- United States

- /

- Healthcare Services

- /

- NasdaqGS:CRVL

CorVel (CRVL): Evaluating the Valuation Following Strong Growth, AI Adoption, and Strategic Acquisitions

Reviewed by Simply Wall St

CorVel (CRVL) just reported quarterly results showing clear growth in both revenue and net income, much of which management credits to its ongoing investment in Agentic AI and targeted acquisitions. Investors are watching these efforts closely as the company focuses on technology-driven efficiency and workforce development.

See our latest analysis for CorVel.

CorVel’s steady adoption of AI and targeted acquisitions has kept it in the headlines, but this momentum has not fully translated into its recent share price return, which has slipped nearly 31% year-to-date. Despite a strong long-term total shareholder return of 153% over five years and positive signals in the latest earnings, current sentiment appears cautious in light of recent volatility.

If you're interested in finding other companies with accelerating innovation and leadership trends, now is a great time to discover fast growing stocks with high insider ownership

With share prices down sharply this year despite robust financial results and ongoing AI investment, the key question is whether CorVel is undervalued at current levels or if the market has already taken its growth potential into account.

Price-to-Earnings of 36.7x: Is it justified?

CorVel is currently trading at a price-to-earnings (P/E) ratio of 36.7x, placing it well above both its industry and peer averages. Given the last close price of $75.36, the stock appears richly valued through the lens of earnings multiples.

The price-to-earnings multiple helps investors gauge how much they are paying for each dollar of company earnings. For a tech-enabled healthcare operator like CorVel, a high P/E can sometimes be justified by rapid growth or exceptional profitability. However, it can also signal overly optimistic expectations.

When comparing CorVel’s P/E of 36.7x to the US Healthcare industry average of 21.5x and the peer average of 22.6x, it is clear the market has set a much steeper price for its shares. This premium suggests that investors expect CorVel’s earnings to grow faster than its competitors or that they see unique value in its business model, even amid recent share price volatility.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 36.7x (OVERVALUED)

However, ongoing share price declines and uncertain market sentiment could challenge CorVel’s valuation, particularly if growth or profitability does not accelerate.

Find out about the key risks to this CorVel narrative.

Another View: What Does the SWS DCF Model Say?

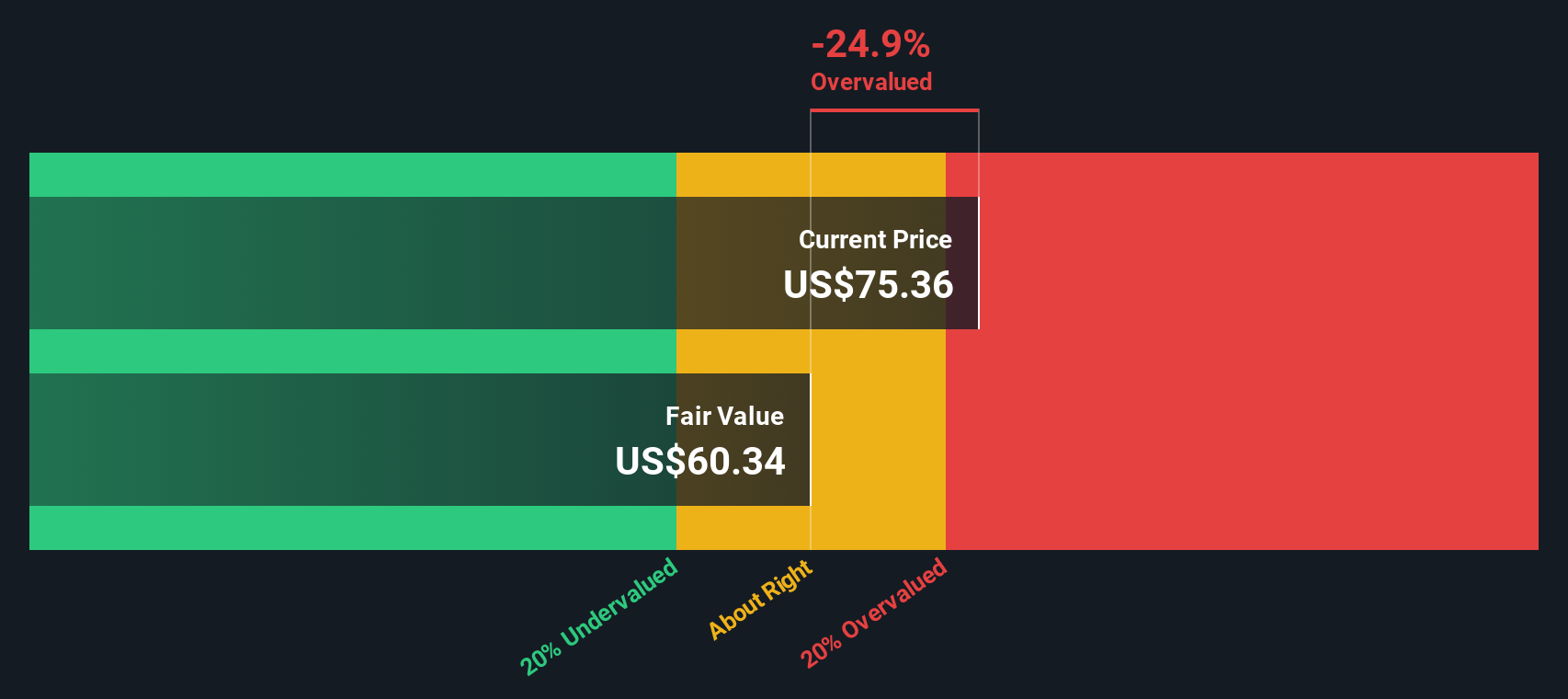

While traditional valuation using earnings suggests CorVel’s shares look expensive, our DCF model provides a different perspective. According to this discounted cash flow analysis, CorVel’s fair value is estimated at $60.34. This estimate makes the current share price of $75.36 appear overvalued by about 25%. Which method will the market trust as the dust settles?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CorVel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 860 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CorVel Narrative

If you'd rather reach your own conclusions or want to see how the numbers stack up for yourself, you can create your own take on CorVel in just a few minutes. Do it your way

A great starting point for your CorVel research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Uncover fresh opportunities beyond CorVel and get a step ahead by using powerful tools trusted by investors worldwide. Stand out with your strategy—these specialized lists can connect you to tomorrow’s market leaders before everyone else catches on.

- Capture attractive income streams by targeting companies with strong payouts, and see which ones offer impressive returns through these 17 dividend stocks with yields > 3%.

- Tap into innovation and ride the wave of breakthroughs by scanning these 25 AI penny stocks for businesses pushing the boundaries in artificial intelligence sectors.

- Stay alert for hidden value plays as you review these 860 undervalued stocks based on cash flows, where smart investors are watching for robust fundamentals and untapped growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRVL

CorVel

Provides workers’ compensation, general and auto liability, and hospital bill auditing and payment integrity solutions.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives