- United States

- /

- Medical Equipment

- /

- NasdaqGS:ICUI

ICU Medical (ICUI) Is Up 8.3% After Sharply Raising 2025 Earnings Guidance and Narrowing Net Loss

Reviewed by Sasha Jovanovic

- ICU Medical reported third quarter 2025 results with sales of US$536.99 million and a net loss of US$3.4 million, compared to US$589.13 million in sales and a net loss of US$32.98 million the year before.

- The company also significantly raised its full-year earnings guidance, substantially narrowing its projected net loss and indicating the potential to break even in fiscal 2025.

- We'll examine how the sharply improved earnings outlook may influence ICU Medical's investment narrative and forward-looking profitability expectations.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

ICU Medical Investment Narrative Recap

To be a shareholder in ICU Medical, you have to believe that the long-term growth in global healthcare demand, ongoing innovation in infusion therapy, and efficiency gains from recent acquisitions will translate into durable profit growth. The latest quarterly results, showing a significant narrowing of the net loss and a sharply improved outlook for 2025, are likely to be seen as pivotal for near-term sentiment. However, the most important short-term catalyst remains the company’s ability to sustain margin recovery, while execution and regulatory risks continue to weigh on the story.

The most relevant recent announcement is ICU Medical’s substantial upgrade to its 2025 earnings guidance. With projected net loss now cut from a potential US$43–35 million to a range of just US$8 million loss to breakeven, this guidance reset meaningfully addresses concerns about ongoing net losses and suggests improved confidence in realizing cost synergies and operational efficiencies, a key short-term catalyst for potential margin expansion and eventual profitability.

In contrast, investors should be aware that despite these improvements, integration and restructuring costs tied to the Smiths Medical acquisition could still...

Read the full narrative on ICU Medical (it's free!)

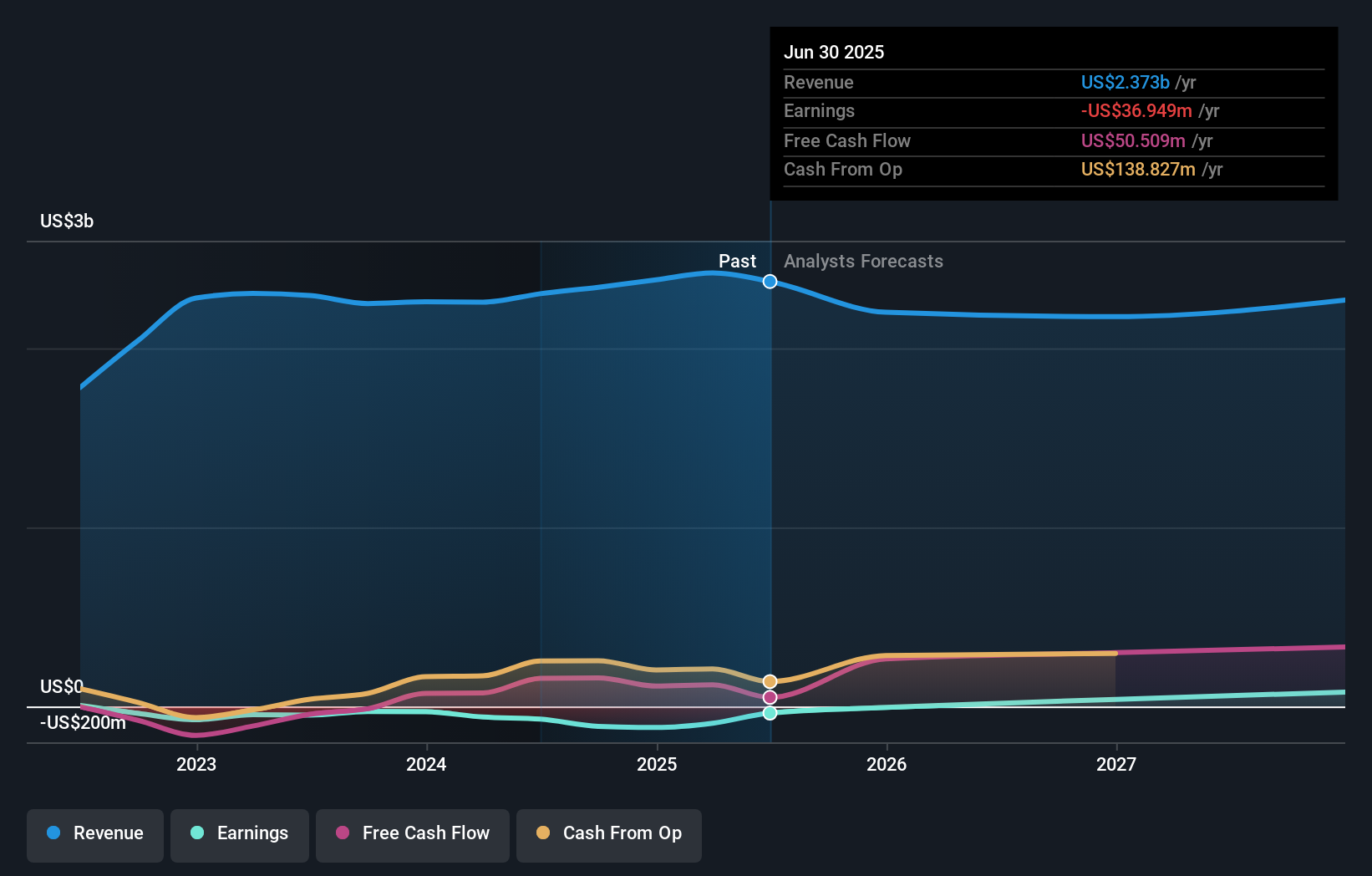

ICU Medical is projected to reach $2.4 billion in revenue and $106.0 million in earnings by 2028. This outlook is based on a slight annual revenue decline of 0.1% and an earnings increase of $142.9 million from the current earnings of -$36.9 million.

Uncover how ICU Medical's forecasts yield a $176.50 fair value, a 36% upside to its current price.

Exploring Other Perspectives

One retail estimate from the Simply Wall St Community puts ICU Medical’s fair value at US$176.50 per share. While community views align on a single figure, analysts remain focused on the execution risks of integration and cost controls, which may affect how quickly the company translates guidance upgrades into improved performance. Explore varied opinions for a fuller picture.

Explore another fair value estimate on ICU Medical - why the stock might be worth as much as 36% more than the current price!

Build Your Own ICU Medical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ICU Medical research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ICU Medical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ICU Medical's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ICUI

ICU Medical

Develops, manufactures, and sells medical devices used in infusion therapy, vascular access, and vital care applications worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives