- United States

- /

- Medical Equipment

- /

- NasdaqCM:ESTA

Establishment Labs Holdings (ESTA) Is Up 27.5% After Achieving First Positive Adjusted EBITDA and Raising Guidance

Reviewed by Sasha Jovanovic

- Establishment Labs Holdings Inc. recently reported third quarter 2025 results showing revenue growth to US$53.78 million and a reduced net loss compared to the previous year, alongside its first-ever positive adjusted EBITDA and raised full-year revenue guidance above US$210 million.

- Momentum in U.S. sales and minimally invasive product offerings have positioned the company for an expanded market share and improved margin prospects.

- We'll now explore how the milestone of positive adjusted EBITDA may reshape Establishment Labs' long-term investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Establishment Labs Holdings Investment Narrative Recap

To own a piece of Establishment Labs Holdings, you need to believe in its ability to accelerate adoption of its Motiva implants and minimally invasive platforms in the U.S. market while executing a path to sustainable profitability. The latest earnings, with positive adjusted EBITDA and raised revenue guidance, support the near-term catalyst of expanding U.S. sales, but do not materially reduce the most important risk: the company’s exposure to high operating costs and the impact on margins. Among recent announcements, the revised 2025 revenue guidance to above US$210 million stands out as particularly relevant. This signals management’s confidence in commercial momentum, especially as Motiva gains traction post-FDA approval and minimally invasive products show promise for expanding the addressable market and supporting the company’s profitability efforts. However, investors should also be aware that despite optimism around growth, the upward trend in operating expenses remains a key consideration for those assessing...

Read the full narrative on Establishment Labs Holdings (it's free!)

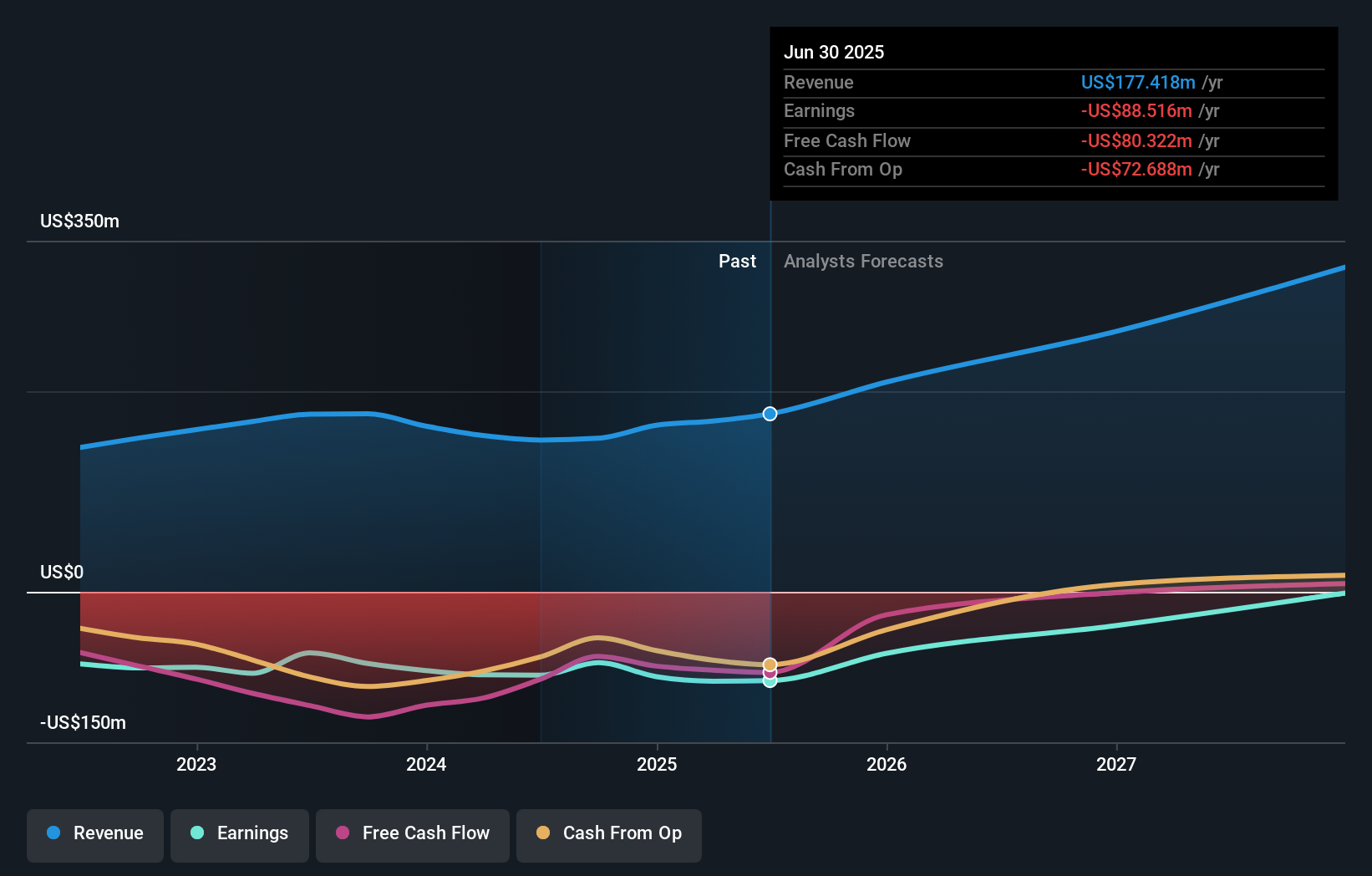

Establishment Labs Holdings is forecast to achieve $381.9 million in revenue and $27.5 million in earnings by 2028. This outlook assumes annual revenue growth of 29.1% and an earnings increase of $116 million from current earnings of -$88.5 million.

Uncover how Establishment Labs Holdings' forecasts yield a $62.22 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Community fair value estimates for Establishment Labs range from US$40.00 to US$62.22, based on three different Simply Wall St Community perspectives. As you compare these valuations, remember that consistent margin pressure from elevated SG&A and R&D spending could influence long-term earnings scalability and investor confidence.

Explore 3 other fair value estimates on Establishment Labs Holdings - why the stock might be worth as much as $62.22!

Build Your Own Establishment Labs Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Establishment Labs Holdings research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Establishment Labs Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Establishment Labs Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Establishment Labs Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESTA

Establishment Labs Holdings

A medical technology company, manufactures and markets medical devices for aesthetic and reconstructive plastic surgeries.

High growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives