- United States

- /

- Medical Equipment

- /

- NasdaqGS:HOLX

We Think Hologic (NASDAQ:HOLX) Can Stay On Top Of Its Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Hologic, Inc. (NASDAQ:HOLX) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Hologic

How Much Debt Does Hologic Carry?

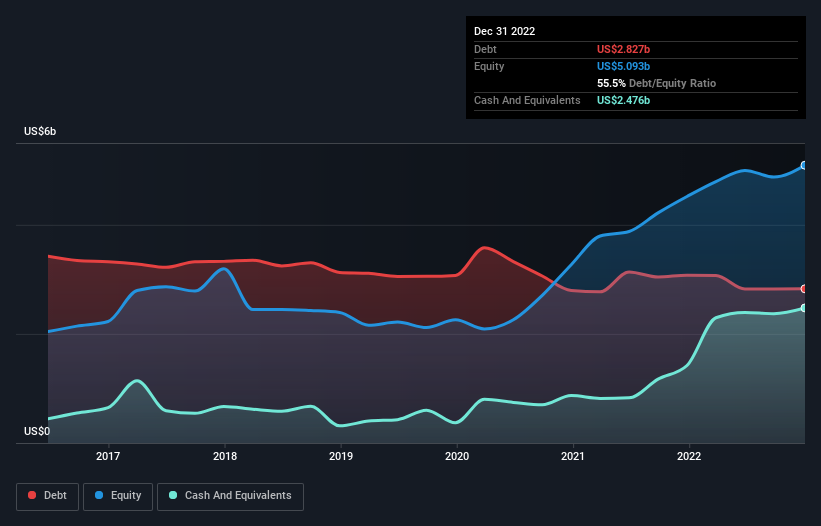

The image below, which you can click on for greater detail, shows that Hologic had debt of US$2.83b at the end of December 2022, a reduction from US$3.08b over a year. However, it also had US$2.48b in cash, and so its net debt is US$350.4m.

How Strong Is Hologic's Balance Sheet?

According to the last reported balance sheet, Hologic had liabilities of US$956.2m due within 12 months, and liabilities of US$3.24b due beyond 12 months. Offsetting this, it had US$2.48b in cash and US$673.8m in receivables that were due within 12 months. So its liabilities total US$1.05b more than the combination of its cash and short-term receivables.

Given Hologic has a humongous market capitalization of US$21.1b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Hologic's net debt is only 0.21 times its EBITDA. And its EBIT easily covers its interest expense, being 19.8 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. It is just as well that Hologic's load is not too heavy, because its EBIT was down 43% over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Hologic's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Hologic generated free cash flow amounting to a very robust 94% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

The good news is that Hologic's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. But the stark truth is that we are concerned by its EBIT growth rate. It's also worth noting that Hologic is in the Medical Equipment industry, which is often considered to be quite defensive. When we consider the range of factors above, it looks like Hologic is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. We'd be motivated to research the stock further if we found out that Hologic insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Hologic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HOLX

Hologic

Develops, manufactures, and supplies diagnostics products, medical imaging systems, and surgical products for women's health through early detection and treatment.

Flawless balance sheet and undervalued.