- United States

- /

- Medical Equipment

- /

- NasdaqCM:KRMD

Market Cool On KORU Medical Systems, Inc.'s (NASDAQ:KRMD) Earnings Pushing Shares 28% Lower

KORU Medical Systems, Inc. (NASDAQ:KRMD) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 13%.

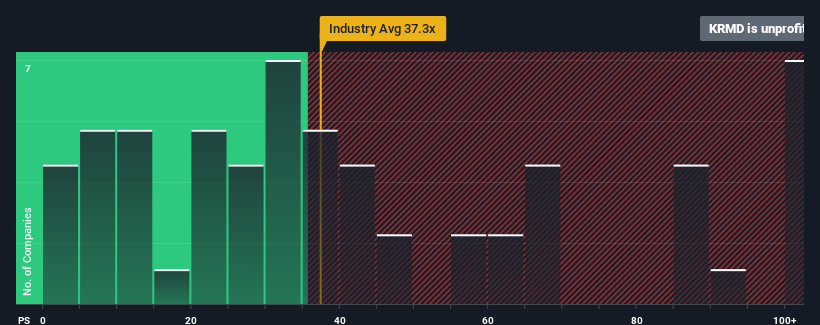

Although its price has dipped substantially, KORU Medical Systems may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of -15.8x, since almost half of all companies in the United States have P/E ratios greater than 16x and even P/E's higher than 33x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

While the market has experienced earnings growth lately, KORU Medical Systems' earnings have gone into reverse gear, which is not great. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for KORU Medical Systems

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, KORU Medical Systems would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 44% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Looking ahead now, EPS is anticipated to climb by 11% per year during the coming three years according to the three analysts following the company. That's shaping up to be similar to the 11% each year growth forecast for the broader market.

In light of this, it's peculiar that KORU Medical Systems' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On KORU Medical Systems' P/E

Shares in KORU Medical Systems have plummeted and its P/E is now low enough to touch the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of KORU Medical Systems' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Before you take the next step, you should know about the 2 warning signs for KORU Medical Systems (1 can't be ignored!) that we have uncovered.

Of course, you might also be able to find a better stock than KORU Medical Systems. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if KORU Medical Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:KRMD

KORU Medical Systems

Develops, manufactures, and commercializes subcutaneous infusion solutions primarily for the subcutaneous drug delivery market in the United States and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives