- United States

- /

- Healthcare Services

- /

- NasdaqGS:ENSG

Assessing Ensign Group (ENSG) Valuation Following Recent Share Price Strength

Reviewed by Simply Wall St

Ensign Group (ENSG) shares saw a slight move today as investors continued to digest its recent returns and performance trends. With returns over the past year surpassing 23% and revenue growing steadily, the company remains a name to watch for value-focused investors.

See our latest analysis for Ensign Group.

After a robust year for Ensign Group, momentum remains strong, with a 34.3% year-to-date share price return reminding investors that growth sentiment is still present. The company’s three- and five-year total shareholder returns of 93% and 149% respectively speak to its long-term track record and continued upside potential.

If impressive compounding like this has you interested, it’s worth seeing what else is out there. Take a look at fast growing stocks with high insider ownership.

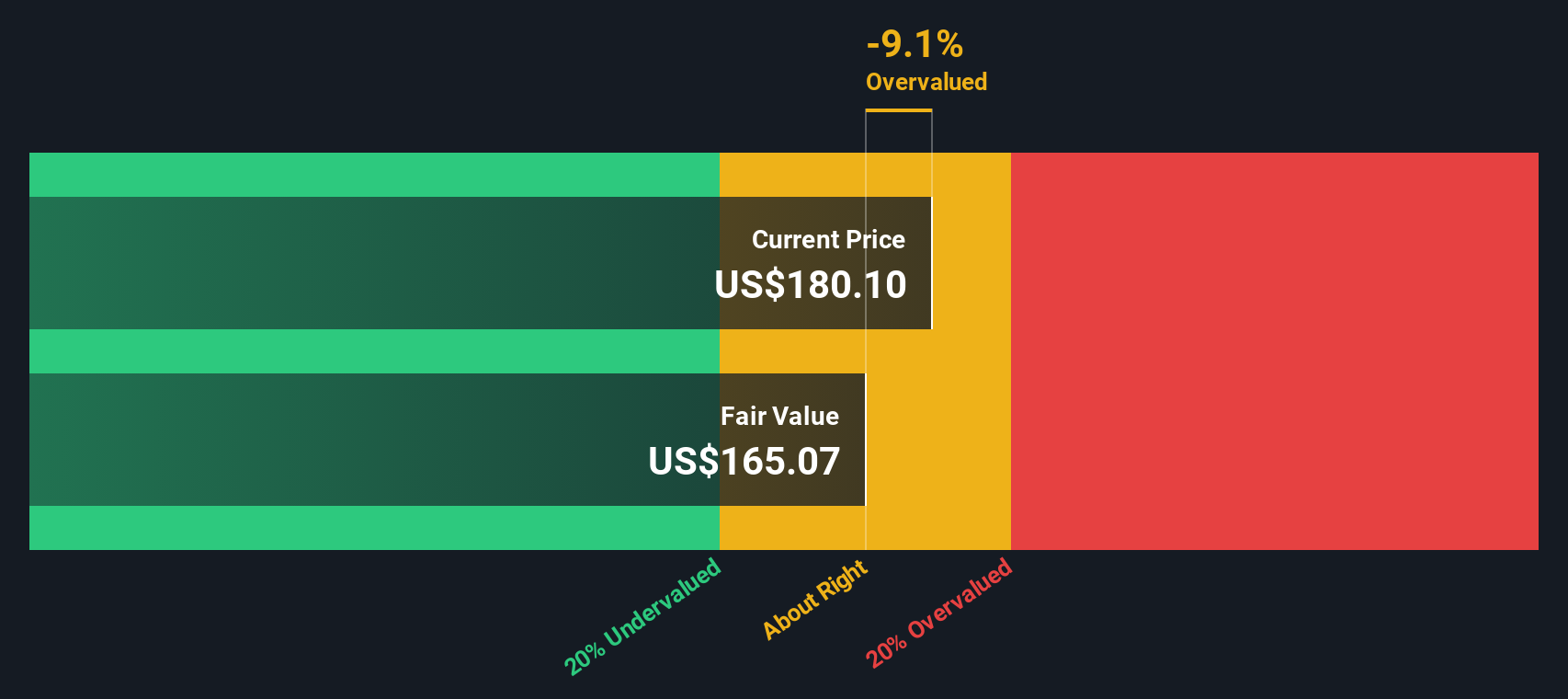

But with Ensign Group’s recent surge and shares trading near record highs, the question remains: is the current price a fair reflection of future prospects, or could there still be an opportunity for investors to buy in early?

Price-to-Earnings of 31.3x: Is it justified?

Ensign Group is currently being valued by the market at a price-to-earnings (P/E) multiple of 31.3x, which is notably higher than many of its industry peers. With shares closing at $178.5, this multiple clearly reflects how investors are currently pricing ENSG's growth profile.

The price-to-earnings ratio captures how much investors are willing to pay for each dollar of company earnings. In sectors like US healthcare, it serves as a key reference point for understanding prevailing market optimism, future growth, and profitability expectations.

With a P/E ratio of 31.3x, Ensign Group is trading at a substantial premium to both the US Healthcare industry average of 21.8x and its closest peers at 15x. This is also above the estimated fair price-to-earnings ratio of 24.5x, suggesting that the current pricing assumes strong ongoing performance. Market participants may be expecting earnings growth or defensive characteristics; however, the gap with peer and fair value benchmarks is significant.

Explore the SWS fair ratio for Ensign Group

Result: Price-to-Earnings of 31.3x (OVERVALUED)

However, market volatility or slower than expected revenue growth could challenge the current optimism surrounding Ensign Group’s elevated valuation.

Find out about the key risks to this Ensign Group narrative.

Another View: SWS DCF Model Suggests Undervaluation

While Ensign Group’s price-to-earnings ratio suggests the stock is expensive compared to peers and estimates, our DCF model provides a different perspective. According to the SWS DCF analysis, the shares are trading about 13.8% below their fair value, indicating potential upside for investors. Can fundamentals ultimately outweigh the market’s pricing skepticism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ensign Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 900 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ensign Group Narrative

If you see things differently or want to dig deeper into the data, you can build your own take in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ensign Group.

Looking for More Investment Ideas?

Don't let your next opportunity slip away. The market is full of promising stocks, and using the right tools could put you ahead of the curve. Take the lead and give yourself the best shot at strong returns by checking out these hand-picked ideas:

- Boost your portfolio with attractive yields and dependable growth by checking out these 18 dividend stocks with yields > 3%. This selection delivers steady income and robust fundamentals.

- Tap into tomorrow’s technology trends by seeking out these 27 AI penny stocks. These companies are at the heart of machine learning, automation, and digital innovation.

- Capitalize on undervalued opportunities others might miss with these 900 undervalued stocks based on cash flows, focused on strong cash flows and discounted prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ensign Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENSG

Ensign Group

Provides skilled nursing, senior living, and rehabilitative services.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives