- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

Merit Medical (MMSI) Rises 5.8% After Q3 Beat and Upgraded Guidance Has the Bull Case Shifted?

Reviewed by Sasha Jovanovic

- In the past week, Merit Medical Systems reported third quarter 2025 financial results with revenue rising to US$384.16 million and adjusted earnings per share exceeding expectations, prompting management to revise full-year revenue guidance upward.

- A key insight is that robust performance in new product launches and ongoing investment in R&D allowed the company to surpass its revenue and profit targets, while slightly improving future outlook amid increased operating costs and reimbursement-related challenges.

- We'll now explore how the better-than-expected earnings and raised guidance may influence Merit Medical Systems' investment thesis and long-term outlook.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Merit Medical Systems Investment Narrative Recap

To be a Merit Medical Systems shareholder, you need conviction in the company’s ability to leverage strong product development and international expansion to capture demand for minimally invasive procedures and grow revenue. The latest quarterly results, featuring a revenue beat and raised full-year guidance, support the near-term catalyst of robust new product uptake, while key risks tied to delayed WRAPSODY reimbursement and operating cost inflation remain, though these were not materially altered by this news update.

Among recent developments, the announcement regarding enrollment of the first patient in the WRAP North America registry is especially relevant. This registry is a critical step in building additional clinical evidence for WRAPSODY CIE, a central long-term growth catalyst impacted by ongoing reimbursement delays and shifting payer conditions.

In contrast to the upbeat quarterly performance, the ongoing WRAPSODY reimbursement delay is something investors should watch closely as it may mean...

Read the full narrative on Merit Medical Systems (it's free!)

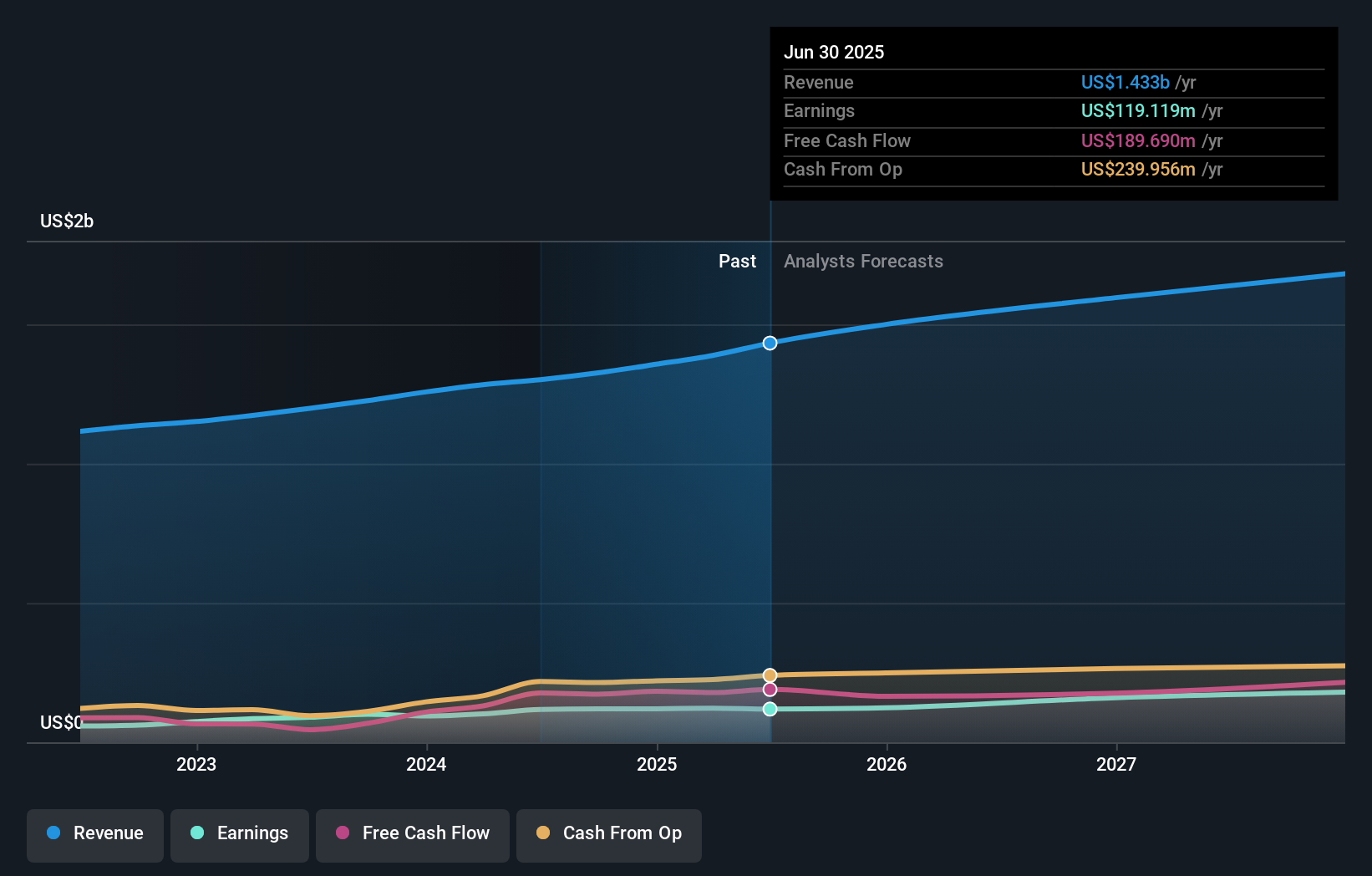

Merit Medical Systems is projected to achieve $1.8 billion in revenue and $197.2 million in earnings by 2028. This outlook is based on a 7.0% annual revenue growth rate and a $78.1 million increase in earnings from the current earnings of $119.1 million.

Uncover how Merit Medical Systems' forecasts yield a $103.55 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimate Merit Medical’s fair value in the US$79.52 to US$103.55 range. Despite the company’s accelerated product launches and guidance upgrades, opinions vary widely on future performance, explore several alternative viewpoints to get a fuller picture.

Explore 2 other fair value estimates on Merit Medical Systems - why the stock might be worth as much as 18% more than the current price!

Build Your Own Merit Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Merit Medical Systems research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Merit Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Merit Medical Systems' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives