- United States

- /

- Healthcare Services

- /

- NasdaqGS:HQY

How Recent Sector Volatility Impacts HealthEquity’s Market Value in 2025

Reviewed by Bailey Pemberton

If you’re looking at HealthEquity right now and trying to decide whether to buy, sell, or sit tight, you’re definitely not alone. The stock has had its fair share of twists lately, and investors are naturally asking what’s next. After touching some highs earlier this year, HealthEquity’s share price has dipped, down 7.1% over the past week and 3.2% for the past month. Year to date, it’s down 8.5%. Looking back further, there’s a different story: over the last year, the stock is actually up 7.4%, and it has delivered a solid 32.7% gain over three years and 56.6% over five years. Clearly, there is some growth potential here, even if the short-term moves have felt a bit rocky.

Much of this action can be traced back to broader market developments that have shifted the way investors feel about the healthcare and benefits sector overall. When the sector gets attention for innovation or policy changes, stocks like HealthEquity can see rapid swings as risk perceptions shift. The recent pullback could very well be tied to these macro moves, rather than any fundamentals specific to HealthEquity.

Now, when it comes to putting a number on value, HealthEquity scores a 3 out of 6 across our core undervaluation checks. That means it is flashing value in half of the categories analysts use to spot potential bargains. But what does that really mean for you? Up next, I’ll break down how those valuation methods work and why the best approach might go even further than the usual checklist.

Approach 1: HealthEquity Discounted Cash Flow (DCF) Analysis

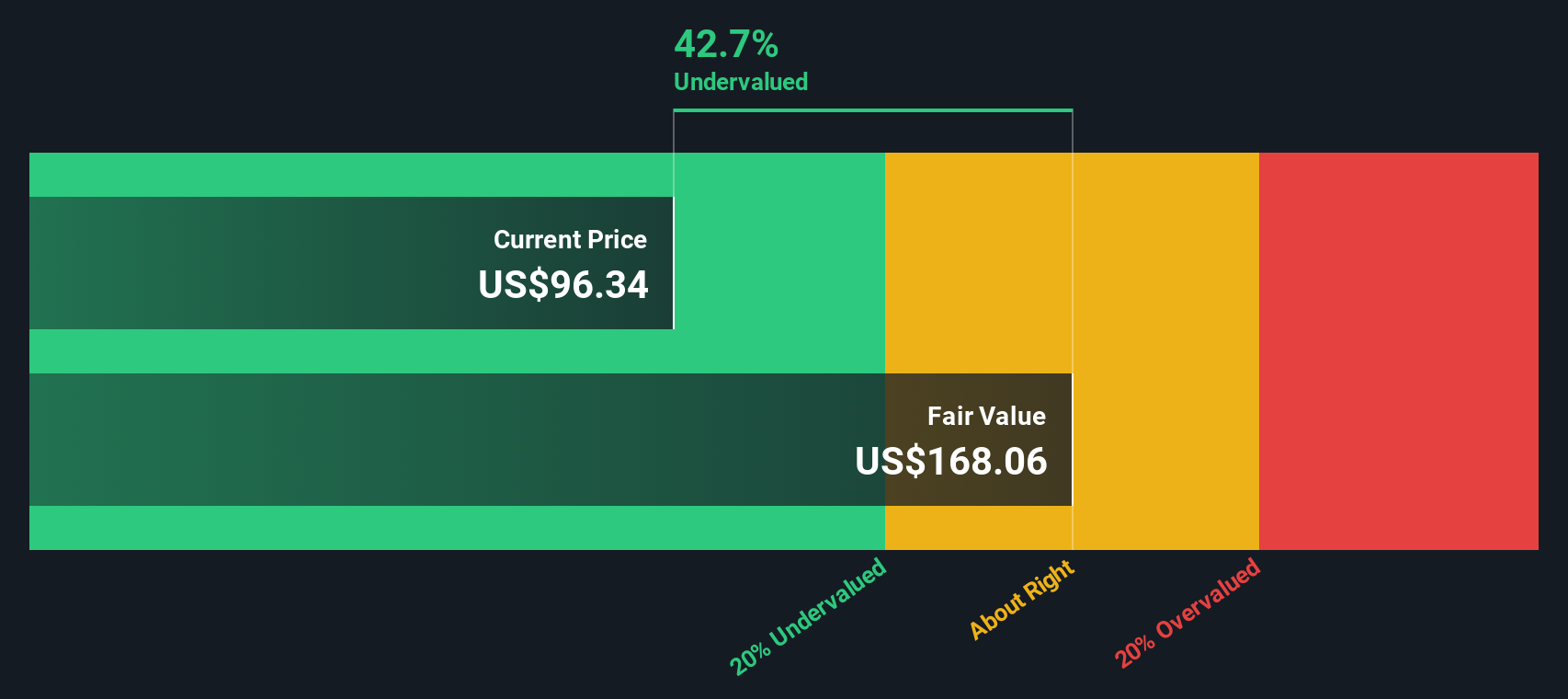

The Discounted Cash Flow (DCF) model estimates a company's true worth by projecting its future free cash flows and then discounting them back to today's dollars, reflecting their value if received now. It is a forward-looking method that focuses on how much cash the business can actually generate for shareholders.

For HealthEquity, the most recent annual Free Cash Flow (FCF) stands at $135.6 million. Analysts expect strong growth, projecting FCF to reach $489 million by fiscal year 2028. Beyond that, Simply Wall St extrapolates out to 2035, forecasting FCF to rise to approximately $728.9 million. All projections are in USD, and figures beyond 2028 are model-driven estimates rather than direct analyst calls.

When these future numbers are discounted back, HealthEquity’s intrinsic value comes out to $168.06 per share. Compared to where HealthEquity trades today, this implies the stock is around 47.3% below what the DCF analysis suggests it is truly worth, signaling a sizable margin of safety for buyers.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests HealthEquity is undervalued by 47.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: HealthEquity Price vs Earnings

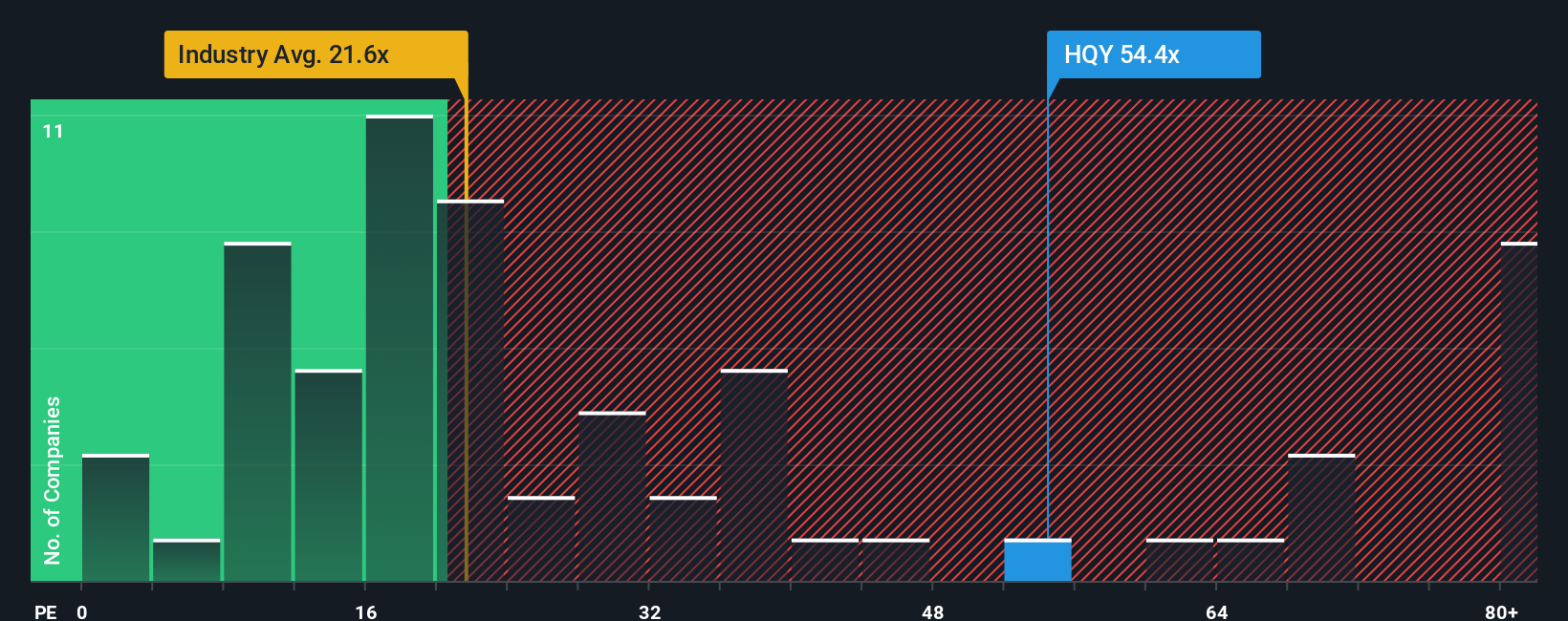

For profitable companies like HealthEquity, the Price-to-Earnings (PE) ratio is a widely used valuation tool. It tells investors how much they are paying today for each dollar of current earnings. Because HealthEquity is consistently generating profit, the PE ratio provides a relevant snapshot of what the market is willing to pay for its earnings power.

The interpretation of a PE ratio depends a lot on growth expectations and perceived risks. High growth companies typically warrant a higher PE, since investors expect future earnings to rise quickly. Conversely, a company facing uncertainty or slower growth will usually trade on a lower multiple. So a fair PE ratio is unique to each company, shaped by its own outlook and risk profile.

Right now, HealthEquity trades at a PE ratio of 52.3x. This is well above both the Healthcare industry average of 21.4x and its peer group median of 18.5x. However, Simply Wall St uses a proprietary Fair Ratio metric, which blends factors like HealthEquity’s earnings growth, profit margins, industry trends, and company-specific risks. Their Fair Ratio for HealthEquity is 32.5x, giving a more holistic sense of what investors should be willing to pay compared to a simple industry or peer average. Because HealthEquity’s current PE is significantly higher than its Fair Ratio, the stock appears overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HealthEquity Narrative

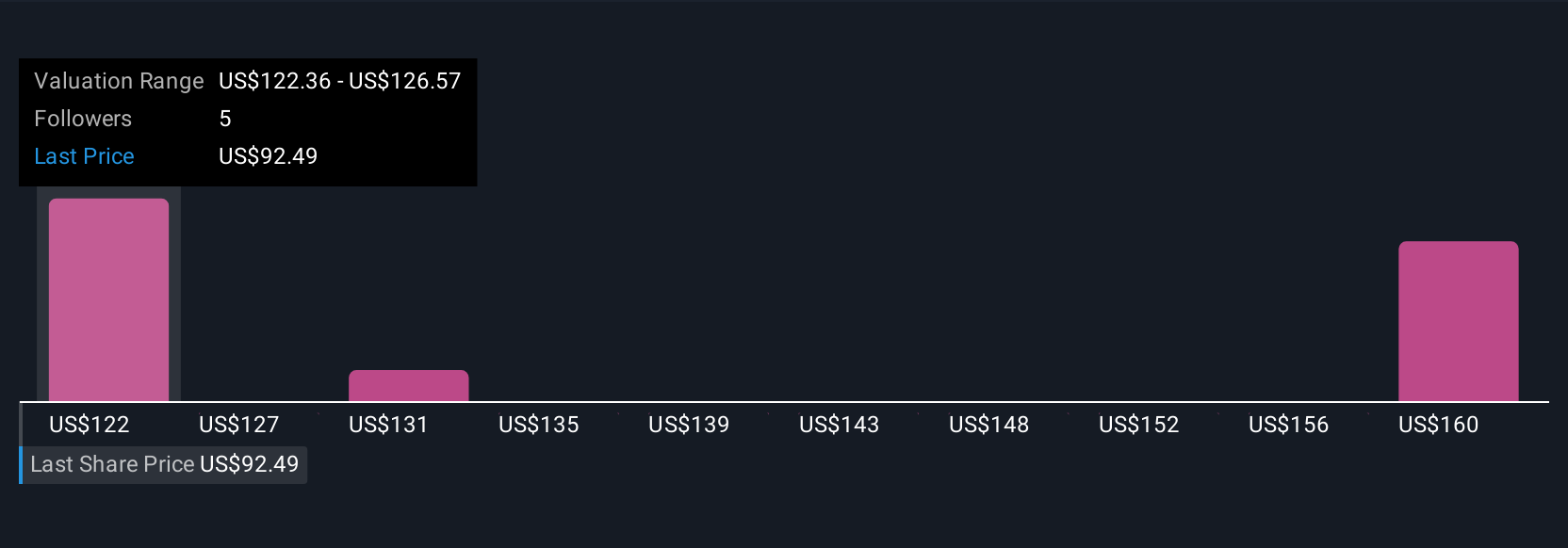

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear story behind the numbers, your take on what you believe HealthEquity is worth, based on your expectations about its future revenue, profits, and margins.

Narratives link the company's story (like regulatory tailwinds or digital innovation) directly to a personalized forecast, and then to an estimated fair value for the shares. This approach moves beyond static checklists, letting you visualize how your assumptions or scenarios drive value, all within Simply Wall St’s Community platform used by millions of investors.

With Narratives, you can quickly compare your estimated Fair Value to HealthEquity’s current price, which can help you decide when to buy, sell, or hold. These estimates update dynamically whenever news, results, or forecasts change.

For example, some investors using the Community see HealthEquity’s fair value as high as $134 if optimistic about regulatory expansion and tech advantages, while others take a more cautious view at $108 based on margin pressures or rising competition.

Do you think there's more to the story for HealthEquity? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HealthEquity might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HQY

HealthEquity

Provides technology-enabled services platforms to consumers and employers in the United States.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives