- United States

- /

- Healthtech

- /

- NasdaqCM:ICAD

Shareholders in iCAD (NASDAQ:ICAD) have lost 80%, as stock drops 13% this past week

This month, we saw the iCAD, Inc. (NASDAQ:ICAD) up an impressive 72%. But the last three years have seen a terrible decline. To wit, the share price sky-dived 80% in that time. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

After losing 13% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for iCAD

Given that iCAD didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years iCAD saw its revenue shrink by 1.8% per year. That's not what investors generally want to see. The share price fall of 22% (per year, over three years) is a stern reminder that money-losing companies are expected to grow revenue. This business clearly needs to grow revenues if it is to perform as investors hope. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

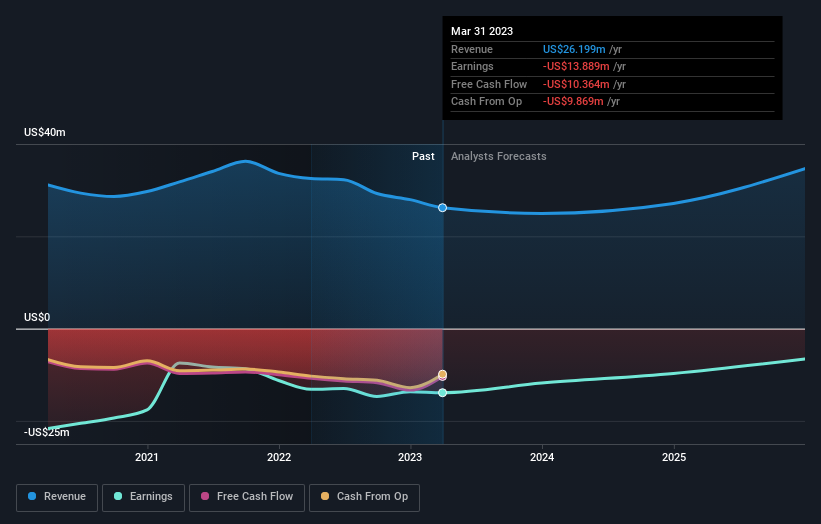

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for iCAD in this interactive graph of future profit estimates.

A Different Perspective

Investors in iCAD had a tough year, with a total loss of 52%, against a market gain of about 17%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - iCAD has 3 warning signs we think you should be aware of.

Of course iCAD may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if iCAD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ICAD

iCAD

Provides AI-powered cancer detection solutions in the United States.

Flawless balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives