- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Intuitive Surgical (ISRG): Evaluating Valuation After Strong Earnings Beat and Renewed Growth Optimism

Reviewed by Simply Wall St

Intuitive Surgical (ISRG) has been in the spotlight after reporting earnings and revenue that surpassed expectations. With this momentum and ongoing growth prospects, many investors are re-evaluating the potential of ISRG in their portfolios.

See our latest analysis for Intuitive Surgical.

Intuitive Surgical’s impressive earnings beat and solid revenue growth have kept investors’ focus sharp, and the company’s business momentum is showing up in the numbers. The latest surge in share price, with a one-month gain of 30.4%, hints at renewed optimism. However, the 4.5% total shareholder return over the past year suggests volatility and big upside swings have defined the journey. Over the longer term, Intuitive Surgical’s 115.9% total shareholder return for three years stands out as a testament to its durable growth story.

If the buzz around breakthrough earnings has you rethinking your watchlist, it’s a great moment to discover other innovators in the space. Check out the See the full list for free..

But with shares up sharply and business momentum in full swing, the big question now is whether Intuitive Surgical is trading at a premium or if there is still a hidden buying opportunity that the market has yet to price in.

Most Popular Narrative: 5.8% Undervalued

With Intuitive Surgical’s last close at $560 and the widely followed narrative assigning a fair value of $594.29, analysts see room for shares to run. This narrative connects robust earnings momentum to long-term catalysts, setting up the next key insight driving valuation.

Strong global procedure growth (18% total, 17% da Vinci specifically), increasing installed base, and rising system utilization indicate that Intuitive is effectively capturing surging demand for minimally invasive, robotic-assisted surgeries as chronic disease rates rise and populations age globally. This directly supports long-term recurring revenue and margin stability.

Want to unlock the secret behind this bullish fair value? Hint: analysts are betting on rapid growth, sticky recurring revenues and a premium multiple that rivals the boldest tech valuations. The numbers driving this view are bigger than you expect. Curious what’s fueling this forecast? Discover the surprising assumptions behind the narrative’s price target now.

Result: Fair Value of $594.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition from remanufactured instruments and ongoing international budget constraints could present challenges for Intuitive Surgical’s future revenue growth and profit margins.

Find out about the key risks to this Intuitive Surgical narrative.

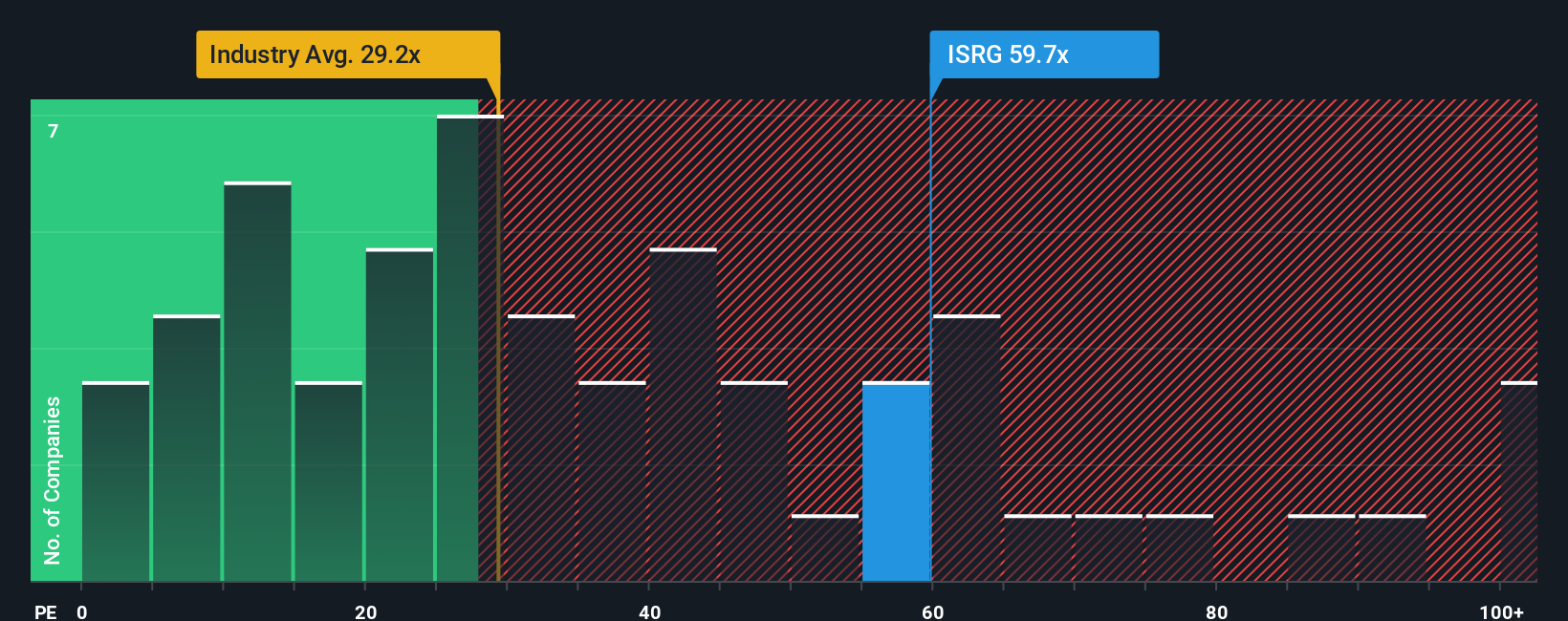

Another View: Market Multiples Paint a Different Picture

Looking through the lens of price-to-earnings, Intuitive Surgical stands out as expensive. Its P/E ratio of 72.3x is more than double the US Medical Equipment industry average of 27.1x and well above peer averages. The fair ratio for ISRG is 39.8x, indicating the market is expecting a lot. Any shift in sentiment could make the valuation vulnerable. Are investors placing too much faith in future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Surgical Narrative

Prefer a hands-on approach or want a viewpoint all your own? Try building your personalized forecast in just a few minutes by using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Intuitive Surgical.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Unlock your full potential by checking out hand-picked stock ideas that could reshape your strategy right now.

- Capture the future of medicine by researching these 32 healthcare AI stocks, which is accelerating breakthroughs in diagnostics, treatment, and digital health across the healthcare sector.

- Boost your long-term returns with these 16 dividend stocks with yields > 3%, which offers steady income streams and the kind of consistency that can steady any portfolio.

- Position yourself ahead of market trends by uncovering these 25 AI penny stocks, fueling the biggest advances in artificial intelligence and automation today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives