- United States

- /

- Medical Equipment

- /

- NasdaqGM:LNTH

Should Investors Reassess Lantheus After Shares Drop 42.5% Amid Medical Imaging Competition?

Reviewed by Bailey Pemberton

- Thinking about whether Lantheus Holdings is a hidden value opportunity or not? You are definitely not alone, especially with all the recent interest around this healthcare stock.

- Lantheus Holdings’ share price has seen some significant swings lately, dropping 11.5% in the last week and down 42.5% year-to-date. However, it is still up an impressive 320% over the past five years.

- Recent headlines surrounding shifts in the medical imaging landscape and competitive product launches have added more fuel to the conversation. This news is influencing both the optimism of long-term bulls and the caution of short-term traders. The focus has grown on how sustainably Lantheus can defend its market position in a rapidly evolving healthcare sector.

- If you are wondering how the numbers stack up, Lantheus scores a robust 5 out of 6 on core valuation checks, indicating potential undervaluation in most key metrics. We will break down these valuation approaches next, and, even more importantly, reveal a smarter way to interpret that final score by the end of the article.

Find out why Lantheus Holdings's -41.6% return over the last year is lagging behind its peers.

Approach 1: Lantheus Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today’s value. This approach provides a way to determine the intrinsic worth of a business based on the cash it can generate for shareholders over time.

Lantheus Holdings currently reports Free Cash Flow (FCF) of $343 million. Analyst estimates cover projections for the next five years, suggesting a steady growth pattern. By 2029, FCF is expected to reach approximately $457 million, with subsequent years extrapolated by Simply Wall St to reflect moderation in growth rates over time.

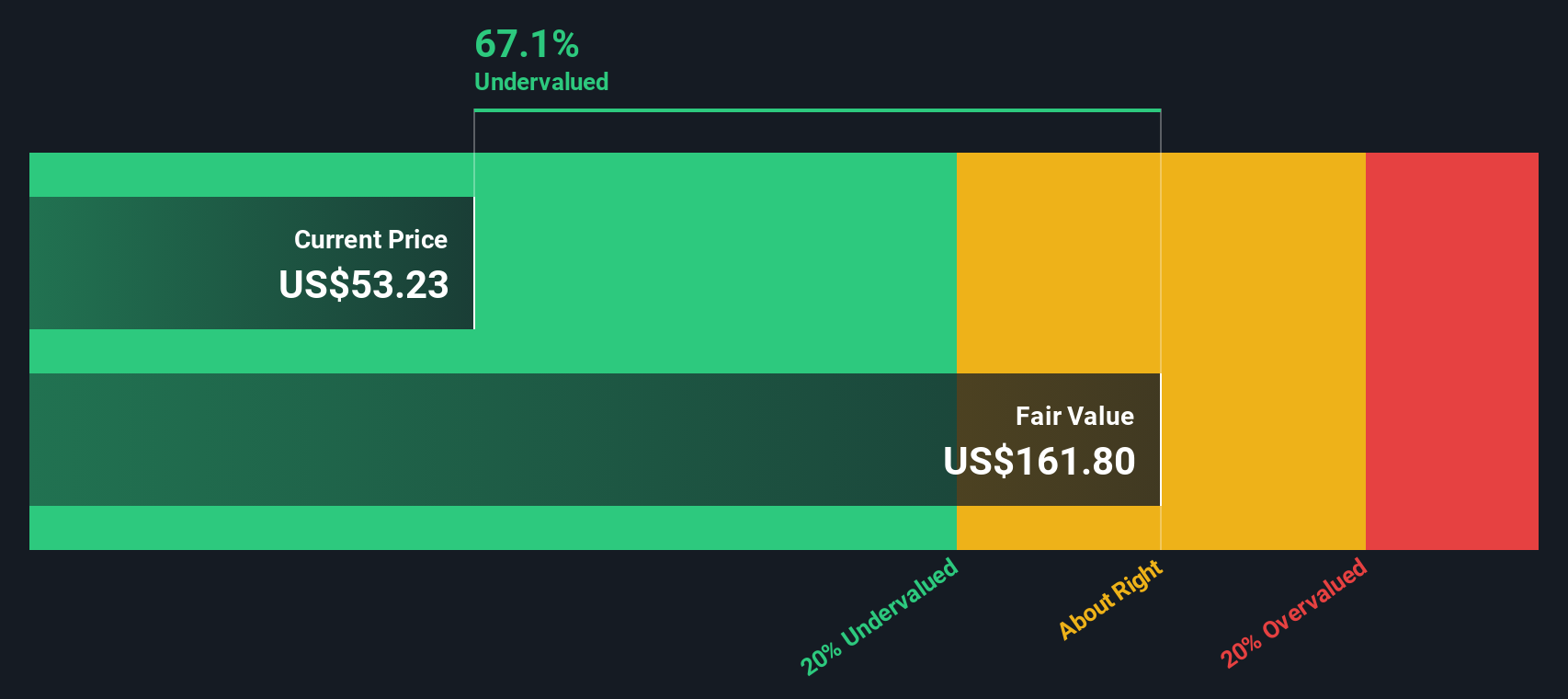

After modeling these future cash flows using the 2 Stage Free Cash Flow to Equity method, the intrinsic value for Lantheus comes out to $138.68 per share. The DCF model suggests the stock is trading at a 63.2% discount to this intrinsic value, indicating significant potential undervaluation compared to its current share price.

DCF results can be especially powerful for companies with clear, predictable cash flows such as Lantheus Holdings. This scenario suggests investors may be overlooking the long-term earning power of this medical equipment leader.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lantheus Holdings is undervalued by 63.2%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Lantheus Holdings Price vs Earnings

For companies that are consistently profitable, the Price-to-Earnings (PE) ratio is often the most widely followed valuation measure. It boils down the company's share price compared to its per-share earnings, making it a quick way for investors to assess how much they're paying for each dollar of profit.

The "right" PE ratio isn't one size fits all, as it reflects market expectations for future growth and risk. Companies anticipated to grow faster or carry less risk often command higher PE multiples, while slower growers or riskier firms tend to have lower ratios.

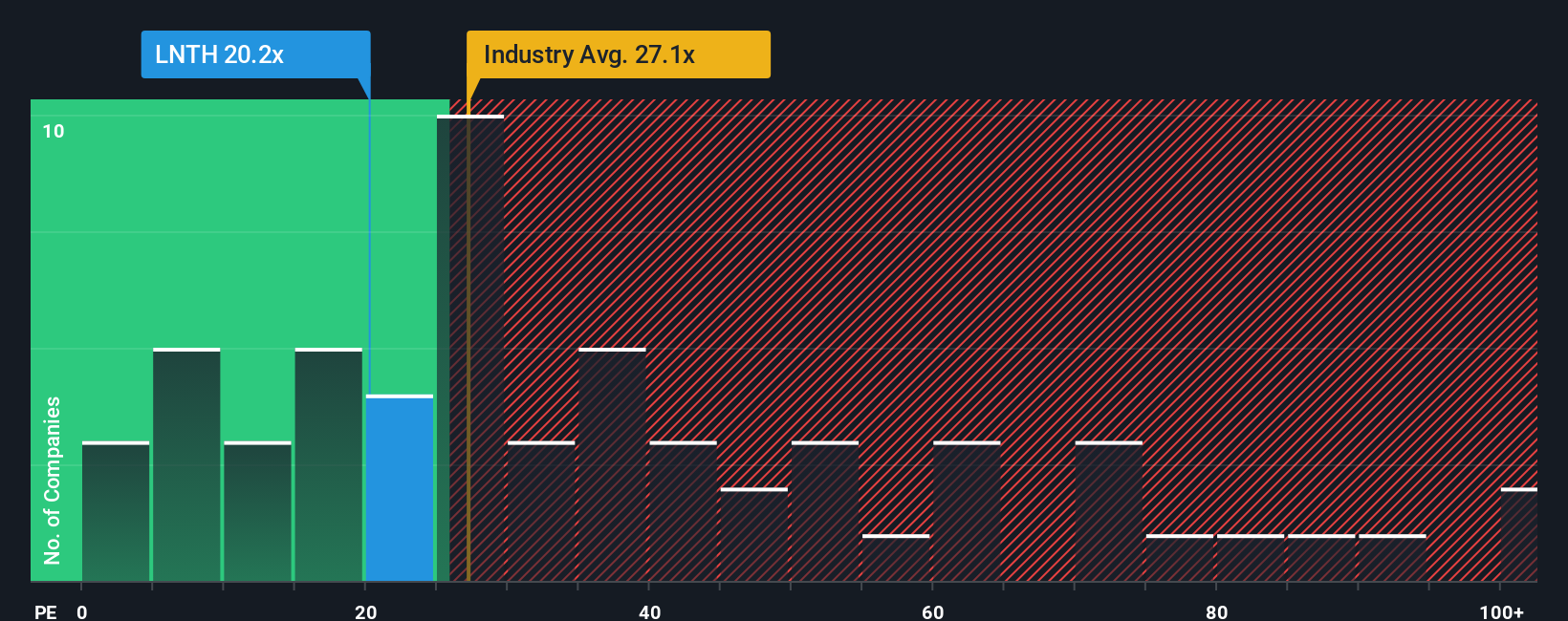

Lantheus Holdings currently trades at a PE ratio of 20.7x. This sits notably below the Medical Equipment industry average of 28.3x and the peer average of 28.6x. On the surface, this discount suggests the market may not be fully appreciating Lantheus' future profit potential, or there are concerns about growth or risk that are being priced in.

Simply Wall St’s proprietary Fair Ratio, which accounts for factors such as earnings growth, risks, profit margins, industry averages, and market cap, indicates a value of 28.0x for Lantheus. Unlike a simple industry or peer comparison, the Fair Ratio offers a more tailored assessment by considering the company’s unique growth outlook and risk profile.

With Lantheus trading at 20.7x and its Fair Ratio at 28.0x, shares appear to be undervalued by this analysis. The stock trades meaningfully below the level that would be justified given its fundamentals and long-term prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lantheus Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a smarter, story-driven approach that connects the numbers to your own perspective on a company like Lantheus Holdings.

A Narrative is simply your own story about a company, where you describe what you think will drive its future, and then tie that story to concrete forecasts and what you believe is a fair value for the stock. Instead of just relying on static models, Narratives allow you to articulate what matters most (such as new drug launches, competition, or industry shifts) and clearly see how this impacts future revenue, earnings, and valuation.

Narratives are quick and easy to create, and they are available for everyone on Simply Wall St’s Community page, used by millions of investors worldwide. By comparing your Narrative’s Fair Value to today’s share price, you can see if the market agrees with your outlook, helping you decide when to buy or sell with more confidence and clarity.

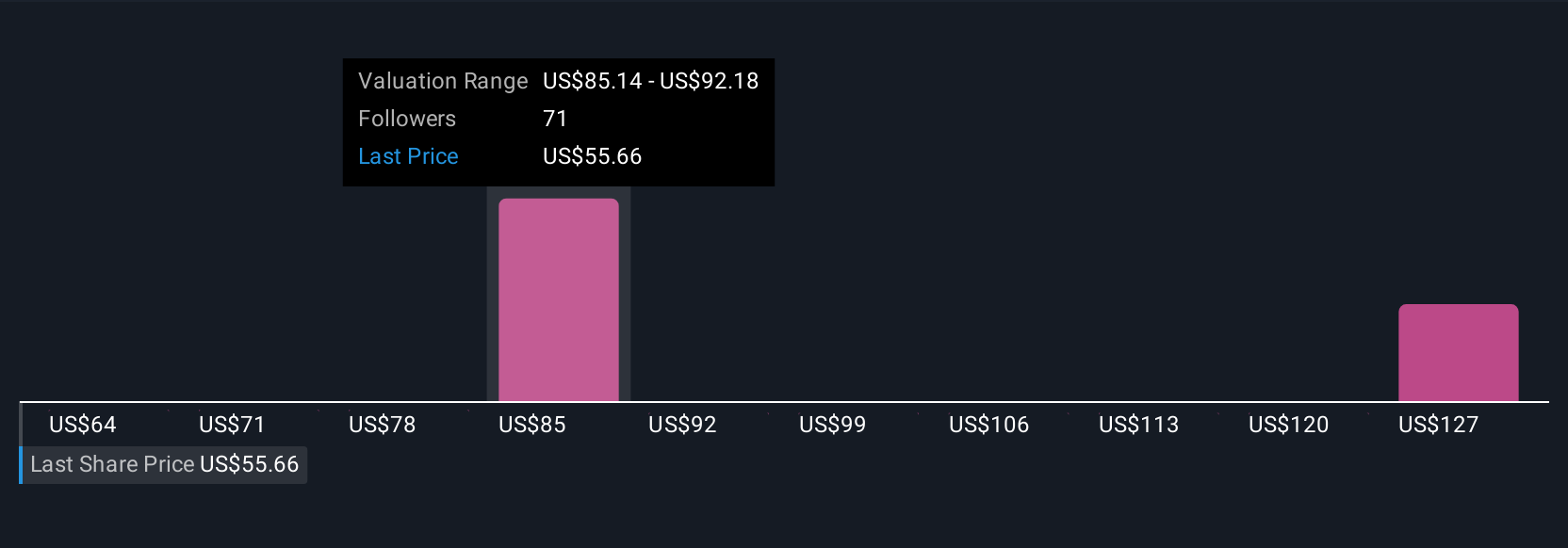

Best of all, Narratives are dynamic. When new information like earnings or major news drops, your scenario and fair value update automatically, keeping your investment case current. For example, one investor might predict a strong recovery in Lantheus’s imaging pipeline and set a fair value near the most optimistic analyst target of $130. Another may be more cautious about competitive threats and use a fair value close to the lowest target of $63, showing how different stories can lead to different investing decisions.

Do you think there's more to the story for Lantheus Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LNTH

Lantheus Holdings

Develops, manufactures, and commercializes diagnostic and therapeutic products that assist clinicians in diagnosis and treatment of heart, cancer, and other diseases worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives