- United States

- /

- Medical Equipment

- /

- NasdaqCM:DCTH

Is Delcath Systems’ First Nine-Month Net Profit Reshaping the Investment Case for DCTH?

Reviewed by Sasha Jovanovic

- Delcath Systems, Inc. recently announced its third quarter and nine-month financial results for 2025, revealing a net income of US$4.60 million for the nine-month period compared to a net loss of US$22.99 million a year earlier.

- This dramatic turnaround from a prior loss to a net profit may signal a shift in the company's operational trajectory and financial stability.

- We'll explore how Delcath's first nine-month net profit in years could reshape the investment narrative and expectations moving forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Delcath Systems Investment Narrative Recap

To believe in Delcath Systems as a shareholder, you would need confidence in the company’s ability to drive commercial adoption of its liver-targeted therapies, particularly HEPZATO and CHEMOSAT, amid growing incidence of metastatic cancers. While the shift to a net profit over the first nine months of 2025 may boost momentum, persistent pricing pressures from 340B and NDRA discounts continue to weigh on average sales prices and could limit near-term earnings expansion if volumes plateau, making this news less material for the most pressing risks and catalysts.

Among Delcath’s recent announcements, the October 18 release of results from the CHOPIN Phase 2 trial for metastatic uveal melanoma stands out, as it directly supports the clinical credibility of CHEMOSAT, potentially lifting hospital adoption and reinforcing the company’s core growth catalyst. Clinical endorsements like these can counter revenue risks should pricing headwinds persist, underscoring the importance of trial outcomes in reshaping near-term market expectations.

In contrast to the company’s recent profitability, investors should be aware that Delcath’s reliance on new treatment site activation still presents operational hurdles, especially if...

Read the full narrative on Delcath Systems (it's free!)

Delcath Systems' narrative projects $182.7 million revenue and $54.9 million earnings by 2028. This requires 37.5% yearly revenue growth and an increase in earnings of $52.7 million from the current $2.2 million.

Uncover how Delcath Systems' forecasts yield a $24.33 fair value, a 156% upside to its current price.

Exploring Other Perspectives

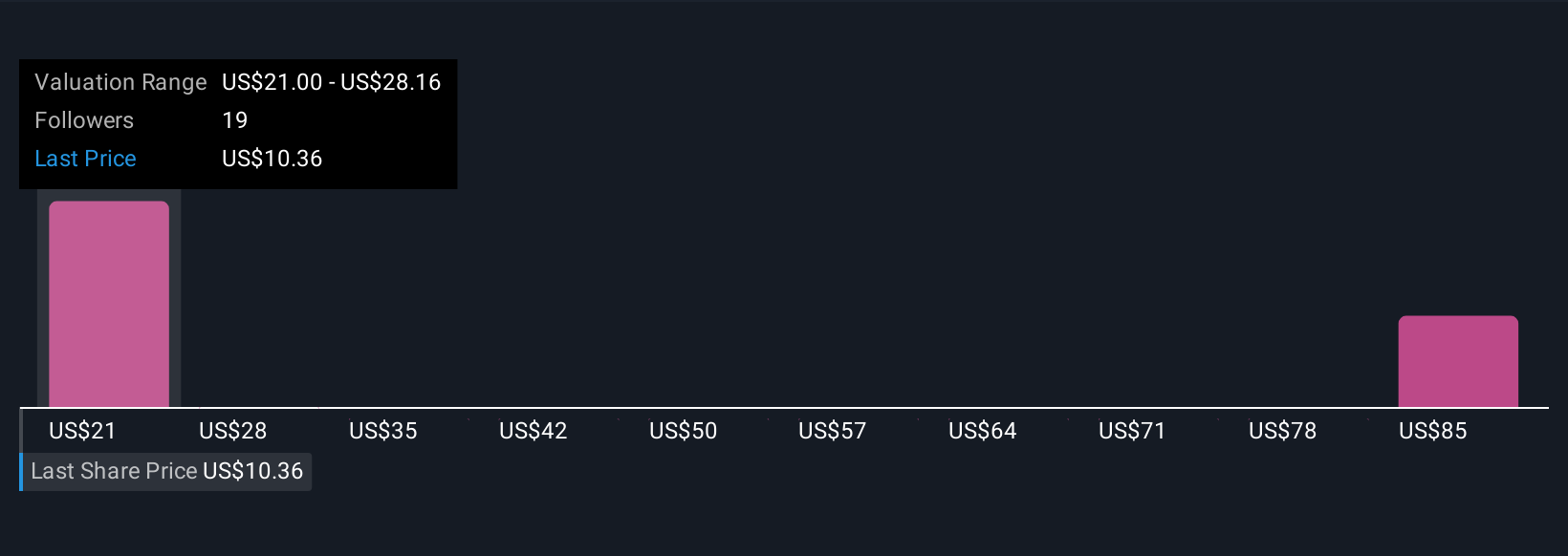

Five Simply Wall St Community fair value forecasts for Delcath Systems range from US$21.00 to US$91.42 per share. This divergence reflects how commercial uptake and clinical expansion remain top of mind for investors seeking to understand the company’s long-term potential.

Explore 5 other fair value estimates on Delcath Systems - why the stock might be worth just $21.00!

Build Your Own Delcath Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delcath Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Delcath Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delcath Systems' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DCTH

Delcath Systems

An interventional oncology company, focuses on the treatment of primary and metastatic liver cancers in the United States and Europe.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives