- United States

- /

- Medical Equipment

- /

- NasdaqGS:HOLX

We Think Hologic (NASDAQ:HOLX) Can Stay On Top Of Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Hologic, Inc. (NASDAQ:HOLX) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Hologic

What Is Hologic's Net Debt?

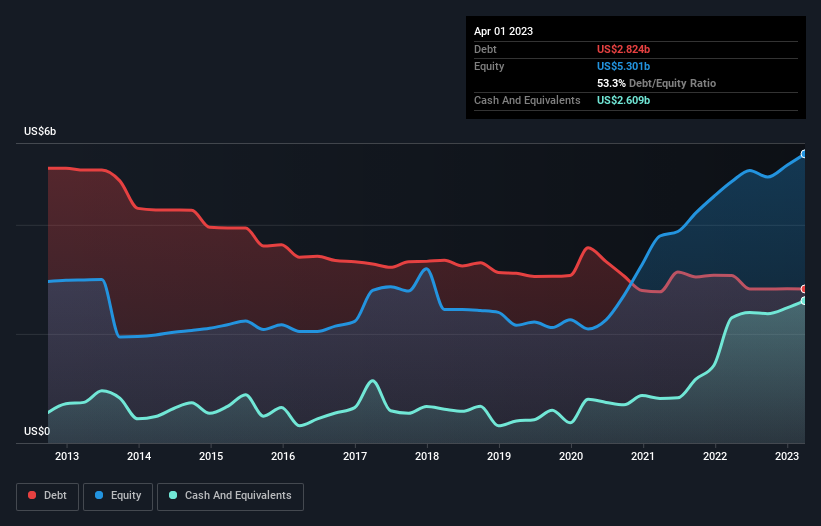

The image below, which you can click on for greater detail, shows that Hologic had debt of US$2.82b at the end of April 2023, a reduction from US$3.07b over a year. However, it does have US$2.61b in cash offsetting this, leading to net debt of about US$215.0m.

How Strong Is Hologic's Balance Sheet?

The latest balance sheet data shows that Hologic had liabilities of US$955.0m due within a year, and liabilities of US$3.19b falling due after that. On the other hand, it had cash of US$2.61b and US$714.0m worth of receivables due within a year. So it has liabilities totalling US$824.6m more than its cash and near-term receivables, combined.

Given Hologic has a humongous market capitalization of US$19.9b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Carrying virtually no net debt, Hologic has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hologic has a low net debt to EBITDA ratio of only 0.16. And its EBIT covers its interest expense a whopping 24.6 times over. So we're pretty relaxed about its super-conservative use of debt. It is just as well that Hologic's load is not too heavy, because its EBIT was down 54% over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Hologic's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Hologic recorded free cash flow worth a fulsome 93% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Our View

The good news is that Hologic's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But we must concede we find its EBIT growth rate has the opposite effect. It's also worth noting that Hologic is in the Medical Equipment industry, which is often considered to be quite defensive. Taking all this data into account, it seems to us that Hologic takes a pretty sensible approach to debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Hologic that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Hologic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HOLX

Hologic

Develops, manufactures, and supplies diagnostics products, medical imaging systems, and surgical products for women's health through early detection and treatment.

Flawless balance sheet and undervalued.