- United States

- /

- Healthcare Services

- /

- NasdaqGS:GH

Guardant Health (GH): Valuation in Focus After Q3 Beat, Raised Guidance, and New Shield Adoption Data

Reviewed by Simply Wall St

Guardant Health (GH) recently caught attention after releasing its third-quarter results, which beat expectations and prompted the company to raise full-year revenue guidance. In addition to the update, Guardant is seeing surging interest in its Shield screening test.

See our latest analysis for Guardant Health.

It has been quite a ride for Guardant Health this year, as the company’s upbeat quarterly results and raised guidance have turbocharged its momentum, sending its share price up an eye-catching 208.9% year-to-date. This surge goes hand-in-hand with impressive business updates, a key strategic partnership, and new industry recognition for Shield, all pointing to sustained growth potential. Looking at the bigger picture, Guardant’s one-year total shareholder return of 317.3% underscores the compounding effect of its recent wins and improving outlook.

If you’re inspired by Guardant’s strong performance and want to explore more names in the sector, now is the perfect moment to discover See the full list for free.

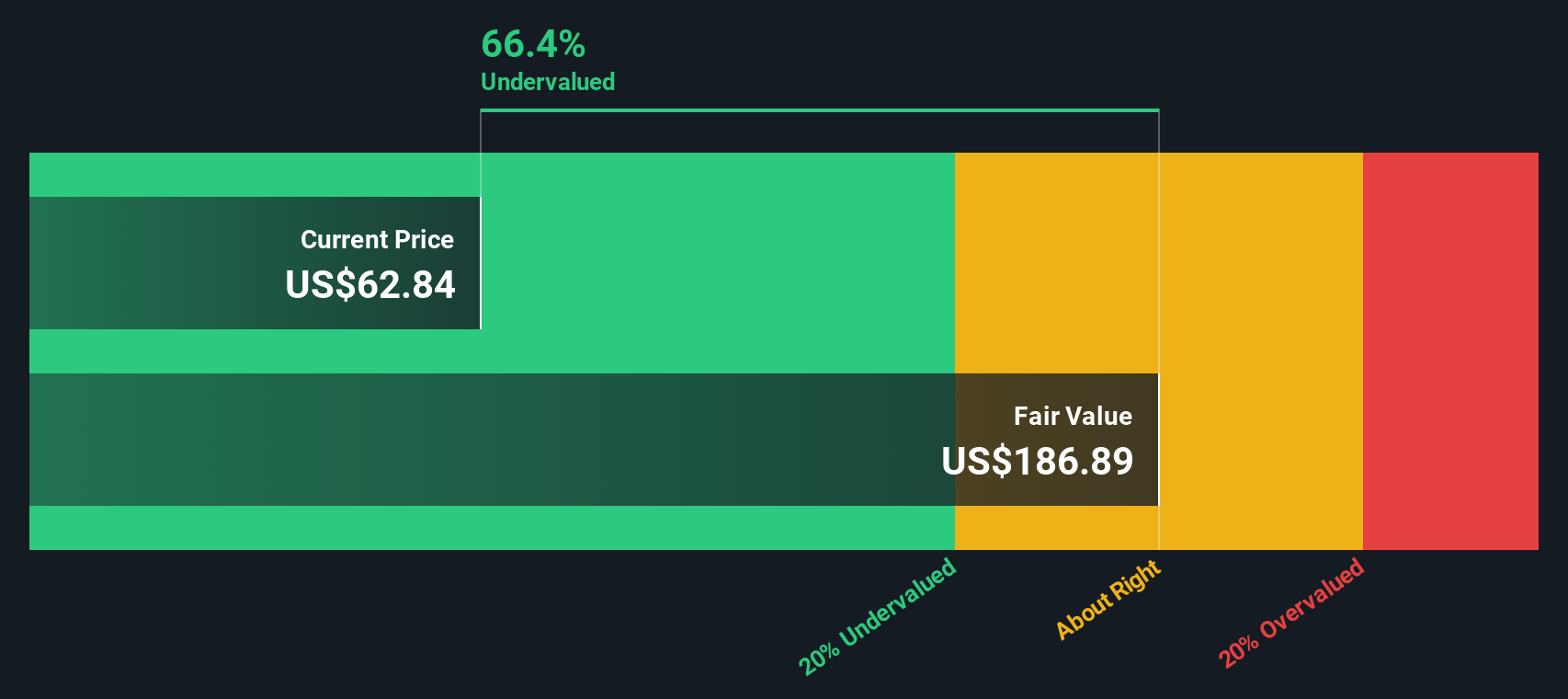

But after this remarkable rally and a wave of positive catalysts, investors may wonder if Guardant Health's stock is still undervalued enough to justify new investments. Alternatively, markets may have already factored in the company's future growth prospects.

Most Popular Narrative: 41.1% Overvalued

Guardant Health’s last close at $98.14 stands well above the fair value of $69.55 set by the most widely followed analyst narrative, highlighting a substantial valuation gap that investors can’t ignore. The market’s enthusiasm is unmistakable; however, the true grounds for this premium rest on more than just headline growth.

Rapid integration of AI-powered clinical analytics and multi-omic profiling into Guardant's "Smart Liquid Biopsy" platform is creating new clinical applications, enhancing product utility and differentiation versus peers, which is leading to higher average selling prices (ASPs), rising margins, and increased potential for broader payer reimbursement and improved net margins.

Ever wonder what’s fueling this bold price target? The narrative hinges on a unique blend of innovation and ambitious profitability forecasts. These are crucial assumptions that set the stage for a high-stakes valuation. Think you can guess what numbers are baked in? Find out exactly which forward-looking projections make or break this story.

Result: Fair Value of $69.55 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing high operating expenses and potential delays in payer coverage for Shield could quickly undermine the bullish outlook that investors currently hold.

Find out about the key risks to this Guardant Health narrative.

Another View: Discounted Cash Flow Model Suggests Deep Value

While analyst price targets peg Guardant Health as overvalued, our DCF model tells a very different story. It estimates Guardant’s fair value at $249.38 per share, which is far above its current level. Could the market be dramatically underestimating the long-term cash flow potential here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Guardant Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Guardant Health Narrative

If you see the story differently or want to dive into the details yourself, you can easily shape your own Guardant Health narrative in just minutes. Do it your way

A great starting point for your Guardant Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Give yourself an edge by checking out hot stock ideas in other fast-moving sectors before they break out. Stay ahead of market trends and find new opportunities now.

- Capitalize on next-generation breakthroughs by tracking these 26 AI penny stocks, which are set to transform industries with artificial intelligence advances.

- Supercharge your portfolio potential with these 840 undervalued stocks based on cash flows. These selections bring strong cash flow and hidden value to the table.

- Position yourself for long-term growth and secure income with these 18 dividend stocks with yields > 3%, offering attractive payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GH

Guardant Health

A precision oncology company, provides blood and tissue tests, and data sets in the United States and internationally.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives