- United States

- /

- Medical Equipment

- /

- NasdaqGM:EDAP

It's A Story Of Risk Vs Reward With EDAP TMS S.A. (NASDAQ:EDAP)

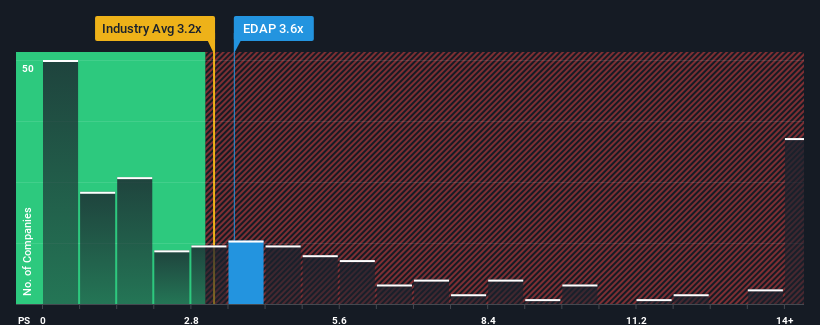

With a median price-to-sales (or "P/S") ratio of close to 3.2x in the Medical Equipment industry in the United States, you could be forgiven for feeling indifferent about EDAP TMS S.A.'s (NASDAQ:EDAP) P/S ratio of 3.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for EDAP TMS

How EDAP TMS Has Been Performing

Recent revenue growth for EDAP TMS has been in line with the industry. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. Those who are bullish on EDAP TMS will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on EDAP TMS will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For EDAP TMS?

There's an inherent assumption that a company should be matching the industry for P/S ratios like EDAP TMS' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.9%. Pleasingly, revenue has also lifted 48% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 17% per annum during the coming three years according to the four analysts following the company. That's shaping up to be materially higher than the 9.8% each year growth forecast for the broader industry.

With this information, we find it interesting that EDAP TMS is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From EDAP TMS' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at EDAP TMS' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for EDAP TMS that you should be aware of.

If you're unsure about the strength of EDAP TMS' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if EDAP TMS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:EDAP

EDAP TMS

Develops, manufactures, promotes, and distributes minimally-invasive medical devices for urology based upon proprietary ultrasound technology in Asia, France, the United States, and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success