- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

Guardant Health, Inc. (NASDAQ:GH) Stocks Shoot Up 48% But Its P/S Still Looks Reasonable

Guardant Health, Inc. (NASDAQ:GH) shares have continued their recent momentum with a 48% gain in the last month alone. The last 30 days were the cherry on top of the stock's 322% gain in the last year, which is nothing short of spectacular.

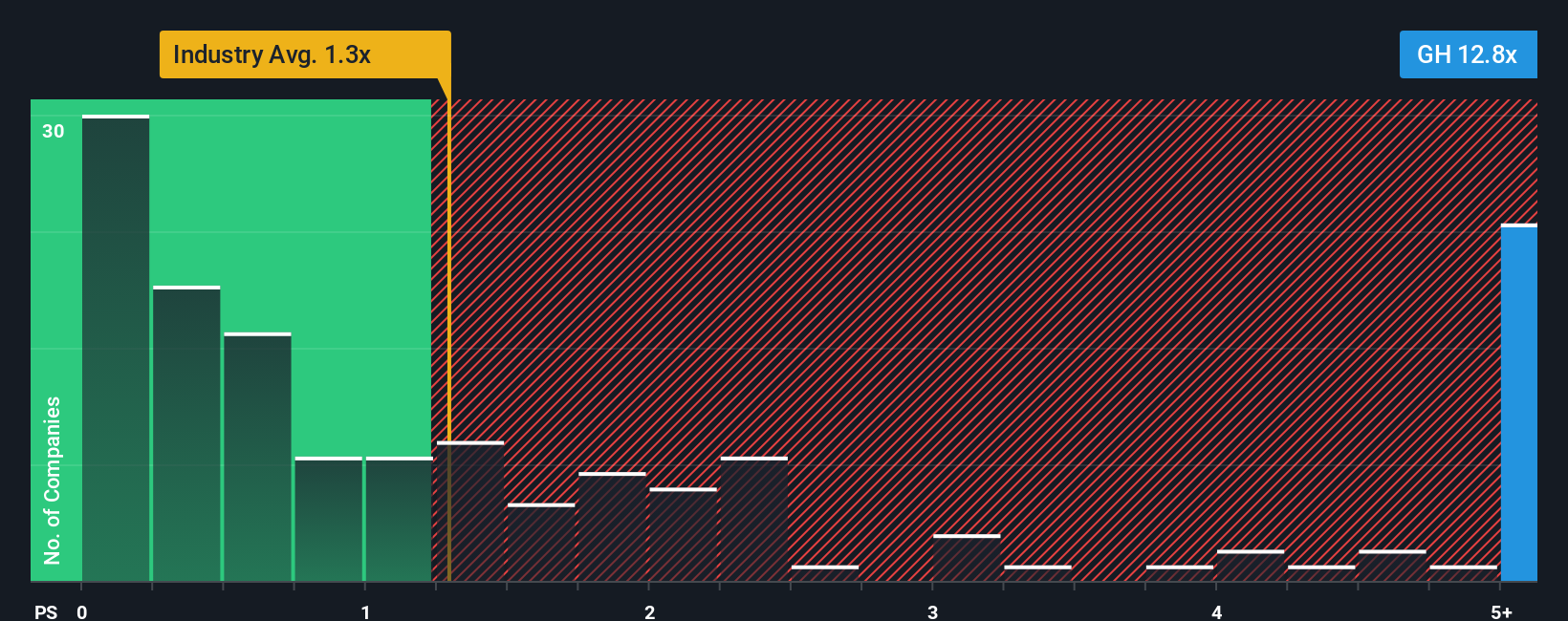

Since its price has surged higher, you could be forgiven for thinking Guardant Health is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 12.8x, considering almost half the companies in the United States' Healthcare industry have P/S ratios below 1.3x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Guardant Health

What Does Guardant Health's P/S Mean For Shareholders?

Guardant Health certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Guardant Health.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Guardant Health's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. Pleasingly, revenue has also lifted 110% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 27% each year over the next three years. That's shaping up to be materially higher than the 5.6% per year growth forecast for the broader industry.

With this information, we can see why Guardant Health is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Shares in Guardant Health have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Guardant Health maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Healthcare industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Guardant Health you should be aware of, and 1 of them is concerning.

If these risks are making you reconsider your opinion on Guardant Health, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives