- United States

- /

- Medical Equipment

- /

- NasdaqCM:DCTH

Delcath Systems (NASDAQ:DCTH) spikes 17% this week, taking one-year gains to 301%

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. While not every stock performs well, when investors win, they can win big. For example, the Delcath Systems, Inc. (NASDAQ:DCTH) share price is up a whopping 301% in the last 1 year, a handsome return in a single year. It's even up 17% in the last week. However, the stock hasn't done so well in the longer term, with the stock only up 16% in three years.

Since it's been a strong week for Delcath Systems shareholders, let's have a look at trend of the longer term fundamentals.

Check out our latest analysis for Delcath Systems

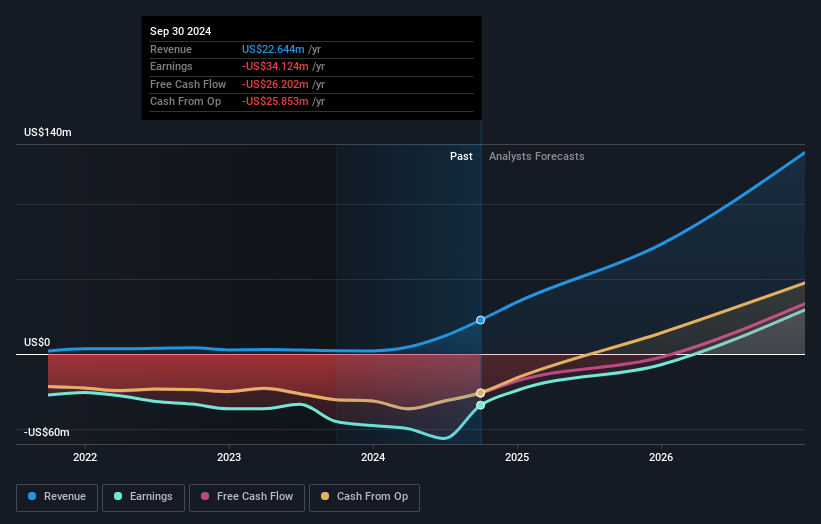

Because Delcath Systems made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over the last twelve months, Delcath Systems' revenue grew by 946%. That's stonking growth even when compared to other loss-making stocks. But the share price seems headed to the moon, up 301% as previously highlighted. Despite the strong growth, it's certainly possible the market has gotten a little over-excited. But if the share price does moderate a bit, there might be an opportunity for high growth investors.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Delcath Systems stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's good to see that Delcath Systems has rewarded shareholders with a total shareholder return of 301% in the last twelve months. Notably the five-year annualised TSR loss of 11% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Delcath Systems you should know about.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:DCTH

Delcath Systems

An interventional oncology company, focuses on the treatment of primary and metastatic liver cancers in the United States and Europe.

High growth potential with adequate balance sheet.