- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

Guardant Health (GH): Valuation in Focus After Reveal Test Expands Therapy Response Tracking

Reviewed by Simply Wall St

Guardant Health (GH) recently expanded its Guardant Reveal blood test to help clinicians track late-stage therapy response in patients with solid tumors. This move draws attention because it promises quicker, tissue-free insights using advanced epigenomic signals.

See our latest analysis for Guardant Health.

Momentum has exploded for Guardant Health this year, with a 231.8% year-to-date share price return driven by major product breakthroughs such as the expanded Guardant Reveal test and the company’s work leading a new industrywide standard for exabyte-scale data. The 1-year total return stands at 222.9%, and after years of underperformance, sustained gains now reflect growing confidence in both innovation and business direction.

If you want to see what other healthcare stocks are making waves, Simply Wall St’s screener highlights new opportunities: See the full list for free.

With share price momentum at record highs and new products gaining traction, is Guardant Health still undervalued, or is the market fully factoring in its growth story and innovation pipeline?

Most Popular Narrative: 12.4% Overvalued

With Guardant Health’s last close at $105.42 and the most closely watched narrative estimating fair value at $93.82, the stock commands a noticeable premium, sparking debate around its future upside.

Rapid integration of AI-powered clinical analytics and multi-omic profiling into Guardant's “Smart Liquid Biopsy” platform is creating new clinical applications, enhancing product utility and differentiation versus peers. This is leading to higher average selling prices (ASPs), rising margins, and increased potential for broader payer reimbursement and improved net margins.

What supports this above-market price? The narrative hinges on breakneck revenue acceleration and a future earnings multiple so high it is almost unheard of in the sector. The real surprise is just how bold the financial projections are behind this fair value. Review the underlying numbers to see what is moving the target so far beyond today’s price.

Result: Fair Value of $93.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent high spending and tougher competition could jeopardize Guardant Health’s growth momentum. This could potentially spark a shift in the current optimistic outlook.

Find out about the key risks to this Guardant Health narrative.

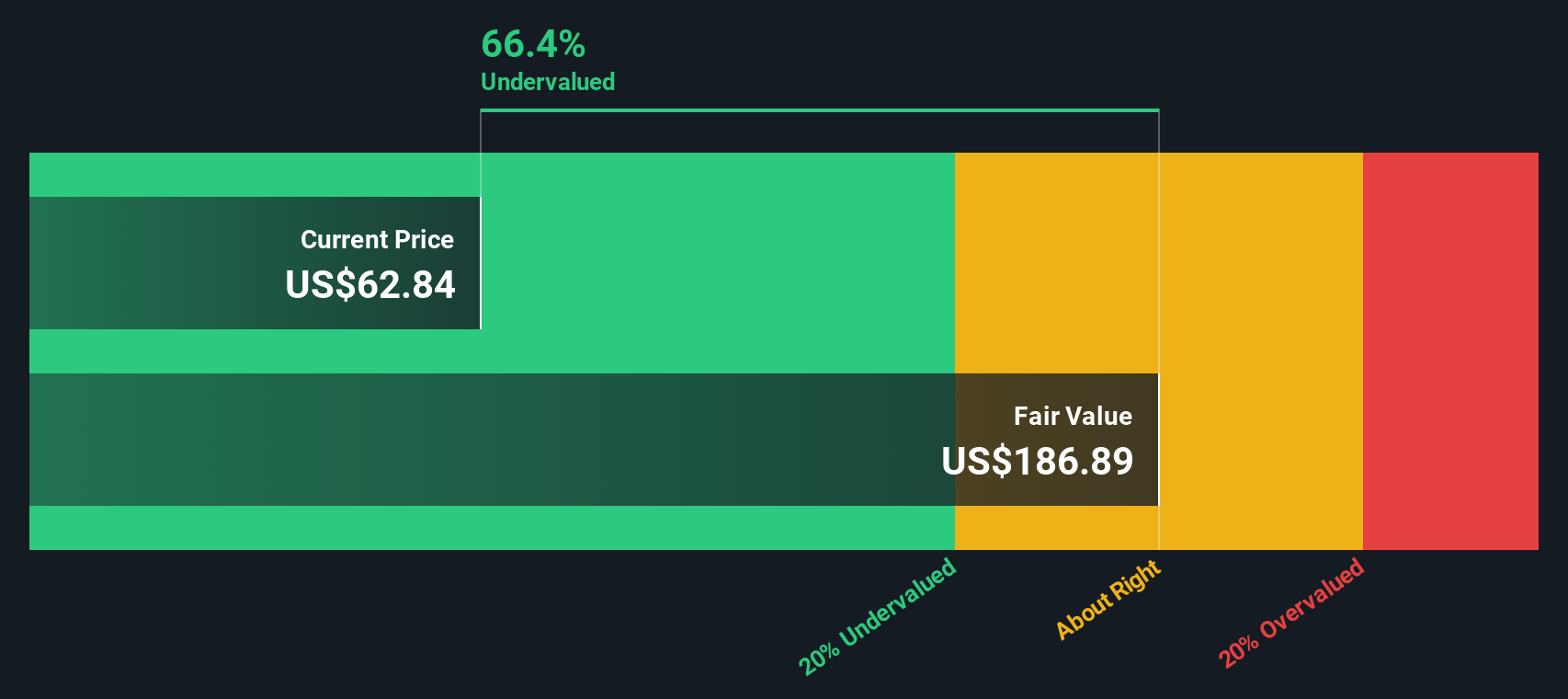

Another View: Our DCF Model Points to Undervaluation

Taking a different approach, the Simply Wall St DCF model estimates Guardant Health’s fair value at $246.97. This figure is significantly higher than both its current share price and analyst targets. While this suggests a major undervaluation, it also raises questions about the sustainability of such high-growth assumptions. Could the market be missing an opportunity, or is the risk of not reaching those projections too high?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Guardant Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Guardant Health Narrative

If you see things differently or prefer to dive into the data on your own terms, you can craft your own story in just a few minutes. Do it your way

A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Big breakthroughs often come from fresh angles. Don’t wait for headlines to spot the next winner. Put Simply Wall St’s unique screeners to work and get ahead today.

- Capture the upside from overlooked value by checking out these 917 undervalued stocks based on cash flows, built to spotlight strong cash flow stories the market may be missing.

- Zero in on disruptive innovation when you browse these 25 AI penny stocks, featuring companies set to shape tomorrow’s world with artificial intelligence breakthroughs.

- Boost your portfolio’s income potential by exploring these 17 dividend stocks with yields > 3%, curated for standout yields and solid dividend histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives