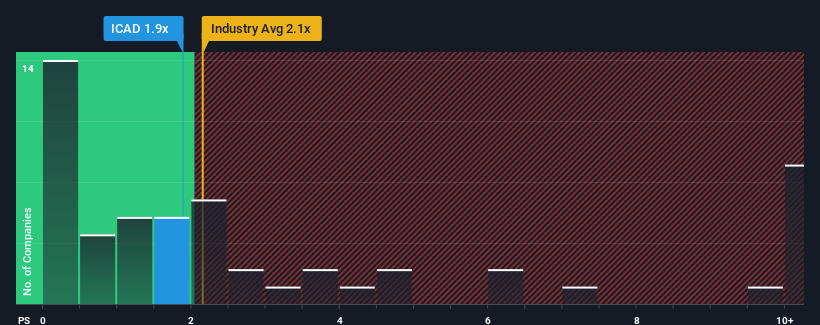

It's not a stretch to say that iCAD, Inc.'s (NASDAQ:ICAD) price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" for companies in the Healthcare Services industry in the United States, where the median P/S ratio is around 2.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for iCAD

What Does iCAD's P/S Mean For Shareholders?

Recent times haven't been great for iCAD as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on iCAD.Is There Some Revenue Growth Forecasted For iCAD?

The only time you'd be comfortable seeing a P/S like iCAD's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 8.0% gain to the company's revenues. Still, lamentably revenue has fallen 44% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 11% over the next year. That's shaping up to be similar to the 9.8% growth forecast for the broader industry.

With this information, we can see why iCAD is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On iCAD's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A iCAD's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Healthcare Services industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for iCAD that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if iCAD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ICAD

iCAD

Provides AI-powered cancer detection solutions in the United States.

Flawless balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives