- United States

- /

- Medical Equipment

- /

- NasdaqGM:LMAT

LeMaitre Vascular (LMAT): Assessing Valuation After Strong Q3 Results and Upbeat Full-Year Guidance

Reviewed by Simply Wall St

LeMaitre Vascular (LMAT) caught investor attention following its latest update, as the company posted strong third quarter results and set higher expectations for both the upcoming quarter and full year.

See our latest analysis for LeMaitre Vascular.

LeMaitre Vascular’s strong financial update and upbeat full-year outlook have caught the market’s attention, but the share price tells a more nuanced story. While the latest results sparked a modest uptick and the stock now trades at $86.82, the 1-year total shareholder return sits at -16.01%, suggesting recent momentum has yet to offset prior weakness. However, the long-term picture looks much brighter, with the company posting a 94.52% total return over three years and 144.58% over five years. This is clear evidence that patient investors have been rewarded during periods of durable growth.

If business resilience like this resonates with you, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With these strong results and higher guidance, is LeMaitre Vascular still flying under the radar for value hunters, or has the market already factored in all that future growth?

Most Popular Narrative: 17.1% Undervalued

LeMaitre Vascular's most widely followed narrative sets a fair value at $104.78, a notable premium to the last close price of $86.82. This gap spotlights optimism about future growth drivers and highlights key numbers fueling bullish expectations.

*Robust growth in international markets, particularly Europe and emerging regions, is being driven by new product launches (such as Artegraft and RestoreFlow) and ongoing regulatory approvals in countries like Germany, Ireland, Canada, Korea, and Singapore. These activities are establishing significant new revenue streams and supporting future revenue growth. The expanding addressable patient population, due to global demographic shifts—especially an aging population and increasing prevalence of diabetes and obesity—is likely to drive sustained demand for vascular interventions and LeMaitre's portfolio, supporting ongoing unit sales and top-line revenue expansion over time.*

Want to know which forecasted growth rates and ambitious margin improvements power this target price? The most watched narrative combines major international expansion and industry tailwinds. Get the full scoop on the details making this valuation possible.

Result: Fair Value of $104.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, international hurdles and the challenge of sustaining recent pricing power could dampen growth. This means forecasts may prove optimistic if challenges persist.

Find out about the key risks to this LeMaitre Vascular narrative.

Another View: What Does the SWS DCF Model Say?

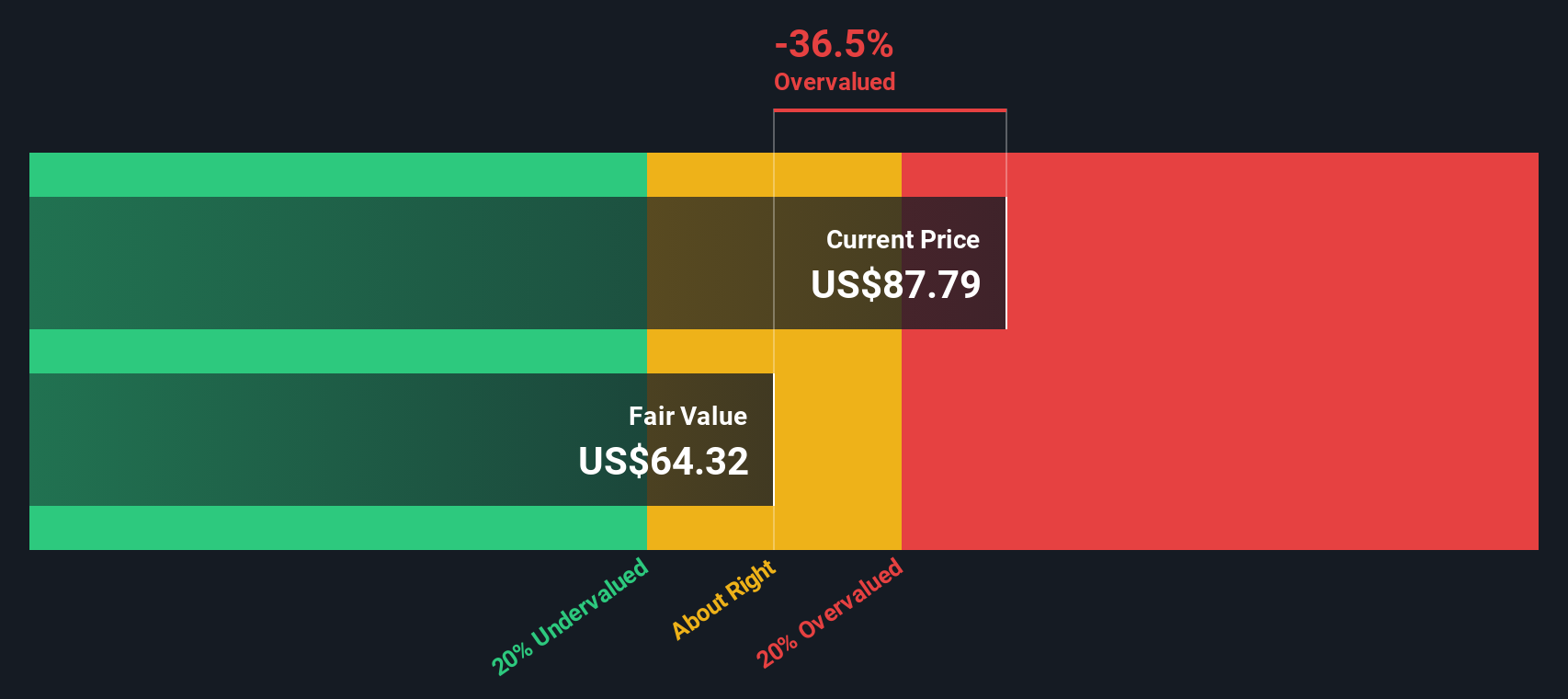

While many are bullish based on projected growth, our DCF model presents a more cautious perspective. It estimates LeMaitre’s fair value at just $64.32, which is well below the current price of $86.82. This suggests the stock may actually be overvalued. Is it possible that the growth outlook is already reflected in today’s valuation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out LeMaitre Vascular for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own LeMaitre Vascular Narrative

If you’re looking to form your own perspective or dig deeper into the details, crafting your own narrative is quicker than you might think. See how you can Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding LeMaitre Vascular.

Ready for More Smart Investment Moves?

If you want to stay ahead of the curve, don’t stop at just one stock. Expand your watchlist with promising opportunities others might miss.

- Snap up income potential by checking out these 16 dividend stocks with yields > 3%, which boasts strong yields above 3%. This can be a good option for those seeking a steady stream from their investments.

- Access tomorrow’s innovations today and see what’s possible with these 28 quantum computing stocks, where companies are at the forefront of quantum computing solutions.

- Cement your edge in the digital frontier by evaluating these 82 cryptocurrency and blockchain stocks, which taps into blockchain technology and future-ready financial platforms.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LMAT

LeMaitre Vascular

Develops, manufactures, and markets medical devices and implants used in the field of vascular surgery in the Americas, Europe, the Middle Esat, Africa, and the Asia Pacific.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives