

See what the community is saying about Merit Medical Systems

Margins Poised for Rebound by 2027

- Analysts forecast Merit’s net profit margin will rise from the current 8.3% to 11.2% within three years, pointing to renewed earnings leverage even as revenue growth is expected to stay behind the wider US market at 6.1% per year versus 10.3%.

- Analysts' consensus view highlights multiple tailwinds fueling this margin expansion

- Operational efficiency investments and automation have already pushed non-GAAP operating margins to a record 21%, while new product launches and regulatory tailwinds such as NTAP approval for WRAPSODY CIE signal further acceleration ahead.

- However, cost pressures persist, with SG&A up 13% and R&D spending rising 24% year-over-year, so future margin gains will require sustained execution on international growth and reimbursement wins.

- Want to see how analysts think these catalysts could transform Merit’s future? 📊 Read the full Merit Medical Systems Consensus Narrative.

Premium Valuation Hinges on Growth Delivery

- At $87.54 per share, the stock trades about 2% above DCF fair value ($85.48) and on a premium price-to-earnings multiple of 43.5x, far higher than both peers (22.4x) and the Medical Equipment industry (27.7x).

- Analysts' consensus view questions whether rapid growth can justify such a rich valuation

- The consensus price target stands at $104.45, 19% above today’s price, but hitting that mark would require earnings to climb to $197.2 million by 2028 and for the PE ratio to remain lofty at 40.7x, which is well above sector norms.

- Analysts warn that pricing and margin assumptions are optimistic, especially with revenue only expected to grow at 7% annually and shares outstanding set to increase by 1.61% per year, both of which could dilute per-share upside.

International Volatility and Reimbursement Risks

- China sales dropped 6% amid macroeconomic headwinds and persistent volume-based purchasing (VBP) pressure, while a key US outpatient reimbursement for WRAPSODY CIE is delayed by two quarters after errors in the application process.

- Analysts' consensus view underscores the importance of resolving these issues quickly

- If WRAPSODY CIE faces further reimbursement delays, anticipated earnings acceleration could fall short, pressuring near-term profit forecasts and limiting the product’s contribution just as global expansion ramps up.

- Tariffs and global trade risk are also emphasized, with the potential to raise costs and crimp margins if US-China trade tensions escalate. This makes international strategy and pricing discipline critical in the coming years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Merit Medical Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures? In just a few minutes, you can craft your own narrative and add a new perspective. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Merit Medical Systems.

See What Else Is Out There

Merit Medical Systems faces challenges with premium valuation, slow revenue growth, and execution risks from international volatility and cost pressures. These factors could hinder future performance.

If you’re searching for compelling opportunities with more attractive entry points, check out these 831 undervalued stocks based on cash flows that could offer better long-term value and upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives