- United States

- /

- Medical Equipment

- /

- NasdaqGS:IRTC

A Look at iRhythm Technologies’s Valuation Following Strong Q3 Results and Upgraded 2025 Revenue Guidance

Reviewed by Simply Wall St

iRhythm Technologies (IRTC) delivered a double helping of news for investors, releasing third-quarter results that showed rising sales and shrinking losses, while also bumping up its full-year 2025 revenue guidance.

See our latest analysis for iRhythm Technologies.

With strong quarterly results and raised full-year revenue guidance, iRhythm Technologies has seen momentum return to its stock. This is reflected in a robust year-to-date share price return of 109% and a 1-year total shareholder return nearing 130%. Recent price gains suggest investors are growing more optimistic about sustained revenue growth and the improving profitability trend.

Want to see which other healthcare names are gaining investor attention after big earnings moves? Discover new opportunities with our See the full list for free.

With shares up sharply and guidance on the rise, investors are left to consider whether iRhythm is still undervalued or if the recent rally has already priced in the company’s future growth prospects.

Most Popular Narrative: 3% Undervalued

With iRhythm's fair value now estimated at $193, just above its recent close of $187.30, the most widely followed narrative suggests there is a slight edge left for investors. The real drivers behind this fair value call are tied to iRhythm's expanding technology footprint and the efficiency gains from ongoing innovation.

Investment in the Zio ecosystem, including next-generation patches, enhanced form factors, and AI-powered analytics such as the Lucem Health partnership, is improving product differentiation, diagnostic yield, and workflow efficiency. This is likely leading to higher gross margins and operating leverage as software and data become a larger component of the business.

Curious what behind-the-scenes financial targets justify this fair value? The narrative leans on future profit margins and bold revenue growth, forecasting numbers rarely seen in the medical technology sector. Only the full narrative reveals the assumptions that truly move the needle.

Result: Fair Value of $193 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory scrutiny and increased competition from new wearable technologies could quickly shift investor sentiment. This could challenge iRhythm’s optimistic growth narrative.

Find out about the key risks to this iRhythm Technologies narrative.

Another View: Market Ratios Paint a Different Picture

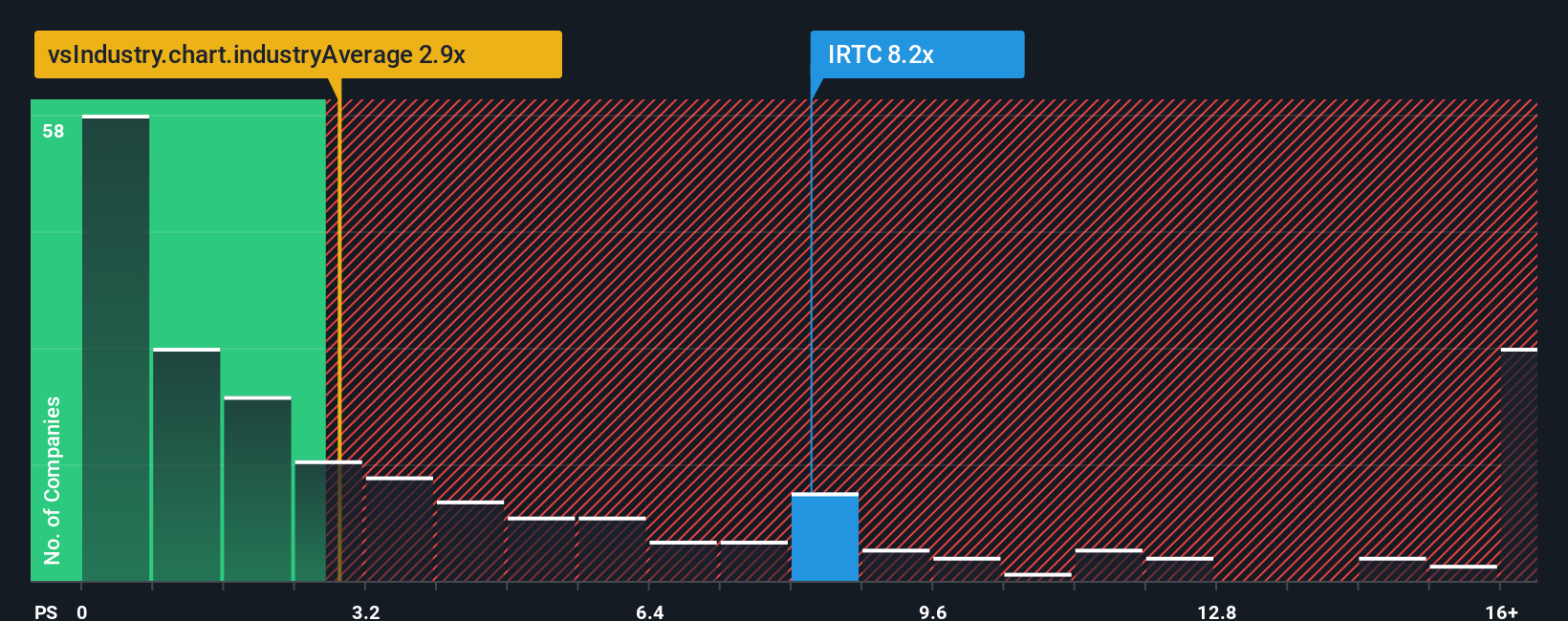

Looking beyond fair value models, iRhythm Technologies appears pricey when comparing its price-to-sales ratio of 8.6x to the industry average of just 2.9x and peer average of 5.8x. The fair ratio is 4.9x, which suggests there may be valuation risk if sentiment shifts. Could investors be ignoring these signals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own iRhythm Technologies Narrative

If this perspective is not quite your own, or you want to dig deeper into the numbers, there is an easy way to assemble your own narrative. Do it your way.

A great starting point for your iRhythm Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for More Opportunities?

Smart investors do not stop at just one idea. Take advantage of exclusive screeners to find other standout stocks with great potential that you could be missing right now.

- Maximize your returns by targeting undervalued companies with solid growth prospects using these 843 undervalued stocks based on cash flows.

- Unlock the potential of artificial intelligence by seeking out forward-thinking businesses through these 27 AI penny stocks.

- Supercharge your passive income with strong yields from these 20 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iRhythm Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IRTC

iRhythm Technologies

A digital healthcare company, engages in the design, development, and commercialization of device-based technology that provides ambulatory cardiac monitoring services to diagnose arrhythmias in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives