- United States

- /

- Healthtech

- /

- NasdaqGS:HSTM

HealthStream (HSTM): Margins Improve, Moderating Growth Challenges Bullish Narratives

Reviewed by Simply Wall St

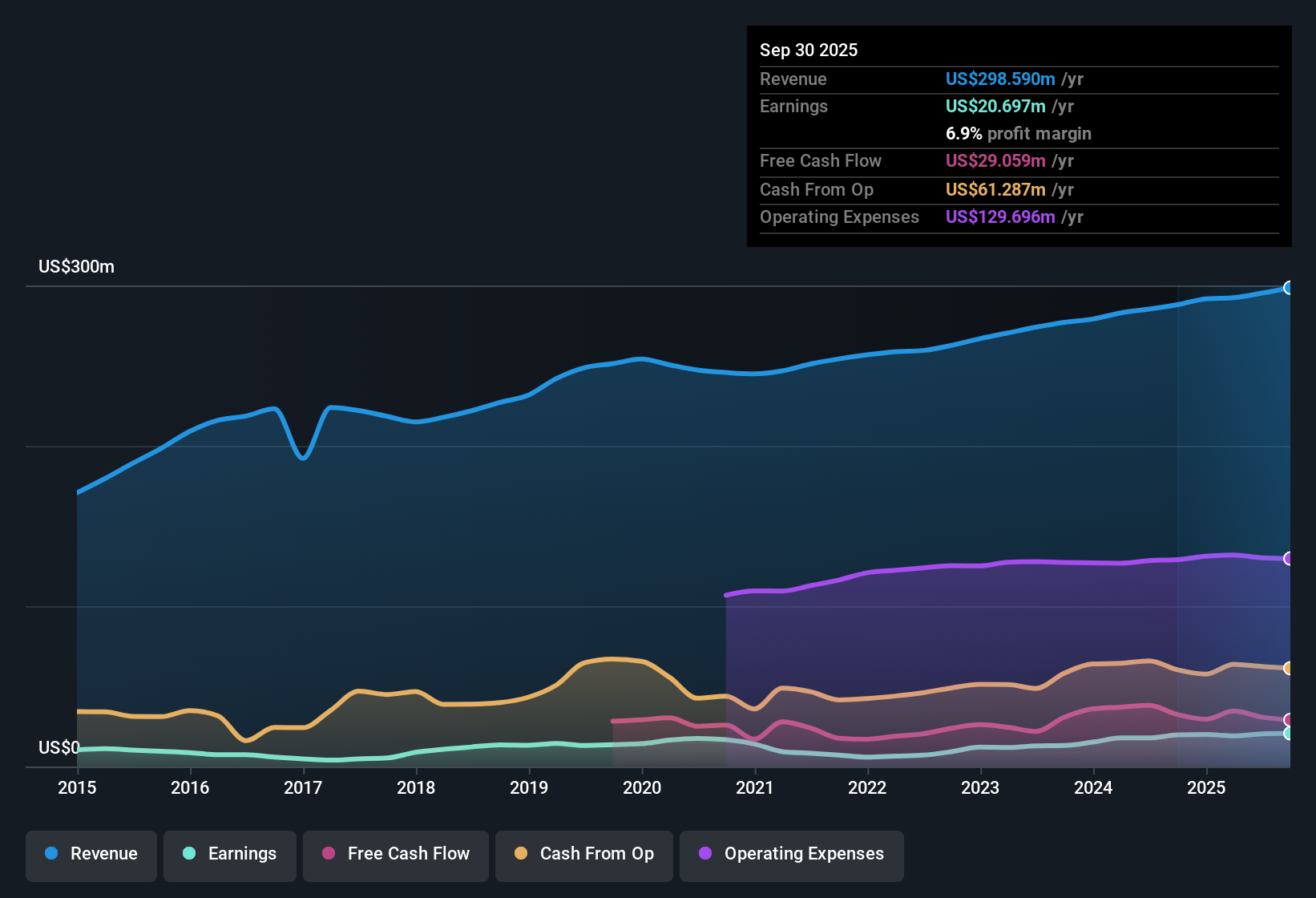

HealthStream (HSTM) reported net profit margins of 6.9%, ticking up from last year’s 6.8%. Earnings have grown at an average annual rate of 18% over the last five years, but most recent annual earnings growth was 5%, coming in below that longer-term pace. Revenue is forecast to rise 4.7% per year and earnings at 7.7%, both trailing expectations for the wider US market. Valuation metrics present a mixed picture with the share price trading below one fair value estimate and a P/E lower than its peer group. Altogether, steady margins and quality historical earnings set a constructive backdrop. The moderation in growth profiles means investors may approach valuation with some caution.

See our full analysis for HealthStream.Next, we’ll see how these headline numbers stack up against the broader market narratives for HealthStream, revealing where the results may support or challenge the prevailing story.

See what the community is saying about HealthStream

Margins Edge Up as Legacy Drag Fades

- HealthStream’s net profit margins ticked up to 6.9%, just above last year’s 6.8%, while operating efficiency has been improving as older legacy product declines lessen their impact.

- Analysts' consensus view highlights that recent growth in HealthStream’s core SaaS applications, such as CredentialStream and ShiftWizard, signals stabilizing performance as the drag from legacy products recedes and supports margin resilience.

- Momentum in recurring revenue and integrated platforms is expected to improve both customer value and margin profile, according to consensus.

- However, they also note that full potential depends on continued migration away from older product lines. If legacy drag persists longer than expected, margin improvement could stall.

Growth Rates Lag Sector Ambitions

- With revenue forecast to grow 4.7% a year and earnings at 7.7%, HealthStream’s expected pace trails that of the broader US market and sector averages. This spotlights the company’s more moderate expansion against ambitious industry peers.

- Analysts' consensus narrative says that, while HealthStream is well positioned through digital transformation and workforce development tailwinds, its slower growth rates could limit valuation upside versus healthcare services peers.

- The consensus points to market-wide catalysts, such as industry digitalization and compliance demand, as supportive. However, it also warns that rising competition and the risk of generative AI disruption could further dampen long-run revenue acceleration.

- They argue that a stable but slower climb in both revenue and profit is likely to keep HealthStream firmly in the “steady performer, not disruptor” camp for now.

Trading Below DCF Fair Value but Analyst Target Out of Reach

- Shares last traded at $26.03, sitting below the latest DCF fair value of $28.43 but still 15.7% under the $34.00 analyst consensus price target. This reflects both positive comparative value and skepticism about reaching analysts’ bullish assumptions on growth and profit multiples.

- Analysts' consensus narrative underscores that to justify the $34.00 price target by 2028, investors would need to see earnings rise to $23.3 million, stable or improving profit margins, and a PE ratio of 49.5x. Achieving these would require both sustained execution and some market optimism.

- With the current PE at 37.3x (below the peer average of 52.3x but above the global healthcare services industry at 35.6x), the disconnect shows how investors may be pricing in a blend of sector value and caution about future performance.

- The share price discount versus DCF and analyst targets leaves room for upside, but also signals that the market is waiting for further evidence that HealthStream can deliver on consensus growth expectations.

For a deeper dive into how these narratives shape the investment case, see how analysts and the community weigh HealthStream's recent performance against its future prospects. 📊 Read the full HealthStream Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for HealthStream on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique insight on HealthStream’s story? In just a few minutes, you can shape and contribute your own narrative. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding HealthStream.

Explore Alternatives

HealthStream lags sector peers with its slower growth rates and limited revenue acceleration. Despite stable margins and some margin improvement, its overall performance trails that of competitors.

If you’re looking for established names set to deliver stronger earnings growth, check out high growth potential stocks screener (50 results) and discover companies aiming for faster expansion than HealthStream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HealthStream might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HSTM

HealthStream

Provides Software-as-a-Service (SaaS) based applications for healthcare organizations in the United States.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives